22569 85th Ave Mediapolis, IA 52637

Estimated Value: $379,000 - $552,000

3

Beds

2

Baths

2,638

Sq Ft

$184/Sq Ft

Est. Value

About This Home

This home is located at 22569 85th Ave, Mediapolis, IA 52637 and is currently estimated at $484,189, approximately $183 per square foot. 22569 85th Ave is a home located in Des Moines County with nearby schools including Mediapolis Elementary School, Mediapolis Community Middle School, and Mediapolis High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 5, 2012

Sold by

Desoe Mitch and Desoe Julie

Bought by

Gerst Robert D and Gerst Andrea T

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$208,000

Outstanding Balance

$144,063

Interest Rate

3.59%

Mortgage Type

New Conventional

Estimated Equity

$340,126

Purchase Details

Closed on

Jul 15, 2011

Sold by

Metzger Shane A and Metzger Dusty L

Bought by

Desoe Mitch and Desoe Julie

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$192,000

Interest Rate

3.37%

Mortgage Type

Adjustable Rate Mortgage/ARM

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Gerst Robert D | $260,000 | None Available | |

| Desoe Mitch | $240,000 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Gerst Robert D | $208,000 | |

| Previous Owner | Desoe Mitch | $192,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,292 | $524,900 | $56,700 | $468,200 |

| 2024 | $3,292 | $284,400 | $12,400 | $272,000 |

| 2023 | $3,200 | $284,400 | $12,400 | $272,000 |

| 2022 | $3,014 | $233,400 | $9,300 | $224,100 |

| 2021 | $3,014 | $233,400 | $9,300 | $224,100 |

| 2020 | $3,120 | $233,400 | $9,300 | $224,100 |

| 2019 | $3,728 | $231,000 | $9,300 | $221,700 |

| 2018 | $3,650 | $277,000 | $41,000 | $236,000 |

| 2017 | $3,650 | $268,300 | $0 | $0 |

| 2016 | $3,578 | $271,400 | $0 | $0 |

| 2015 | $3,578 | $271,400 | $0 | $0 |

| 2014 | $3,612 | $207,400 | $0 | $0 |

Source: Public Records

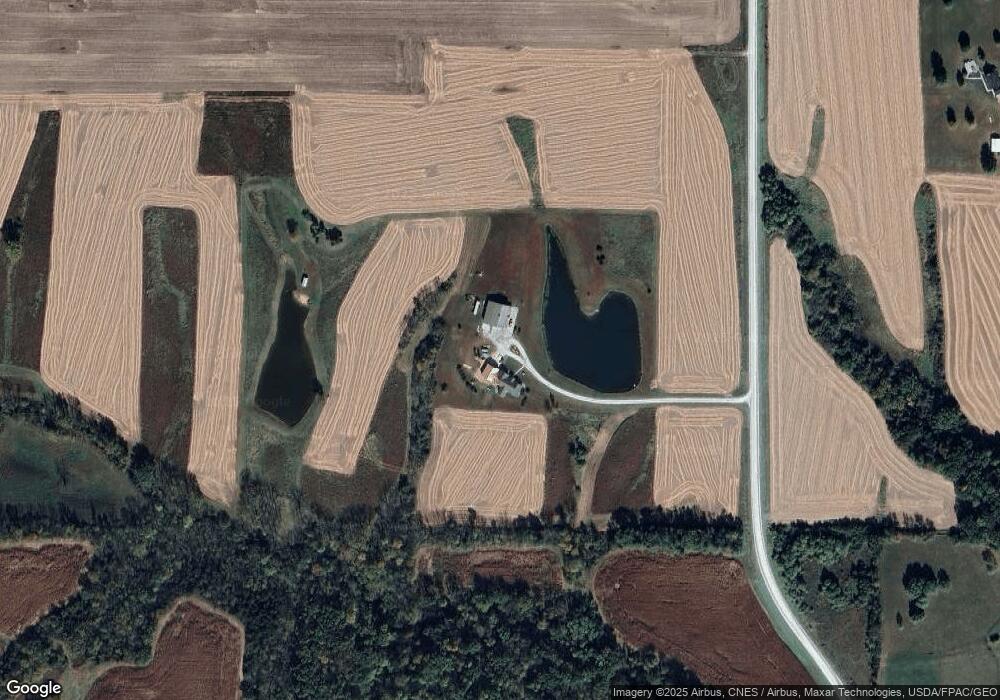

Map

Nearby Homes

- 205 Laci Dru

- 209 Laci Dru

- 201 Laci Dru

- 1011 Middle St

- 1012 Main St

- 3556 Highway 99

- 10361 155th St

- 1 155th St

- 2431 Road 1325 E

- 2499 County Highway 3

- 2422 County Highway 3

- 503 Edwards St

- 20 Willits Ln

- 600 E Division St

- 13186 Cedar Hills Dr

- 310 S Church St

- 208 E Division St

- 110 N Blair St

- 1352 Township Rd

- 301 S 11th St

- 8751 Mediapolis Rd

- 0 82nd Lot 3 Unit 20169791

- 0 82nd Lot 3 Unit 5424212

- Lot 3 82nd Ave

- 0 82nd Lot 2 Unit 20169790

- 0 82nd Lot 2 Unit 5424211

- 0 82nd Unit 5424794

- 0 Lot #2 Kings Country Estates Unit 20165406

- 0 Lot #2 Kings Country Estates Unit 5423803

- 7 Kings Country Estates

- 0 Kings Country Estates Lot 11 Unit 20165451

- 0 Kings Country Estates Lot 11 Unit 5423817

- 0 Kings Country Estates Lot 12 Unit 20165454

- 0 Kings Country Estates Lot 12 Unit 5423819

- Lot 8 82nd Ave

- 0 Kings Country Estates Unit 20165417

- 0 Kings Country Estates Unit 20165408

- 0 Kings Country Estates Unit Lot 3 20165407

- 0 Kings Country Estates Unit 5423809

- 0 Kings Country Estates Unit 5423804