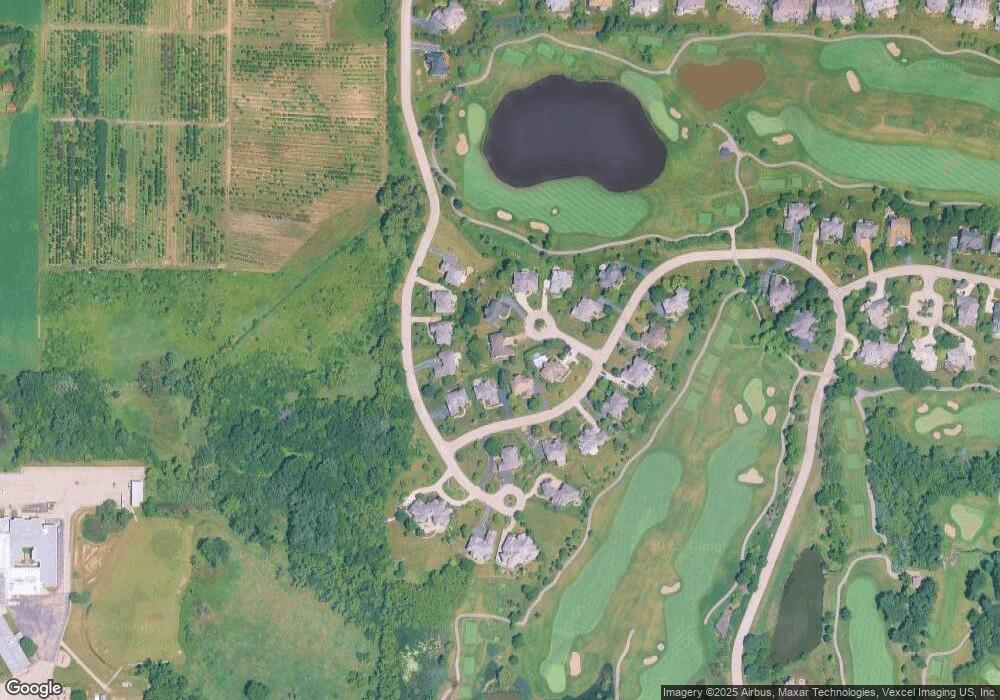

22255 W Mashie Ct Mundelein, IL 60060

Ivanhoe NeighborhoodEstimated Value: $881,342 - $1,172,000

4

Beds

4

Baths

3,893

Sq Ft

$252/Sq Ft

Est. Value

About This Home

This home is located at 22255 W Mashie Ct, Mundelein, IL 60060 and is currently estimated at $982,086, approximately $252 per square foot. 22255 W Mashie Ct is a home located in Lake County with nearby schools including Fremont Elementary School, Fremont Intermediate School, and Fremont Jr High/Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 8, 2016

Sold by

Ebben Susan B

Bought by

Ebben Susan B and Susan B Ebben Trust

Current Estimated Value

Purchase Details

Closed on

Dec 28, 2011

Sold by

Fusco Thomas J and Fusco Angela M

Bought by

Ebben Susan B

Purchase Details

Closed on

Apr 13, 2011

Sold by

Fusco Thomas J and Fusco Angela M

Bought by

Fusco Thomas J and Fusco Angela M

Purchase Details

Closed on

Feb 12, 2000

Sold by

Odell Brian M and Odell Mary C

Bought by

Fusco Thomas J and Fusco Angela M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$403,200

Interest Rate

7.25%

Purchase Details

Closed on

Apr 15, 1995

Sold by

Starzwood Development Inc

Bought by

Odell Brian M and Odell Mary C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$375,000

Interest Rate

5%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ebben Susan B | -- | Attorney | |

| Ebben Susan B | $572,500 | Ct | |

| Fusco Thomas J | -- | None Available | |

| Fusco Thomas J | $504,000 | -- | |

| Odell Brian M | $497,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Fusco Thomas J | $403,200 | |

| Previous Owner | Odell Brian M | $375,000 | |

| Closed | Fusco Thomas J | $50,400 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $15,909 | $224,363 | $36,745 | $187,618 |

| 2023 | $15,126 | $205,574 | $33,668 | $171,906 |

| 2022 | $15,126 | $190,678 | $42,293 | $148,385 |

| 2021 | $14,482 | $183,999 | $40,812 | $143,187 |

| 2020 | $14,530 | $178,935 | $39,689 | $139,246 |

| 2019 | $15,252 | $184,299 | $38,319 | $145,980 |

| 2018 | $14,897 | $183,422 | $46,777 | $136,645 |

| 2017 | $14,730 | $177,649 | $45,305 | $132,344 |

| 2016 | $15,292 | $197,003 | $43,029 | $153,974 |

| 2015 | $16,372 | $184,684 | $40,338 | $144,346 |

| 2014 | $14,646 | $168,918 | $38,177 | $130,741 |

| 2012 | $14,672 | $170,418 | $38,516 | $131,902 |

Source: Public Records

Map

Nearby Homes

- 21787 W Vernon Ridge Dr

- 29026 N Brassie Ct

- 21776 W Jupiter Ct

- 21757 W Jupiter Ct

- 21855 W Murfield Ct

- 28488 N Seminole Ct

- 1497 Kessler Dr

- 3180 Semple Way

- Abbeyville Plan at Sheldon Woods - Meadows

- 3170 Semple Way

- Continental Plan at Sheldon Woods - Meadows

- Newberry Plan at Sheldon Woods - Meadows

- Mercer Plan at Sheldon Woods - Meadows

- 1084 Joice Ln

- 1104 Joice Ln

- 1114 Joice Ln

- 1277 Kessler Dr

- 1044 Joice Ln

- 1144 Joice Ln

- 1154 Joice Ln

- 22283 W Mashie Ct

- 28987 N Sky Crest Dr

- 28975 N Sky Crest Dr

- 22317 W Vernon Ridge Dr

- 22301 W Vernon Ridge Dr

- 22221 W Mashie Ct

- 28993 N Sky Crest Dr

- 22284 W Mashie Ct

- 22285 W Vernon Ridge Dr

- 22269 W Vernon Ridge Dr

- 22256 W Mashie Ct

- 28955 N Niblick Knoll Ct Unit 4D

- 28984 N Sky Crest Dr

- 28954 N Sky Crest Dr

- 28968 N Sky Crest Dr

- 28940 N Sky Crest Dr

- 28915 N Sky Crest Dr

- 28924 N Sky Crest Dr

- 28921 N Niblick Knoll Ct

- 28984 N Niblick Knoll Ct