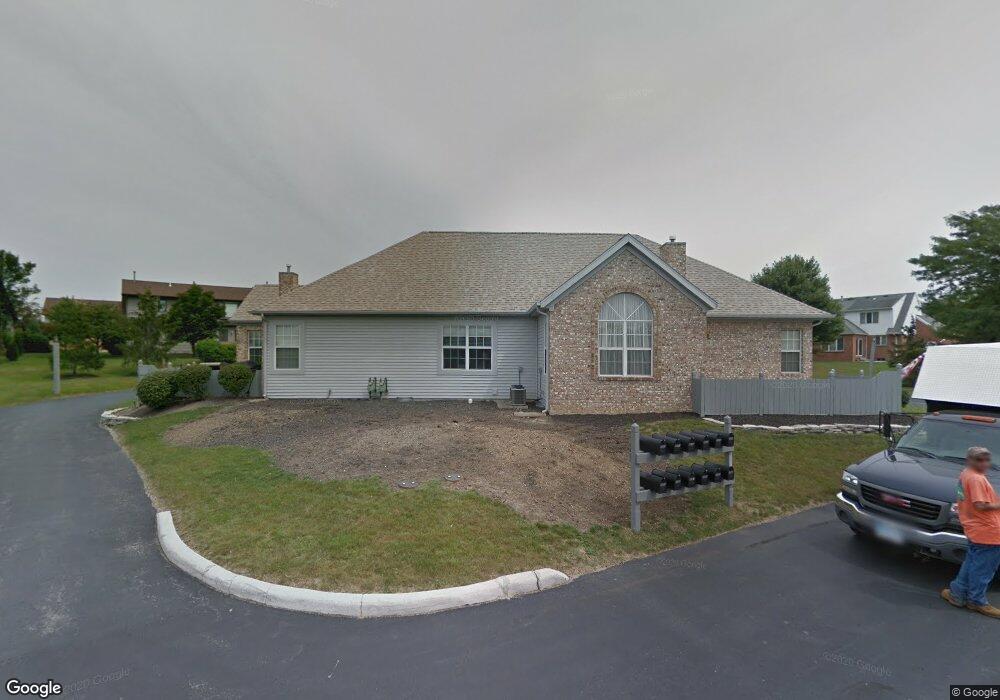

2243 Fox Run Cir Unit 1040 Findlay, OH 45840

Estimated Value: $188,119 - $208,000

2

Beds

2

Baths

1,115

Sq Ft

$179/Sq Ft

Est. Value

About This Home

This home is located at 2243 Fox Run Cir Unit 1040, Findlay, OH 45840 and is currently estimated at $199,030, approximately $178 per square foot. 2243 Fox Run Cir Unit 1040 is a home located in Hancock County with nearby schools including Wilson Vance Elementary School, Whittier Elementary School, and Glenwood Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 27, 2016

Bought by

Ulrich Desra A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Interest Rate

3.81%

Purchase Details

Closed on

Jul 25, 2003

Sold by

Best Roger and Best Nancy J

Bought by

Ulrich Desra A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$108,500

Interest Rate

4.62%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Apr 23, 2002

Sold by

Hoctel Bill A

Bought by

Pleiman Tamara L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$88,000

Interest Rate

6.93%

Mortgage Type

Balloon

Purchase Details

Closed on

Nov 9, 2000

Sold by

Wayne Robert

Bought by

Bill A Hoctel

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$70,000

Interest Rate

7.91%

Mortgage Type

New Conventional

Purchase Details

Closed on

Feb 7, 1995

Sold by

Foxgate Farms Inc

Bought by

Sink Robert and Sink Judith

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ulrich Desra A | -- | -- | |

| Ulrich Desra A | $108,500 | Mid Am Title | |

| Pleiman Tamara L | $110,000 | -- | |

| Bill A Hoctel | $101,000 | -- | |

| Sink Robert | $84,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Ulrich Desra A | -- | |

| Previous Owner | Ulrich Desra A | $108,500 | |

| Previous Owner | Pleiman Tamara L | $88,000 | |

| Previous Owner | Bill A Hoctel | $70,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,702 | $47,900 | $2,800 | $45,100 |

| 2023 | $1,704 | $47,900 | $2,800 | $45,100 |

| 2022 | $1,698 | $47,900 | $2,800 | $45,100 |

| 2021 | $1,508 | $37,040 | $2,100 | $34,940 |

| 2020 | $1,507 | $37,040 | $2,100 | $34,940 |

| 2019 | $1,479 | $37,040 | $2,100 | $34,940 |

| 2018 | $1,412 | $32,480 | $2,100 | $30,380 |

| 2017 | $706 | $32,480 | $2,100 | $30,380 |

| 2016 | $1,399 | $32,480 | $2,100 | $30,380 |

| 2015 | $1,436 | $32,830 | $2,100 | $30,730 |

| 2014 | $1,436 | $32,830 | $2,100 | $30,730 |

| 2012 | $1,448 | $32,830 | $2,100 | $30,730 |

Source: Public Records

Map

Nearby Homes

- 2245 Fox Run Cir Unit 1037

- 534 Deer Lake Dr Unit 41

- 845 Fox Run Rd

- 456 Strathaven Dr

- 801 Fox Run Rd

- 0 Meadowview Dr

- 665 Meadowview Dr

- 2047 Imperial Ln

- 601 Yorkshire Dr

- 207 Wellington Place

- 838 Longmeadow Ln

- 822 Bright Rd

- 1932 Queenswood Dr

- 1926 Queenswood Dr

- 537 Bristol Dr

- 267 Sierra Ct

- 1825 Greendale Ave

- 8419 E Woodland Trail

- 1817 Camelot Ln

- 8457 Lakewood Dr

- 2247 Fox Run Cir

- 2241 Fox Run Cir Unit U1039

- 1111 Fox Run Rd

- 1115 Fox Run Rd

- 2206 Quail Lake Rd Unit 47

- 2202 Quail Lake Rd

- 2208 Quail Lake Rd Unit 46

- 2210 Quail Lake Rd

- 2210 Quail Lake Rd Unit 45

- 2200 Quail Lake Rd Unit 50

- 2251 Fox Run Cir

- 2253 Fox Run Cir Unit 935

- 2234 Fox Run Cir Unit 1246

- 2236 Fox Run Cir Unit U1245

- 2212 Quail Lake Rd

- 2205 Quail Lake Rd

- 2254 Fox Run Cir

- 2207 Quail Lake Rd Unit 31

- 2255 Fox Run Cir

- 2257 Fox Run Cir