220 San Benancio Rd Unit D Salinas, CA 93908

Corral de Tierra NeighborhoodEstimated Value: $1,228,304 - $1,582,000

4

Beds

2

Baths

2,344

Sq Ft

$579/Sq Ft

Est. Value

About This Home

This home is located at 220 San Benancio Rd Unit D, Salinas, CA 93908 and is currently estimated at $1,356,076, approximately $578 per square foot. 220 San Benancio Rd Unit D is a home located in Monterey County with nearby schools including Toro Park Elementary School, Washington Elementary School, and San Benancio Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 2, 2018

Sold by

Standridge Peter J and Standridg Peter J

Bought by

Stanridge Peter J

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$611,000

Outstanding Balance

$530,629

Interest Rate

4.5%

Mortgage Type

New Conventional

Estimated Equity

$825,447

Purchase Details

Closed on

Mar 16, 2018

Sold by

Pappas Mark and Pappas Carolyn

Bought by

Standridge Peter J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$600,000

Interest Rate

4.32%

Mortgage Type

Unknown

Purchase Details

Closed on

Mar 2, 1999

Sold by

Weinstein Alan Ira

Bought by

Pappas Mark and Pappas Carolyn

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$243,000

Interest Rate

6.79%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Stanridge Peter J | -- | Old Republic Title Co | |

| Standridge Peter J | $700,000 | Chicago Title Co | |

| Pappas Mark | $355,000 | Old Republic Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Stanridge Peter J | $611,000 | |

| Closed | Standridge Peter J | $600,000 | |

| Previous Owner | Pappas Mark | $243,000 | |

| Closed | Pappas Mark | $76,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $9,614 | $881,813 | $256,009 | $625,804 |

| 2024 | $9,614 | $864,524 | $250,990 | $613,534 |

| 2023 | $9,278 | $847,573 | $246,069 | $601,504 |

| 2022 | $9,328 | $830,955 | $241,245 | $589,710 |

| 2021 | $8,923 | $814,663 | $236,515 | $578,148 |

| 2020 | $8,728 | $806,310 | $234,090 | $572,220 |

| 2019 | $8,693 | $790,500 | $229,500 | $561,000 |

| 2018 | $5,299 | $489,107 | $206,664 | $282,443 |

| 2017 | $5,377 | $479,517 | $202,612 | $276,905 |

| 2016 | $5,213 | $470,116 | $198,640 | $271,476 |

| 2015 | $5,161 | $463,056 | $195,657 | $267,399 |

| 2014 | $4,989 | $453,987 | $191,825 | $262,162 |

Source: Public Records

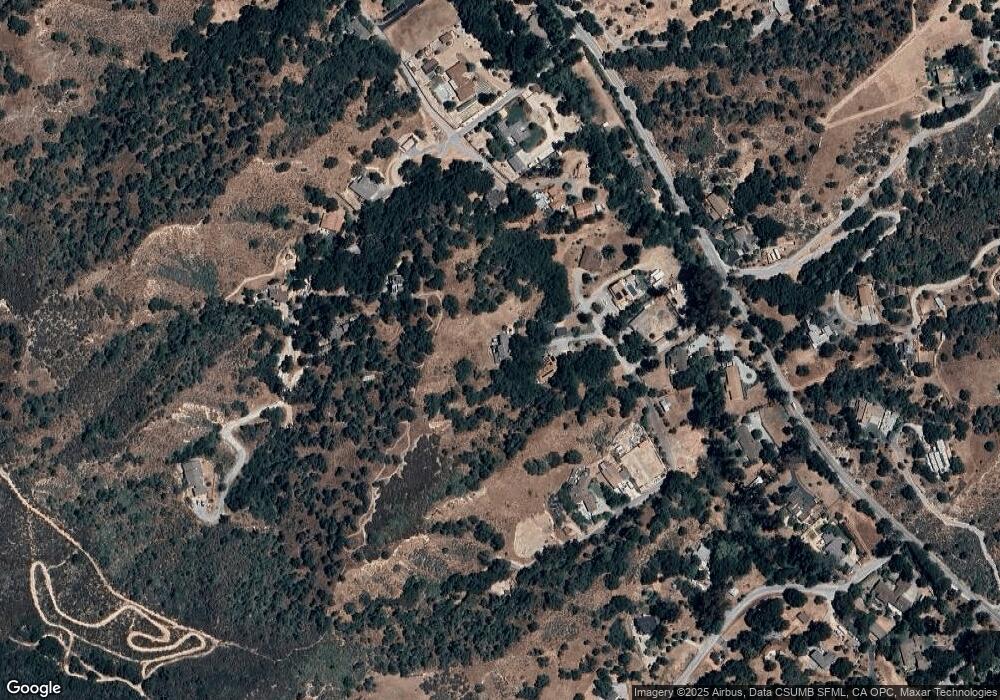

Map

Nearby Homes

- 15847 Pleasant Valley Ln

- 108 San Benancio Rd

- 442 Corral de Tierra Rd

- 453 Corral de Tierra Rd

- 25603 Creekview Cir

- 382 Corral de Tierra Rd

- 397 B Corral de Tierra Rd

- 14220 Mountain Quail Rd

- 0 Corral de Tierra Rd

- 14285 Mountain Quail Rd

- 14075 Mountain Quail Rd

- 14475 Mountain Quail Rd Unit 4

- 17 Calera Canyon Rd

- 23799 Monterey Salinas Hwy Unit 18

- 27765 Mesa Del Toro Rd

- 13525 Paseo Terrano

- 13500 Paseo Terrano

- 89 Robley Rd

- 17755 Corral Del Cielo Rd

- 25317 Camino de Chamisal

- 220 San Benancio Rd Unit J

- 220 San Benancio Rd Unit C

- 220 San Benancio Rd Unit B

- 220 San Benancio Rd

- 220 San Benancio Rd Unit A

- 220 San Benancio Rd Unit E

- 25944 Deer Run Ln

- 218 San Benancio Rd

- 224 San Benancio Rd

- 25946 Deer Run Ln

- 222 San Benancio Rd

- 226 San Benancio Rd

- 220D San Benancio Rd

- 220B San Benancio Rd Unit ML81325433

- 25945 Deer Run Ln

- 228 San Benancio Rd

- 25947 Deer Run Ln Unit A

- 234 San Benancio Rd

- 247 San Benancio Rd

- 211 San Benancio Rd