2201 Holland Dr Placerville, CA 95667

Estimated Value: $602,000 - $732,000

4

Beds

2

Baths

2,360

Sq Ft

$282/Sq Ft

Est. Value

About This Home

This home is located at 2201 Holland Dr, Placerville, CA 95667 and is currently estimated at $665,004, approximately $281 per square foot. 2201 Holland Dr is a home located in El Dorado County with nearby schools including Camino Elementary School, El Dorado High School, and El Dorado Adventist School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 30, 2017

Sold by

Bolla Devon J

Bought by

Ericson Matthew Owen

Current Estimated Value

Purchase Details

Closed on

Mar 10, 2014

Sold by

Ericson Matthew O and Ericson Audrey C

Bought by

Ericson Matthew O

Purchase Details

Closed on

Aug 6, 2013

Sold by

Ericson Matthew O

Bought by

Country Park Estate Trust

Purchase Details

Closed on

Jun 21, 2006

Sold by

Ericson Audrey and Ericson Matthew O

Bought by

Ericson Matthew O and Ericson Audrey C

Purchase Details

Closed on

Sep 15, 1998

Sold by

Owen Ericson Matthew and Tmodrang Ericson Audrey

Bought by

Ericson Matthew O and Ericson Audrey

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$200,000

Interest Rate

6.88%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ericson Matthew Owen | -- | None Available | |

| Ericson Matthew O | -- | None Available | |

| Country Park Estate Trust | -- | None Available | |

| Ericson Matthew O | -- | None Available | |

| Ericson Matthew O | -- | Chicago Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Ericson Matthew O | $200,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,361 | $230,118 | $44,494 | $185,624 |

| 2024 | $2,361 | $225,607 | $43,622 | $181,985 |

| 2023 | $2,312 | $221,184 | $42,767 | $178,417 |

| 2022 | $2,278 | $216,848 | $41,929 | $174,919 |

| 2021 | $2,247 | $212,597 | $41,107 | $171,490 |

| 2020 | $2,216 | $210,418 | $40,686 | $169,732 |

| 2019 | $2,181 | $206,293 | $39,889 | $166,404 |

| 2018 | $2,115 | $202,249 | $39,107 | $163,142 |

| 2017 | $2,074 | $198,285 | $38,341 | $159,944 |

| 2016 | $2,118 | $194,398 | $37,590 | $156,808 |

| 2015 | $1,958 | $191,479 | $37,026 | $154,453 |

| 2014 | $1,924 | $187,730 | $36,301 | $151,429 |

Source: Public Records

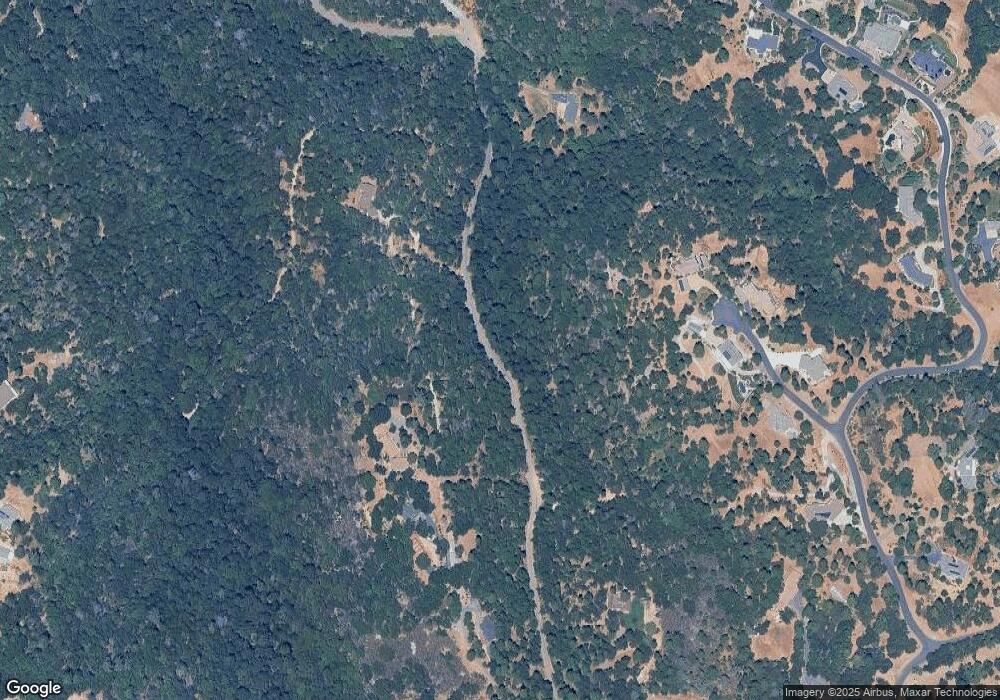

Map

Nearby Homes

- 1110 Madrone Ln

- 2095 Wild Goose Canyon Rd

- 2500 Gold Bug Ln

- 1049 Kimi Way

- 1421 Highland Ct

- 9425 Mosquito Rd

- 2689 Morrene Dr

- 0 Mona Ave

- 2655 Mona Dr

- 1015 Utah Dr

- 1011 Utah Dr

- 2624 Liberty Mine Ct

- 1017 Utah Dr

- Plan 2 at Sutter’s Ridge

- 1001 Utah Dr

- 2771 Morrene Dr

- 3022 Constellation Ave

- 944 Crawford Drift Ct

- 945 Crawford Drift Ct

- 2399 Kingsgate Rd

- 2261 Holland Dr

- 2715 Pocket Mine Rd

- 2250 Crestmont Ln

- 3021 Antigua Ct

- 2251 Crestmont Ln

- 2260 Crestmont Ln

- 3234 Wasatch Rd

- 2680 Pocket Mine Rd

- 2271 Crestmont Ln

- 3220 Wasatch Rd

- 3200 Wasatch Rd

- 2270 Crestmont Ln

- 2654 Pocket Mine Rd

- 2285 Crestmont Ln

- 3411 Parleys Canyon Rd

- 3211 Wasatch Rd

- 2301 Meadow Ln

- 2271 Olympia Ln

- 3205 Wasatch Rd

- 3271 Wasatch Rd