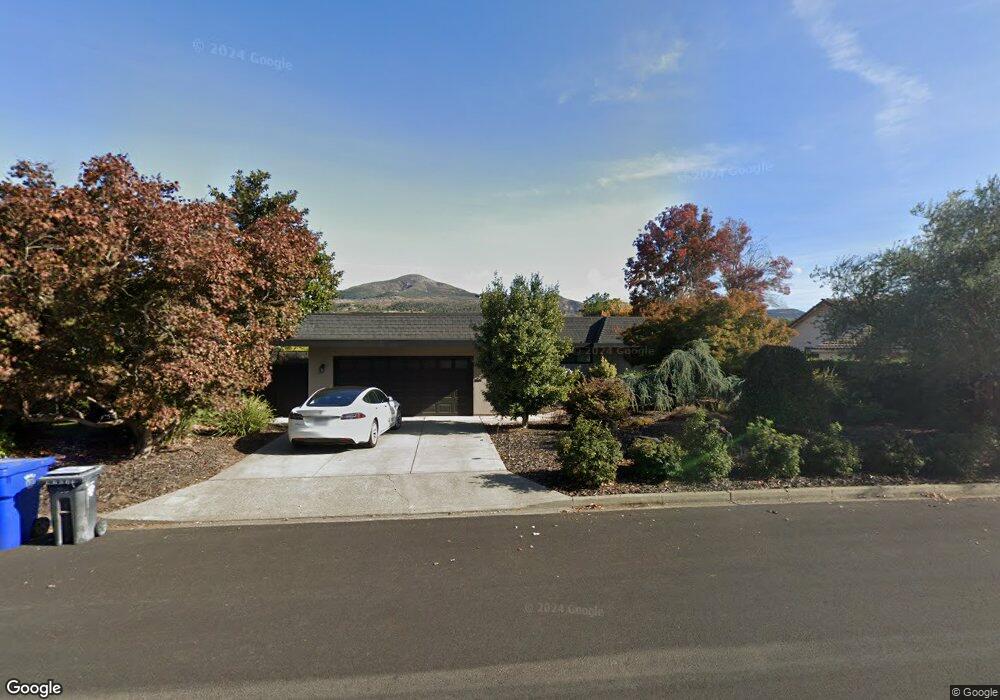

220 Kaanapali Dr Napa, CA 94558

Silverado Resort NeighborhoodEstimated Value: $2,057,530 - $2,196,000

4

Beds

4

Baths

2,377

Sq Ft

$903/Sq Ft

Est. Value

About This Home

This home is located at 220 Kaanapali Dr, Napa, CA 94558 and is currently estimated at $2,146,633, approximately $903 per square foot. 220 Kaanapali Dr is a home located in Napa County with nearby schools including Vichy Elementary School, Silverado Middle School, and Vintage High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 22, 2025

Sold by

Keller Family Trust and Keller James

Bought by

Wilcox Justin and Wilcox Jennifer

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$600,000

Outstanding Balance

$597,337

Interest Rate

6.65%

Mortgage Type

New Conventional

Estimated Equity

$1,549,296

Purchase Details

Closed on

Feb 9, 2023

Sold by

Mary Belli Revocable Trust

Bought by

Keller Family Trust

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$1,000,000

Interest Rate

6.33%

Mortgage Type

New Conventional

Purchase Details

Closed on

May 21, 2003

Sold by

Belli Mary

Bought by

Belli Mary and The Mary Belli Revocable Trust

Purchase Details

Closed on

Jan 23, 2003

Sold by

Belli Mary and Cohen Arthur M

Bought by

Belli Mary

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Wilcox Justin | $2,210,000 | Placer Title | |

| Keller Family Trust | $1,924,000 | Old Republic Title | |

| Belli Mary | -- | -- | |

| Belli Mary | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Wilcox Justin | $600,000 | |

| Previous Owner | Keller Family Trust | $1,000,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $22,548 | $2,001,729 | $1,300,500 | $701,229 |

| 2024 | $22,548 | $1,962,480 | $1,275,000 | $687,480 |

| 2023 | $22,548 | $412,984 | $128,050 | $284,934 |

| 2022 | $5,447 | $404,888 | $125,540 | $279,348 |

| 2021 | $5,366 | $396,950 | $123,079 | $273,871 |

| 2020 | $5,321 | $392,880 | $121,817 | $271,063 |

| 2019 | $5,218 | $385,178 | $119,429 | $265,749 |

| 2018 | $5,134 | $377,627 | $117,088 | $260,539 |

| 2017 | $4,997 | $370,224 | $114,793 | $255,431 |

| 2016 | $4,834 | $362,966 | $112,543 | $250,423 |

| 2015 | $4,496 | $357,515 | $110,853 | $246,662 |

| 2014 | $4,427 | $350,513 | $108,682 | $241,831 |

Source: Public Records

Map

Nearby Homes

- 265 Kaanapali Dr

- 2863 Atlas Peak Rd

- 2134 Monticello Rd

- 2015 Monticello Rd

- 1777 Mckinley Rd

- 2152 Monticello Rd

- 1600 Atlas Peak Rd Unit 432

- 1600 Atlas Peak Rd Unit 428

- 1600 Atlas Peak Rd Unit 365

- 2186 Monticello Rd

- 1101 Hedgeside Ave

- 2143 Monticello Rd

- 833 Augusta Cir Unit 34

- 1776 Monticello Rd

- 808 Augusta Cir

- 1597 Estee Ave

- 1079 Hedgeside Ave

- 1669 Atlas Peak Rd

- 2277 Monticello Rd

- 894 Oak Leaf Way

- 216 Kaanapali Dr

- 226 Kaanapali Dr

- 212 Kaanapali Dr

- 230 Kaanapali Dr

- 219 Kaanapali Dr

- 223 Kaanapali Dr

- 213 Kaanapali Dr

- 229 Kaanapali Dr

- 208 Kaanapali Dr

- 234 Kaanapali Dr

- 209 Kaanapali Dr

- 235 Kaanapali Dr

- 204 Kaanapali Dr

- 205 Kaanapali Dr

- 240 Kaanapali Dr

- 241 Kaanapali Dr

- 198 Kaanapali Dr

- 199 Kaanapali Dr

- 1547 Silver Trail

- 244 Kaanapali Dr