2265 Teardrop Ave Columbus, OH 43235

The Gables NeighborhoodEstimated Value: $247,815 - $256,000

2

Beds

3

Baths

1,024

Sq Ft

$247/Sq Ft

Est. Value

About This Home

This home is located at 2265 Teardrop Ave, Columbus, OH 43235 and is currently estimated at $252,704, approximately $246 per square foot. 2265 Teardrop Ave is a home located in Franklin County with nearby schools including Daniel Wright Elementary School, Ann Simpson Davis Middle School, and Dublin Scioto High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 6, 2023

Sold by

Carter Jennifer E

Bought by

Shinde Rohit and Shinde Pranoti

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$205,000

Outstanding Balance

$200,757

Interest Rate

7.09%

Mortgage Type

New Conventional

Estimated Equity

$51,947

Purchase Details

Closed on

Jul 30, 2001

Sold by

Pritchard Jennifer S and Pritchard Jennifer S

Bought by

Carter Jennifer E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$102,500

Interest Rate

6.37%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

May 20, 1997

Sold by

Moscato M Ellen and Moscato Ellen Valore

Bought by

Pritchard Jennifer S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$67,100

Interest Rate

7.5%

Purchase Details

Closed on

Sep 22, 1994

Sold by

Qualstan Corp

Bought by

Ellen Valore M

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Shinde Rohit | $233,000 | World Class Title | |

| Carter Jennifer E | $102,500 | Chicago Title | |

| Pritchard Jennifer S | $83,900 | Franklin Abstract | |

| Ellen Valore M | $75,100 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Shinde Rohit | $205,000 | |

| Previous Owner | Carter Jennifer E | $102,500 | |

| Previous Owner | Pritchard Jennifer S | $67,100 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,147 | $68,570 | $18,380 | $50,190 |

| 2023 | $4,089 | $68,570 | $18,380 | $50,190 |

| 2022 | $3,003 | $46,800 | $8,050 | $38,750 |

| 2021 | $3,052 | $46,800 | $8,050 | $38,750 |

| 2020 | $3,033 | $46,800 | $8,050 | $38,750 |

| 2019 | $2,980 | $40,710 | $7,000 | $33,710 |

| 2018 | $2,808 | $40,710 | $7,000 | $33,710 |

| 2017 | $2,679 | $40,710 | $7,000 | $33,710 |

| 2016 | $2,607 | $36,230 | $5,460 | $30,770 |

| 2015 | $2,623 | $36,230 | $5,460 | $30,770 |

| 2014 | $2,626 | $36,230 | $5,460 | $30,770 |

| 2013 | $1,481 | $40,250 | $6,055 | $34,195 |

Source: Public Records

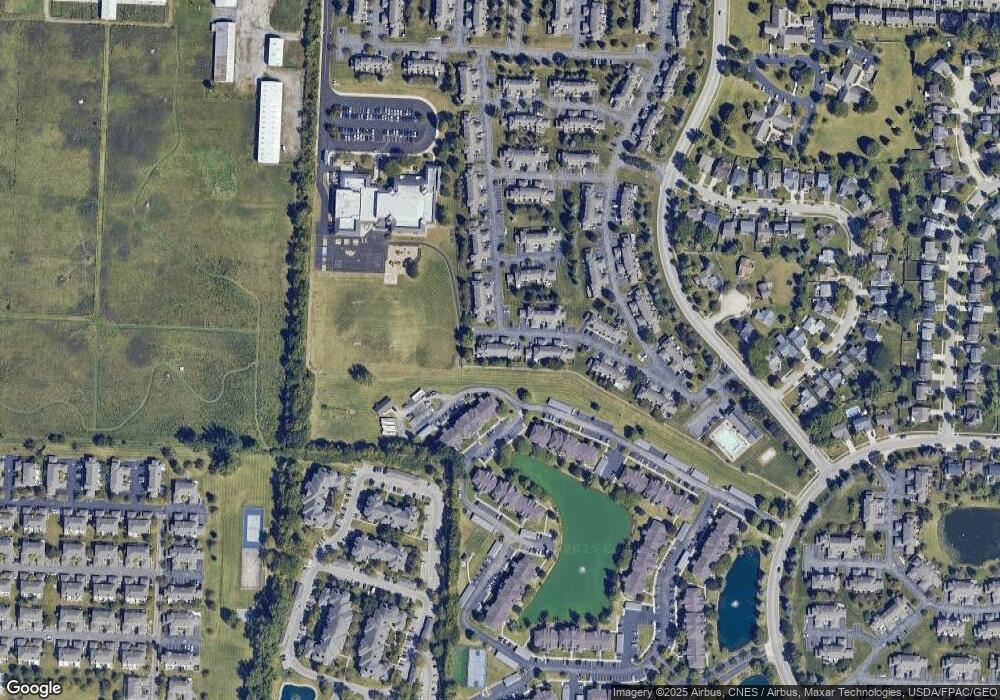

Map

Nearby Homes

- 2229 Teardrop Ave Unit 35E

- 5624 Wigmore Dr Unit 50B

- 2260 Lila Way Unit 62D

- 2540 Dahlia Way Unit 26D

- 2560 Trotterslane Dr

- 2579 Trotterslane Dr

- 5646 Dorsey Dr

- 2622 Trottersway Dr

- 2585 Trottersway Dr Unit 2585

- 5283 Ruthton Rd Unit 19

- 2491 Calais Way

- 5294 Brandy Oaks Ln

- 5273 Brandy Oaks Ln

- 5268 Captains Ct

- 5322 Darlington Rd Unit E

- 2744 Greystone Dr Unit E

- 5000 Slate Run Woods Ct

- 5108 Ranstead Ct

- 1683 Saint Albans Ct Unit 22-83

- 5111 Schuylkill St

- 2263 Teardrop Ave Unit 39B

- 2267 Teardrop Ave Unit 39D

- 2261 Teardrop Ave Unit 39A

- 2269 Teardrop Ave Unit 39E

- 2271 Teardrop Ave

- 2251 Teardrop Ave Unit 38F

- 2249 Teardrop Ave

- 5601 Barney Ln

- 2248 Teardrop Ave Unit 37B

- 5603 Barney Ln Unit 40B

- 2247 Teardrop Ave

- 2247 Teardrop Ave Unit 38D

- 2250 Teardrop Ave Unit 37A

- 5605 Barney Ln Unit 40C

- 2245 Teardrop Ave

- 2246 Teardrop Ave Unit 37C

- 5607 Barney Ln Unit 40D

- 2244 Teardrop Ave Unit 37D

- 2243 Teardrop Ave

- 2241 Teardrop Ave Unit 38A