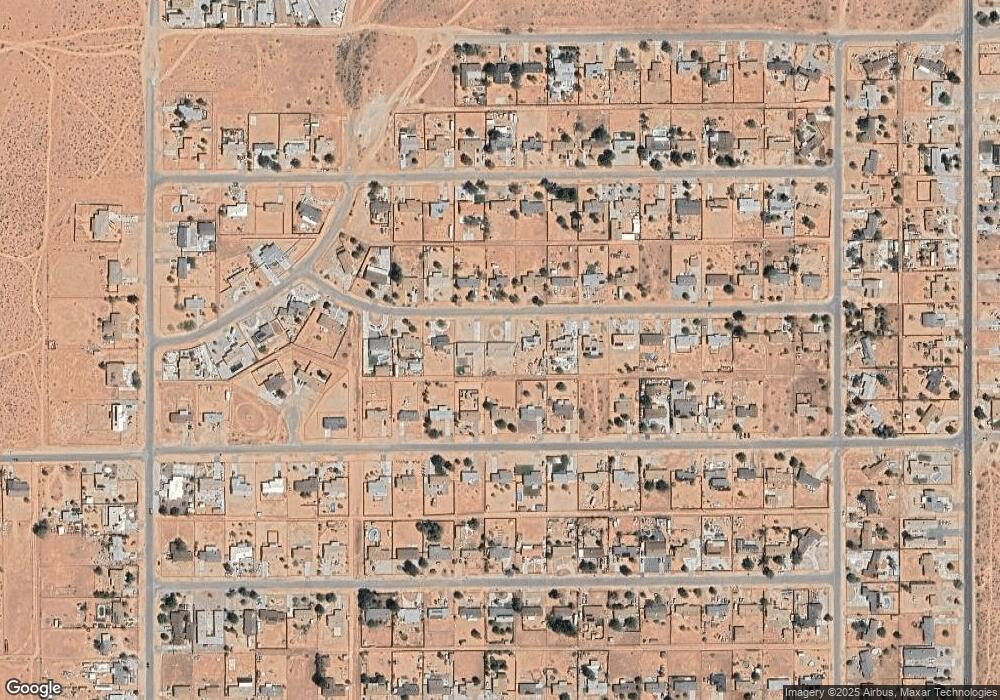

22273 Minnetonka Rd Apple Valley, CA 92308

High Desert NeighborhoodEstimated Value: $417,000 - $473,000

4

Beds

2

Baths

2,066

Sq Ft

$215/Sq Ft

Est. Value

About This Home

This home is located at 22273 Minnetonka Rd, Apple Valley, CA 92308 and is currently estimated at $443,850, approximately $214 per square foot. 22273 Minnetonka Rd is a home located in San Bernardino County with nearby schools including Sandia Elementary School and Apple Valley High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 16, 2020

Sold by

Shattles Mark T

Bought by

Duran Bryan S and Duran Yunuen E

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$292,602

Outstanding Balance

$263,362

Interest Rate

4.62%

Mortgage Type

FHA

Estimated Equity

$180,488

Purchase Details

Closed on

Oct 20, 2009

Sold by

Burt Parker Limited Partnership

Bought by

Haas B C

Purchase Details

Closed on

Nov 7, 2008

Sold by

Haas B C and Haas Hass B

Bought by

Burt Parker Limited Partnership

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$211,000

Interest Rate

6.47%

Mortgage Type

Seller Take Back

Purchase Details

Closed on

Jun 15, 2008

Sold by

Richmond Kenneth

Bought by

Haas B C

Purchase Details

Closed on

Jan 31, 2006

Sold by

Jackson Monroe

Bought by

Richmond Kenneth

Purchase Details

Closed on

Nov 30, 2005

Sold by

Wozniak Joseph A and Wozniak Marcia Cook

Bought by

Jackson Monroe

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Duran Bryan S | $298,000 | First American Title Company | |

| Haas B C | -- | First American Title Company | |

| Burt Parker Limited Partnership | $212,000 | First American | |

| Haas B C | -- | Accommodation | |

| Richmond Kenneth | $97,000 | First American | |

| Jackson Monroe | $37,500 | Commonwealth Title | |

| Jackson Monroe | $37,500 | Commonwealth Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Duran Bryan S | $292,602 | |

| Previous Owner | Burt Parker Limited Partnership | $211,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,182 | $325,905 | $65,180 | $260,725 |

| 2024 | $4,182 | $319,515 | $63,902 | $255,613 |

| 2023 | $4,072 | $313,250 | $62,649 | $250,601 |

| 2022 | $4,062 | $307,108 | $61,421 | $245,687 |

| 2021 | $3,533 | $301,087 | $60,217 | $240,870 |

| 2020 | $1,868 | $153,438 | $35,409 | $118,029 |

| 2019 | $1,833 | $150,430 | $34,715 | $115,715 |

| 2018 | $1,789 | $147,480 | $34,034 | $113,446 |

| 2017 | $1,764 | $144,589 | $33,367 | $111,222 |

| 2016 | $1,676 | $141,754 | $32,713 | $109,041 |

| 2015 | $1,651 | $139,625 | $32,222 | $107,403 |

| 2014 | $1,629 | $136,890 | $31,591 | $105,299 |

Source: Public Records

Map

Nearby Homes

- 22315 Tehama Rd

- 12416 Tonikan Rd

- 0 Little Beaver Rd Unit HD25073438

- 22035 Pahute Rd

- 12595 Central Rd

- 10647 Central Rd

- 22241 Nisqually Rd Unit 118

- 22241 Nisqually Rd Unit 121

- 22241 Nisqually Rd Unit 38

- 22241 Nisqually Rd Unit 20

- 22241 Nisqually Rd Unit 98

- 22241 Nisqually Rd Unit 169

- 22241 Nisqually Rd Unit 153

- 22241 Nisqually Rd Unit 143

- 0 Pahute Rd Unit HD25164188

- 1 Pahute Rd

- 12409 Pawnee Rd

- 0 Sioux Rd

- 22020 Nisqually Rd Unit 3

- 22020 Nisqually Rd Unit 49

- 22285 Minnetonka Rd

- 22257 Minnetonka Rd

- 22276 Pahute Rd

- 22305 Minnetonka Rd

- 22243 Minnetonka Rd

- 22288 Pahute Rd

- 22258 Pahute Rd

- 22276 Minnetonka Rd

- 22258 Minnetonka Rd

- 22288 Minnetonka Rd

- 22308 Pahute Rd

- 22246 Pahute Rd

- 22319 Minnetonka Rd

- 22225 Minnetonka Rd

- 22246 Minnetonka Rd

- 22308 Minnetonka Rd

- 22222 Pahute Rd

- 22222 Minnetonka Rd

- 22322 Minnetonka Rd

- 22333 Minnetonka Rd