2253 Cove Landing Unit 2253 Grove City, OH 43123

Estimated Value: $266,000 - $276,000

2

Beds

2

Baths

1,367

Sq Ft

$199/Sq Ft

Est. Value

About This Home

This home is located at 2253 Cove Landing Unit 2253, Grove City, OH 43123 and is currently estimated at $271,367, approximately $198 per square foot. 2253 Cove Landing Unit 2253 is a home located in Franklin County with nearby schools including Monterey Elementary School, Park Street Intermediate School, and Grove City High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 23, 2019

Sold by

Karaffa Joseph U

Bought by

Hively Jacob K and Hively Nancy L

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$104,000

Outstanding Balance

$91,251

Interest Rate

4.5%

Mortgage Type

Adjustable Rate Mortgage/ARM

Estimated Equity

$180,116

Purchase Details

Closed on

Sep 21, 2007

Sold by

Schad Teresa L and Sawyer Steve E

Bought by

Karaffa Joseph U

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$110,400

Interest Rate

6.55%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Feb 15, 2006

Sold by

Schad Teresa L and Sawyer Steven E

Bought by

Schad Teresa L and Sawyer Steven E

Purchase Details

Closed on

Aug 11, 2004

Sold by

The Village At Gantz Park Llc

Bought by

Livi Sawyer Myrtle E and Livi Myrtle E Sawyer Revocable

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hively Jacob K | $130,000 | Land And Mortgage Title Box | |

| Karaffa Joseph U | $138,000 | Land & Mo | |

| Schad Teresa L | -- | None Available | |

| Livi Sawyer Myrtle E | $157,900 | Midland-Cel |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Hively Jacob K | $104,000 | |

| Previous Owner | Karaffa Joseph U | $110,400 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,935 | $86,520 | $17,500 | $69,020 |

| 2023 | $3,879 | $86,520 | $17,500 | $69,020 |

| 2022 | $2,636 | $43,230 | $7,040 | $36,190 |

| 2021 | $2,687 | $43,230 | $7,040 | $36,190 |

| 2020 | $2,678 | $43,230 | $7,040 | $36,190 |

| 2019 | $2,693 | $40,330 | $6,130 | $34,200 |

| 2018 | $1,458 | $40,330 | $6,130 | $34,200 |

| 2017 | $1,453 | $40,330 | $6,130 | $34,200 |

| 2016 | $2,329 | $32,130 | $4,830 | $27,300 |

| 2015 | $1,281 | $32,130 | $4,830 | $27,300 |

| 2014 | $2,331 | $32,130 | $4,830 | $27,300 |

| 2013 | $1,294 | $37,800 | $5,670 | $32,130 |

Source: Public Records

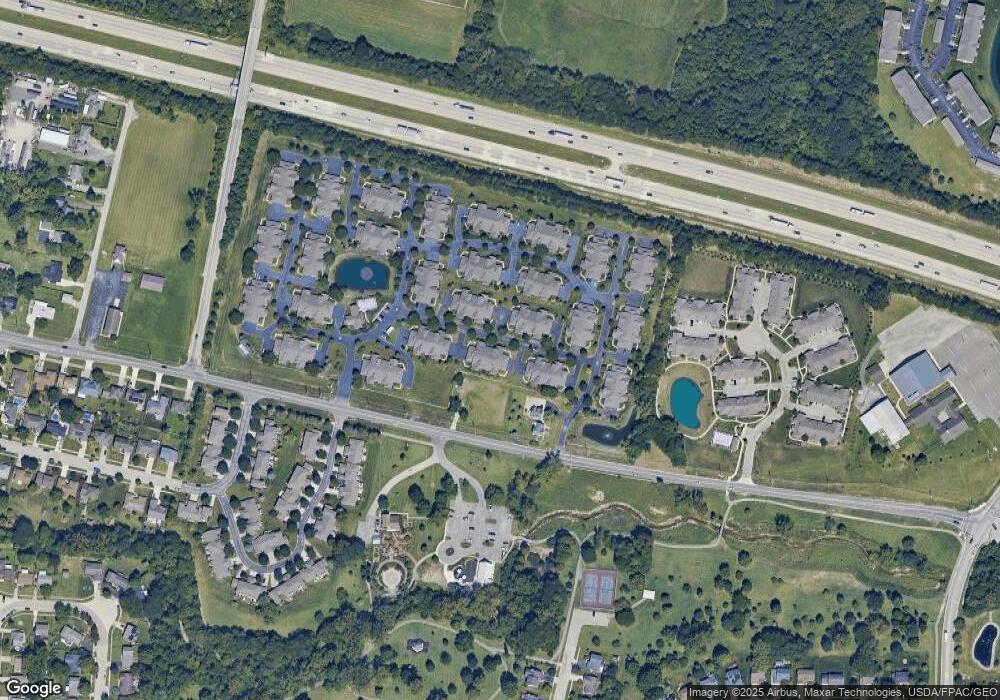

Map

Nearby Homes

- 3140 Catan Loop Unit 3140

- 3187 Parkview Cir Unit 3187

- 3201 Parkview Cir

- 3153 Scenic Way

- 3343 Marshrun Dr

- 3156 Hoover Rd

- 2407 Sunladen Dr

- 3378 Josephine Cir

- 2539 Swan Dr Unit 2539

- 1892 Farmbrook Cir S

- 3400 Marshrun Dr

- 2541 Swan Dr

- 3333 Tareyton Dr

- 1962 Farmbrook Cir N Unit 6

- 1948 Farmbrook Cir S Unit 7

- 3172 Pine Manor Blvd Unit 3172

- 2408 Warfield Dr

- 2321 Hunterstown Dr

- 2421 Yates Ave

- 2300 Ziner Cir N

- 2251 Cove Landing Unit 2251

- 2257 Cove Landing Unit 2257

- 2255 Cove Landing Unit 2255

- 2233 Cove Landing Unit 2233

- 2231 Cove Landing Unit 2231

- 2250 Cove Landing Unit 2250

- 2277 Cove Landing Unit 2277

- 2270 Cove Landing

- 2246 Cove Landing Unit 2246

- 2229 Cove Landing Unit 2229

- 2227 Cove Landing Unit 2227

- 2252 Cove Landing Unit 2252

- 2160 Home Rd

- 2248 Cove Landing Unit 2248

- 2272 Cove Landing Unit 2272

- 2275 Cove Landing Unit 2275

- 2276 Cove Landing Unit 2276

- 2241 Bainter Ave Unit 2241

- 3118 Pratt Ln Unit 3118

- 3116 Pratt Ln Unit 3116