223 Foxtail Dr Unit F Greenacres, FL 33415

Estimated Value: $323,613 - $363,000

3

Beds

2

Baths

1,433

Sq Ft

$242/Sq Ft

Est. Value

About This Home

This home is located at 223 Foxtail Dr Unit F, Greenacres, FL 33415 and is currently estimated at $347,153, approximately $242 per square foot. 223 Foxtail Dr Unit F is a home located in Palm Beach County with nearby schools including Cholee Lake Elementary School, Okeeheelee Middle School, and Montessori Academy of Early Enrichment.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 23, 2024

Sold by

Labonte Christina Ann and Labonte Theodore A

Bought by

Cabanilla Michael San Pedro

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$16,229

Outstanding Balance

$16,057

Interest Rate

6.77%

Estimated Equity

$331,096

Purchase Details

Closed on

Jul 16, 2004

Sold by

Gray Andre D and Gray Sharon Stinson

Bought by

Labonte Theodore A and Yandek Christina A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$130,000

Interest Rate

5.38%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Oct 13, 2001

Sold by

Stinson Edward J and Stinson Annie Pearl

Bought by

Gray Andre D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$123,338

Interest Rate

5.98%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Cabanilla Michael San Pedro | $339,000 | First American Title Insurance | |

| Labonte Theodore A | $180,000 | Fidelity Natl Title Ins Co | |

| Gray Andre D | -- | Sun Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Cabanilla Michael San Pedro | $16,229 | |

| Open | Cabanilla Michael San Pedro | $324,582 | |

| Previous Owner | Labonte Theodore A | $130,000 | |

| Previous Owner | Gray Andre D | $123,338 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,025 | $80,743 | -- | -- |

| 2023 | $984 | $78,391 | $0 | $0 |

| 2022 | $945 | $76,108 | $0 | $0 |

| 2021 | $933 | $73,891 | $0 | $0 |

| 2020 | $928 | $72,871 | $0 | $0 |

| 2019 | $925 | $71,233 | $0 | $0 |

| 2018 | $852 | $69,905 | $0 | $0 |

| 2017 | $774 | $68,467 | $0 | $0 |

| 2016 | $779 | $67,059 | $0 | $0 |

| 2015 | $797 | $66,593 | $0 | $0 |

| 2014 | $786 | $66,064 | $0 | $0 |

Source: Public Records

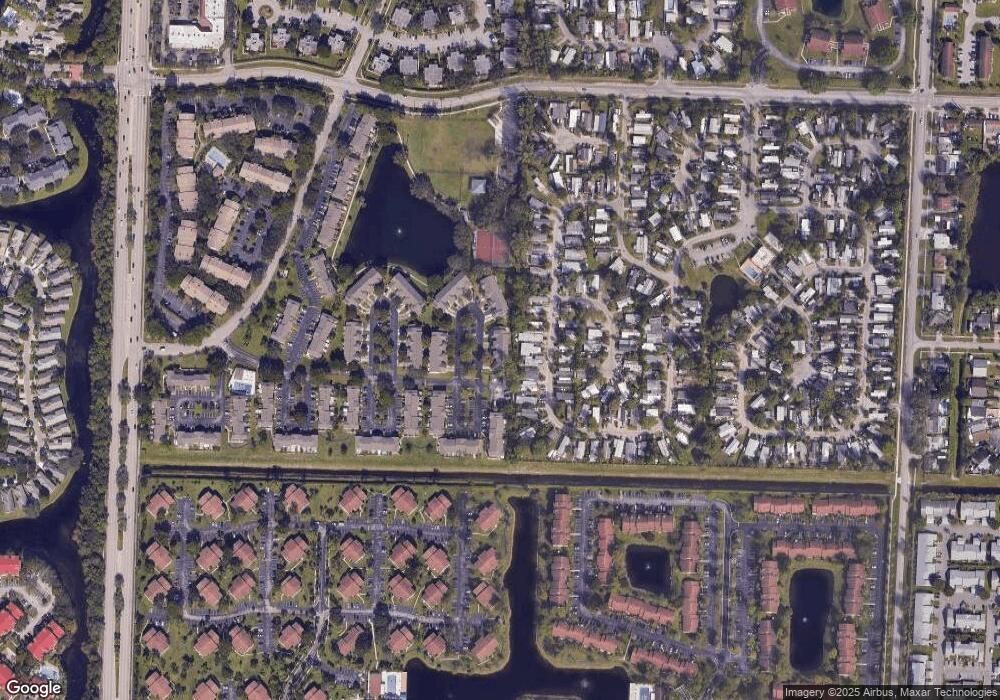

Map

Nearby Homes

- 224 Foxtail Dr Unit F

- 226 Foxtail Dr Unit C

- 229 Foxtail Dr Unit A

- 529 Shady Pine Way Unit D1

- 2220 White Pine Cir Unit B

- 528 Shady Pine Way Unit B1

- 615 Sea Pine Way Unit 40

- 519 Shady Pine Way Unit C1

- 212 Foxtail Dr Unit H

- 612 Sea Pine Way Unit 60

- 627 Sea Pine Way Unit 21

- 510 Shady Pine Way Unit A2

- 541 Shady Pine Way Unit A

- 6340 Red Pine Ln Unit A

- 512 Shady Pine Way Unit B1

- 301 Harbour Pointe Way Unit 3010

- 406 Harbour Pointe Way

- 405 Harbour Pointe Way

- 542 Shady Pine Way Unit H

- 175 Harbor Lake Cir

- 223 Foxtail Dr Unit C

- 223 Foxtail Dr Unit G

- 223 Foxtail Dr Unit C

- 223 Foxtail Dr Unit B

- 223 Foxtail Dr Unit D

- 223 Foxtail Dr Unit H

- 223 Foxtail Dr

- 223 Foxtail Dr Unit A

- 224 Foxtail Dr Unit E

- 224 Foxtail Dr

- 224 Foxtail Dr Unit B

- 224 Foxtail Dr Unit D

- 224 Foxtail Dr Unit A

- 224 Foxtail Dr Unit C

- 224 Foxtail Dr Unit H

- 224 Foxtail Dr Unit G

- 226 Foxtail Dr Unit E

- 226 Foxtail Dr Unit A

- 226 Foxtail Dr Unit F

- 226 Foxtail Dr Unit G