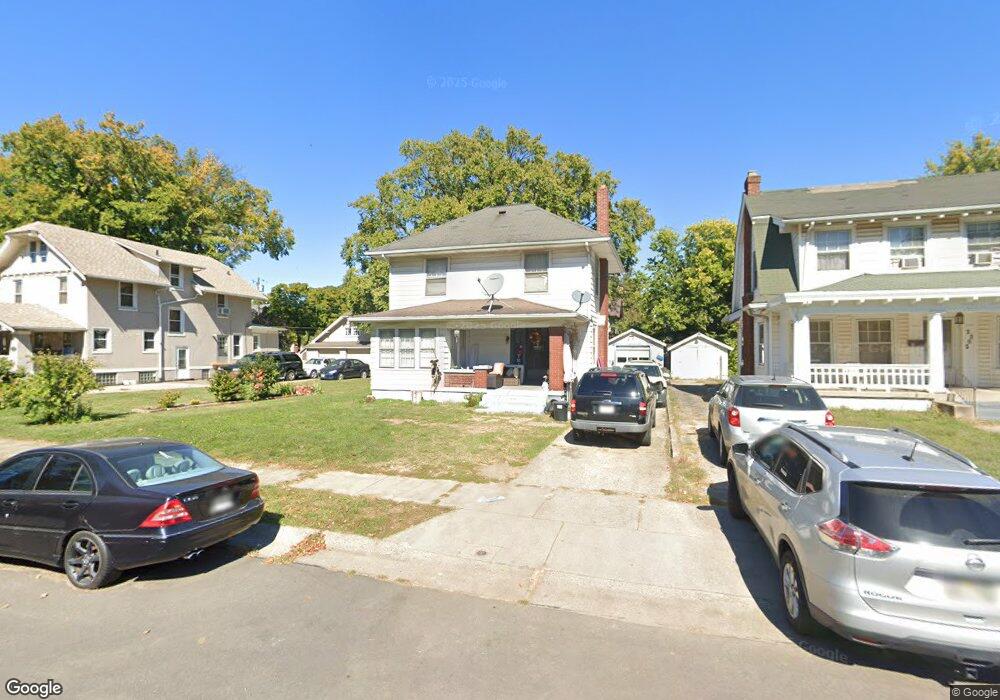

2201 Arlington Ave Middletown, OH 45044

Highlands NeighborhoodEstimated Value: $137,000 - $165,000

3

Beds

1

Bath

1,386

Sq Ft

$108/Sq Ft

Est. Value

About This Home

This home is located at 2201 Arlington Ave, Middletown, OH 45044 and is currently estimated at $150,247, approximately $108 per square foot. 2201 Arlington Ave is a home located in Butler County with nearby schools including Mayfield Elementary School, Highview 6th Grade Center, and Middletown Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 18, 2024

Sold by

May Zachary

Bought by

May Zachary and Jones Judy

Current Estimated Value

Purchase Details

Closed on

Nov 15, 2010

Sold by

Federal Home Loan Mortgage Corporation

Bought by

May David B

Purchase Details

Closed on

Oct 18, 2010

Sold by

Linn Michael J

Bought by

Federal Home Loan Mortgage Corp

Purchase Details

Closed on

Jun 30, 2005

Sold by

Wilson Jennifer J and Wilson Harry B

Bought by

Linn Michael J and Smith Jillian N

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$106,500

Interest Rate

5.69%

Mortgage Type

Fannie Mae Freddie Mac

Purchase Details

Closed on

Jun 1, 1990

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| May Zachary | -- | None Listed On Document | |

| May David B | $31,000 | Attorney | |

| Federal Home Loan Mortgage Corp | $55,400 | None Available | |

| Linn Michael J | $107,000 | -- | |

| -- | $22,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Linn Michael J | $106,500 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,780 | $33,580 | $4,400 | $29,180 |

| 2024 | $1,780 | $33,580 | $4,400 | $29,180 |

| 2023 | $1,769 | $38,120 | $4,400 | $33,720 |

| 2022 | $1,434 | $23,480 | $4,400 | $19,080 |

| 2021 | $1,347 | $23,480 | $4,400 | $19,080 |

| 2020 | $1,403 | $23,480 | $4,400 | $19,080 |

| 2019 | $1,317 | $18,170 | $4,430 | $13,740 |

| 2018 | $1,177 | $18,170 | $4,430 | $13,740 |

| 2017 | $1,179 | $18,170 | $4,430 | $13,740 |

| 2016 | $1,062 | $16,100 | $4,430 | $11,670 |

| 2015 | $1,047 | $16,100 | $4,430 | $11,670 |

| 2014 | $2,399 | $16,100 | $4,430 | $11,670 |

| 2013 | $2,399 | $25,920 | $6,050 | $19,870 |

Source: Public Records

Map

Nearby Homes

- 2023 Arlington Ave

- 2208 Superior Ave

- 2119 Central Ave

- 407 S Sutphin St

- 2008 Logan Ave

- 325 Moore St

- 1814.5 Logan Ave

- 2420 Superior Ave

- 113 N Sutphin St

- 102 Franklin St

- 209 Monroe St

- 501 Stanley St

- 615 Cleveland St

- 2619 Central Ave

- 6800 Fielders Way

- 2020 Grand Ave

- 2109 Queen Ave

- 2304 Flemming Rd

- 2128 Queen Ave

- 2409 Queen Ave

- 2203 Arlington Ave

- 2115 Arlington Ave

- 2115 Arlington Ave

- 2205 Arlington Ave

- 2110 Linden Ave

- 2108 Linden Ave

- 2207 Arlington Ave

- 2113 Arlington Ave

- 2202 Linden Ave

- 2198 Arlington Ave

- 2204 Linden Ave

- 2209 Arlington Ave

- 2200 Arlington Ave

- 2104 Linden Ave

- 2202 Arlington Ave

- 2196 Arlington Ave

- 2204 Arlington Ave

- 2111 Arlington Ave

- 2206 Linden Ave

- 113 S Sutphin St