22407 Steeplechase Ln Diamond Bar, CA 91765

Estimated Value: $2,413,188 - $4,640,000

6

Beds

7

Baths

5,404

Sq Ft

$645/Sq Ft

Est. Value

About This Home

This home is located at 22407 Steeplechase Ln, Diamond Bar, CA 91765 and is currently estimated at $3,485,297, approximately $644 per square foot. 22407 Steeplechase Ln is a home located in Los Angeles County with nearby schools including Castle Rock Elementary School, South Pointe Middle School, and Diamond Bar High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 4, 2016

Sold by

Lodhia Bharat

Bought by

Lodhia Bharat and Lodhia Gitanjali Bharat

Current Estimated Value

Purchase Details

Closed on

May 21, 2002

Sold by

Kim Hyung Min

Bought by

Lodhia Bharat and Lodhia Gitanjali

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$987,500

Interest Rate

5.52%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Mar 28, 1997

Sold by

First Bank National Assn

Bought by

Kim Hyung Min and Kim Un Hui

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$650,000

Interest Rate

7.98%

Purchase Details

Closed on

Jan 29, 1997

Sold by

Chow David

Bought by

First Bank National Assn and First Boston Mtg Securities Corp Conduit

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$650,000

Interest Rate

7.98%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Lodhia Bharat | -- | None Available | |

| Lodhia Bharat | $1,020,000 | Chicago Title | |

| Kim Hyung Min | $820,000 | Fidelity National Title | |

| First Bank National Assn | $738,099 | Benefit Land Title Ins Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Lodhia Bharat | $987,500 | |

| Previous Owner | Kim Hyung Min | $650,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $17,826 | $1,477,281 | $757,034 | $720,247 |

| 2024 | $17,826 | $1,448,316 | $742,191 | $706,125 |

| 2023 | $17,451 | $1,419,919 | $727,639 | $692,280 |

| 2022 | $17,046 | $1,392,078 | $713,372 | $678,706 |

| 2021 | $16,723 | $1,364,784 | $699,385 | $665,399 |

| 2019 | $16,196 | $1,324,306 | $678,642 | $645,664 |

| 2018 | $15,465 | $1,298,340 | $665,336 | $633,004 |

| 2016 | $14,300 | $1,247,926 | $639,501 | $608,425 |

| 2015 | $14,390 | $1,229,182 | $629,896 | $599,286 |

| 2014 | -- | $1,205,105 | $617,558 | $587,547 |

Source: Public Records

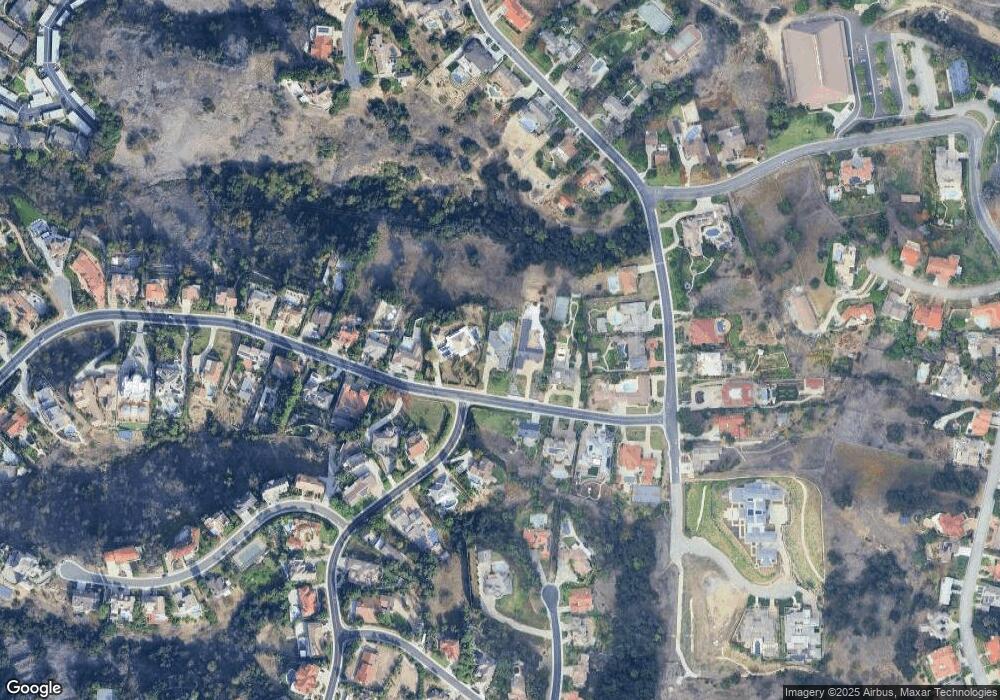

Map

Nearby Homes

- 22427 Steeplechase Ln

- 22528 Lazy Meadow Dr

- 22532 Lazy Meadow Dr

- 22517 Lazy Meadow Dr

- 22189 Rim Fire Ln

- 22455 Ridge Line Rd

- 22536 Ridge Line Rd

- 22586 Pacific Ln

- 22621 Ridge Line Rd

- 22883 Canyon View Rd

- 2256 Shady Hills Dr

- 2282 Shady Hills Dr

- 2119 Dublin Ln Unit 3

- 2621 Steeplechase Ln

- 2611 Steeplechase Ln

- 2243 Feather Rock Rd

- 2809 Oak Knoll Dr

- 21600 Laurelrim Dr Unit B

- 2820 Shadow Canyon Rd

- 2118 Tierra Loma Dr

- 22415 Steeplechase Ln

- 22315 Steeplechase Ln

- 22418 Steeplechase Ln

- 22442 Steeplechase Ln

- 22305 Steeplechase Ln

- 2505 Wagon Train Ln

- 22428 Steeplechase Ln

- 22245 Steeplechase Ln

- 2447 Alamo Heights Dr

- 2514 Wagon Train Ln

- 2435 Alamo Heights Dr

- 22304 Steeplechase Ln

- 2459 Alamo Heights Dr

- 2423 Alamo Heights Dr

- 22438 Steeplechase Ln

- 22235 Steeplechase Ln

- 22242 Steeplechase Ln

- 2524 Wagon Train Ln

- 22225 Steeplechase Ln

- 22454 Steeplechase Ln