Estimated Value: $304,000 - $425,000

3

Beds

2

Baths

1,928

Sq Ft

$181/Sq Ft

Est. Value

About This Home

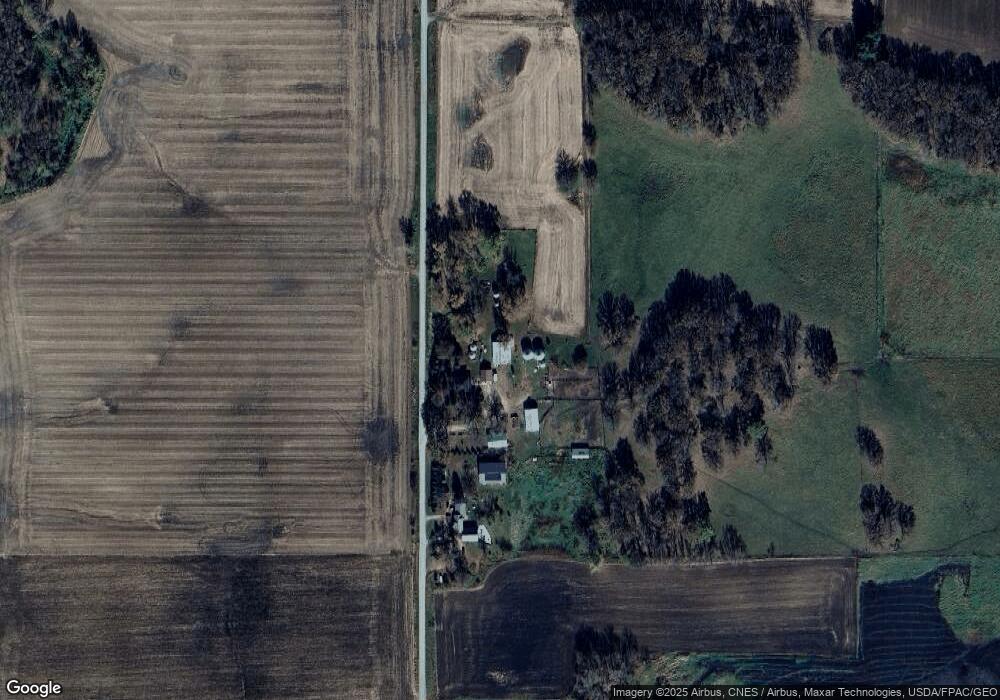

This home is located at 22410 670th Ave, Alden, MN 56009 and is currently estimated at $348,110, approximately $180 per square foot. 22410 670th Ave is a home located in Freeborn County with nearby schools including Alden-Conger Elementary School and Alden-Conger Secondary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 25, 2020

Sold by

Bryson Erik Ross and Bryson Erica Joy

Bought by

Benson Brandon Allen

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$280,250

Outstanding Balance

$249,267

Interest Rate

2.9%

Mortgage Type

New Conventional

Estimated Equity

$98,843

Purchase Details

Closed on

Jul 22, 2013

Sold by

Bryson William H and Bryson Arlene G

Bought by

Bryson Erik Ross and Bryson Erica Joy

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$180,000

Interest Rate

3.93%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Benson Brandon Allen | $295,000 | None Available | |

| Bryson Erik Ross | -- | Minnesota Abstract & Title C | |

| Bryson Erik Ross | -- | Minnesota Abstract & Title C | |

| Bryson Ann E | -- | Minnesota Abstract & Title C | |

| Bryson Ann E | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Benson Brandon Allen | $280,250 | |

| Previous Owner | Bryson Ann E | $180,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,640 | $308,500 | $103,000 | $205,500 |

| 2024 | $4,822 | $317,900 | $103,000 | $214,900 |

| 2023 | $3,468 | $300,400 | $103,000 | $197,400 |

| 2022 | $2,374 | $290,900 | $88,000 | $202,900 |

| 2021 | $1,568 | $193,100 | $73,400 | $119,700 |

| 2020 | $1,422 | $176,700 | $63,400 | $113,300 |

| 2019 | $1,346 | $176,700 | $63,400 | $113,300 |

| 2018 | $1,072 | $0 | $0 | $0 |

| 2016 | $930 | $0 | $0 | $0 |

| 2015 | $842 | $0 | $0 | $0 |

| 2014 | $838 | $0 | $0 | $0 |

| 2012 | $4,184 | $0 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 23371 650th Ave

- 259 Elizabeth St

- 232 N Broadway

- 20343 680th Ave Unit LotWP001

- 119 Hall Ln

- 146 Washington Ave

- 136 1st Ave W

- 304 S Broadway

- 150 Mason Ave

- 22598 700th Ave

- 67927 270th St

- 206 Mckinley St

- 25975 630th Ave

- 65672 275th St

- 608 Lakeshore Dr

- TBD Lake Chapeau Dr

- 2704 Campus Ln

- 2418 W Main St

- 1740 Bay Oaks Dr

- 1518 Elm St