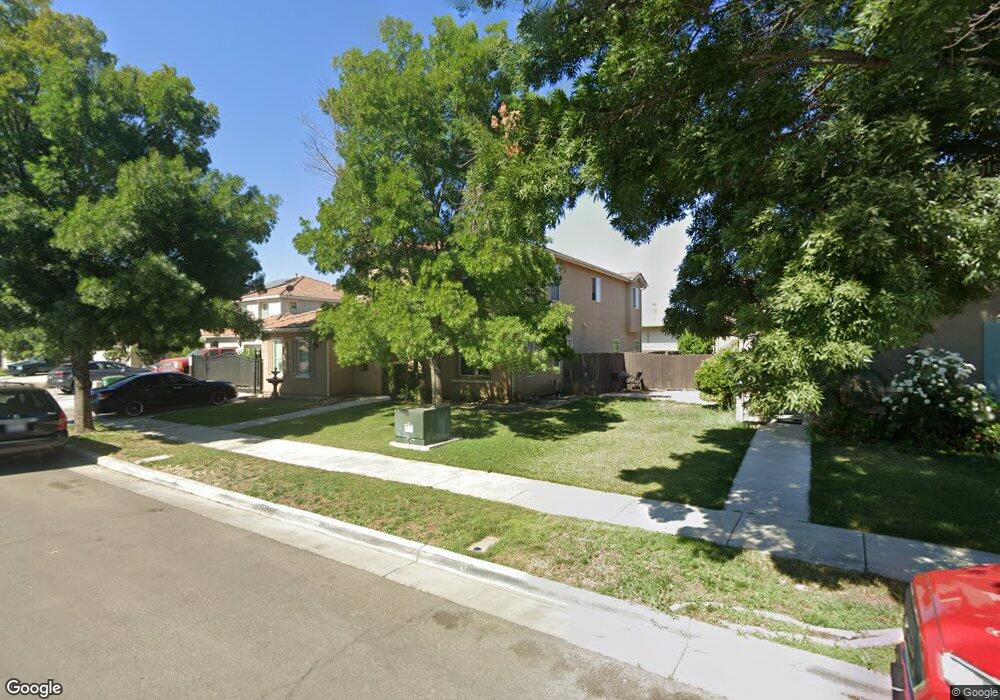

225 Honeybell Ct Los Banos, CA 93635

Estimated Value: $555,865 - $678,000

4

Beds

3

Baths

2,319

Sq Ft

$259/Sq Ft

Est. Value

About This Home

This home is located at 225 Honeybell Ct, Los Banos, CA 93635 and is currently estimated at $600,466, approximately $258 per square foot. 225 Honeybell Ct is a home located in Merced County with nearby schools including Los Banos Elementary School, Los Banos Junior High School, and Pacheco High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 8, 2022

Sold by

Oceguera Ana P

Bought by

Oceguera Ana P

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$43,000

Outstanding Balance

$36,306

Interest Rate

4.81%

Mortgage Type

New Conventional

Estimated Equity

$564,160

Purchase Details

Closed on

Oct 9, 2018

Sold by

Oceguera Julian J and Oceguera Ana P

Bought by

Oceguera Ana P

Purchase Details

Closed on

Jul 5, 2006

Sold by

Orchard Terrace Estates Llc

Bought by

Oceguera Julian J and Oceguera Ana P

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$331,098

Interest Rate

5.5%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Oceguera Ana P | -- | Trans County Title | |

| Oceguera Ana P | -- | None Available | |

| Oceguera Julian J | $544,500 | Fidelity Natl Title Co Of Ca |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Oceguera Ana P | $43,000 | |

| Previous Owner | Oceguera Julian J | $331,098 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,651 | $564,000 | $140,000 | $424,000 |

| 2024 | $6,651 | $532,000 | $130,000 | $402,000 |

| 2023 | $5,856 | $482,500 | $110,000 | $372,500 |

| 2022 | $6,288 | $523,500 | $110,000 | $413,500 |

| 2021 | $5,108 | $414,000 | $95,000 | $319,000 |

| 2020 | $5,152 | $419,500 | $95,000 | $324,500 |

| 2019 | $5,338 | $437,500 | $85,000 | $352,500 |

| 2018 | $4,305 | $349,000 | $85,000 | $264,000 |

| 2017 | $3,797 | $301,500 | $60,000 | $241,500 |

| 2016 | $3,650 | $282,000 | $55,000 | $227,000 |

| 2015 | $3,431 | $265,000 | $60,000 | $205,000 |

| 2014 | $3,097 | $238,000 | $30,000 | $208,000 |

Source: Public Records

Map

Nearby Homes

- 355 Chestnut St

- 127 Willmott Ave

- 20176 Overland Rd

- 0 Illinois Ave Unit 225094934

- 725 Nevada Ave

- 341 Lime Ave

- 410 Orange Ave

- 0 W I St Unit ML81999689

- 450 Orange Ave

- 204 North St

- 233 W I St

- 133 W I St

- 475 Santa Barbara St

- 830 Auction St

- 860 Fritz Dr

- 601 Betten St

- 625 Betten St

- 316 Rosalie Ct

- 1026 3rd St

- 255 Birchwood Ave

- 233 Honeybell Ct

- 217 Honeybell Ct

- 241 Honeybell Ct

- 209 Honeybell Ct

- 226 Honeybell Ct

- 218 Honeybell Ct

- 234 Honeybell Ct

- 249 Honeybell St

- 249 Honeybell Ct

- 201 Honeybell Ct

- 242 Honeybell Ct

- 208 Honeybell Ct

- 257 Honeybell Ct

- 250 Honeybell Ct

- 227 Sunburst St

- 219 Sunburst St

- 235 Sunburst St

- 211 Sunburst St

- 243 Sunburst St

- 258 Honeybell Ct