2227 Teardrop Ave Unit 35D Columbus, OH 43235

The Gables NeighborhoodEstimated Value: $219,000 - $1,268,806

2

Beds

2

Baths

832

Sq Ft

$589/Sq Ft

Est. Value

About This Home

This home is located at 2227 Teardrop Ave Unit 35D, Columbus, OH 43235 and is currently estimated at $489,702, approximately $588 per square foot. 2227 Teardrop Ave Unit 35D is a home located in Franklin County with nearby schools including Daniel Wright Elementary School, Ann Simpson Davis Middle School, and Dublin Scioto High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 17, 2016

Sold by

Fullen Milton E

Bought by

Golden Hopldings Llc

Current Estimated Value

Purchase Details

Closed on

Dec 30, 2004

Sold by

Quisenberry Belinda L and Quisenberry Mark W

Bought by

Fullen Milton E

Purchase Details

Closed on

Sep 17, 1999

Sold by

Williams Frances E

Bought by

Cernava Belinda L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$71,400

Interest Rate

7.12%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Aug 16, 1994

Sold by

Qualstan Corp

Bought by

Williams Frances E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$77,300

Interest Rate

8.62%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Golden Hopldings Llc | $610,000 | Northwest Title Box | |

| Fullen Milton E | $110,000 | -- | |

| Cernava Belinda L | $84,000 | Transohio Title | |

| Williams Frances E | $79,850 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Cernava Belinda L | $71,400 | |

| Previous Owner | Williams Frances E | $77,300 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,607 | $58,420 | $18,380 | $40,040 |

| 2023 | $3,557 | $58,415 | $18,375 | $40,040 |

| 2022 | $2,611 | $39,730 | $8,050 | $31,680 |

| 2021 | $2,653 | $39,730 | $8,050 | $31,680 |

| 2020 | $2,638 | $39,730 | $8,050 | $31,680 |

| 2019 | $2,591 | $34,550 | $7,000 | $27,550 |

| 2018 | $1,302 | $34,550 | $7,000 | $27,550 |

| 2017 | $2,402 | $34,550 | $7,000 | $27,550 |

| 2016 | $2,365 | $31,960 | $5,530 | $26,430 |

| 2015 | $1,190 | $31,960 | $5,530 | $26,430 |

| 2014 | $2,383 | $31,960 | $5,530 | $26,430 |

| 2013 | $1,343 | $35,490 | $6,125 | $29,365 |

Source: Public Records

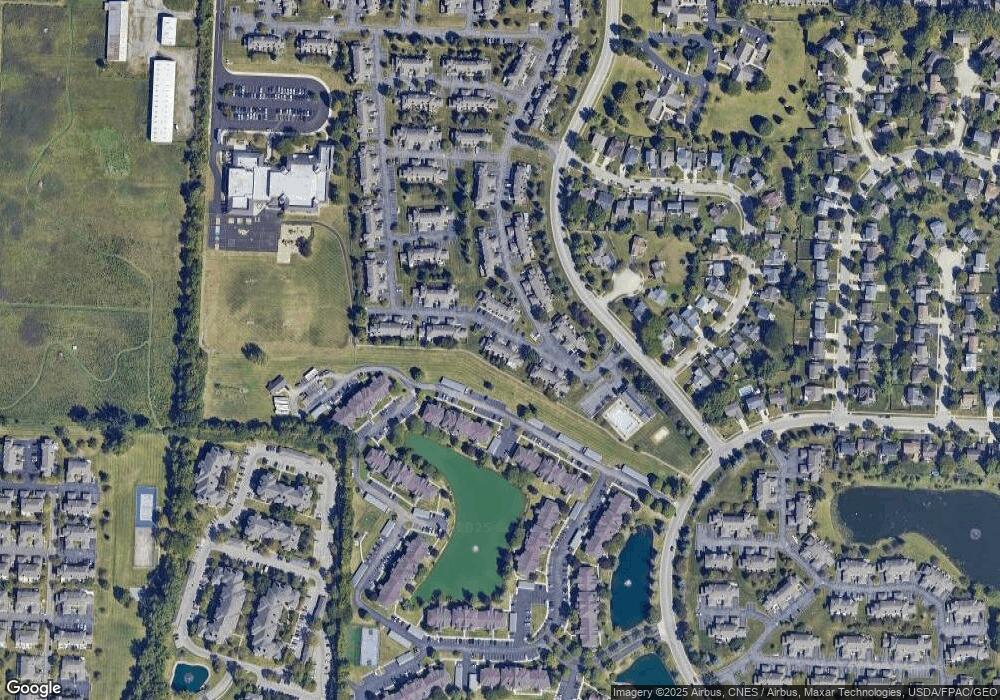

Map

Nearby Homes

- 2229 Teardrop Ave Unit 35E

- 2265 Teardrop Ave Unit 39C

- 2260 Lila Way Unit 62D

- 2236 Victoria Park Dr Unit 2236

- 5470 Baneberry Ave

- 2179 Victoria Park Dr Unit 2179

- 5396 Coral Berry Dr Unit 70E

- 2527 Maxim Ln Unit 40D

- 2522 Gardenia Dr Unit 16C

- 2560 Trotterslane Dr

- 2172 Hedgerow Rd Unit 2172G

- 5283 Ruthton Rd Unit 19

- 2550 Gardenia Dr Unit 13D

- 5656 Ramblewood Ct

- 2585 Trottersway Dr Unit 2585

- 5294 Brandy Oaks Ln

- 2622 Trottersway Dr

- 5258 Captains Ct

- 5297 Brandy Oaks Ln Unit 5297

- 5264 Parkcrest Ln Unit 5264

- 2225 Teardrop Ave Unit 35C

- 2223 Teardrop Ave Unit 35B

- 2231 Teardrop Ave Unit 35F

- 2221 Teardrop Ave Unit 35A

- 2222 Teardrop Ave Unit 36E

- 2224 Teardrop Ave Unit 36D

- 2220 Teardrop Ave

- 2211 Teardrop Ave Unit 34F

- 2226 Teardrop Ave

- 2209 Teardrop Ave Unit 34E

- 2241 Teardrop Ave Unit 38A

- 2228 Teardrop Ave

- 2243 Teardrop Ave

- 2230 Teardrop Ave

- 2207 Teardrop Ave Unit D

- 2207 Teardrop Ave Unit 34D

- 2245 Teardrop Ave

- 2205 Teardrop Ave Unit 34C

- 2247 Teardrop Ave

- 2247 Teardrop Ave Unit 38D