2274 County Road 3250 Paradise, TX 76073

Estimated Value: $503,000 - $682,986

3

Beds

2

Baths

2,118

Sq Ft

$293/Sq Ft

Est. Value

About This Home

This home is located at 2274 County Road 3250, Paradise, TX 76073 and is currently estimated at $619,995, approximately $292 per square foot. 2274 County Road 3250 is a home located in Wise County with nearby schools including Paradise Elementary School, Paradise Intermediate School, and Paradise Junior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 6, 2020

Sold by

Nick Mccasland

Bought by

Swartz Scott

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$195,853

Outstanding Balance

$183,307

Interest Rate

6.25%

Mortgage Type

Land Contract Argmt. Of Sale

Estimated Equity

$436,688

Purchase Details

Closed on

Jul 7, 2014

Sold by

Mccasland Brooklyn Sierra

Bought by

Mccasland Nickey Ray

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$80,000

Interest Rate

4.19%

Mortgage Type

Seller Take Back

Purchase Details

Closed on

May 29, 2001

Sold by

Mccasland Nick and Mccasland Debbie

Bought by

Mccasland Nick

Purchase Details

Closed on

Aug 23, 1995

Bought by

Mccasland Nick

Purchase Details

Closed on

Jul 11, 1994

Bought by

Mccasland Nick

Purchase Details

Closed on

Jun 2, 1993

Bought by

Mccasland Nick

Purchase Details

Closed on

Jan 1, 1901

Bought by

Mccasland Nick

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Swartz Scott | $205,853 | None Available | |

| Mccasland Nickey Ray | -- | None Available | |

| Mccasland Nick | -- | -- | |

| Mccasland Nick | -- | -- | |

| Mccasland Nick | -- | -- | |

| Mccasland Nick | -- | -- | |

| Mccasland Nick | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Swartz Scott | $195,853 | |

| Previous Owner | Mccasland Nickey Ray | $80,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $8,440 | $721,482 | $246,064 | $475,418 |

| 2024 | $8,440 | $697,535 | $246,064 | $451,471 |

| 2023 | $8,760 | $628,225 | $0 | $0 |

| 2022 | $8,724 | $558,970 | $189,140 | $369,830 |

| 2021 | $7,664 | $469,340 | $177,170 | $292,170 |

| 2020 | $6,983 | $417,340 | $135,870 | $281,470 |

| 2019 | $6,676 | $415,250 | $135,870 | $279,380 |

| 2018 | $6,144 | $352,790 | $106,960 | $245,830 |

| 2017 | $5,543 | $312,280 | $79,130 | $233,150 |

| 2016 | $5,077 | $280,130 | $69,670 | $210,460 |

| 2015 | -- | $281,880 | $65,540 | $216,340 |

| 2014 | -- | $217,800 | $7,930 | $209,870 |

Source: Public Records

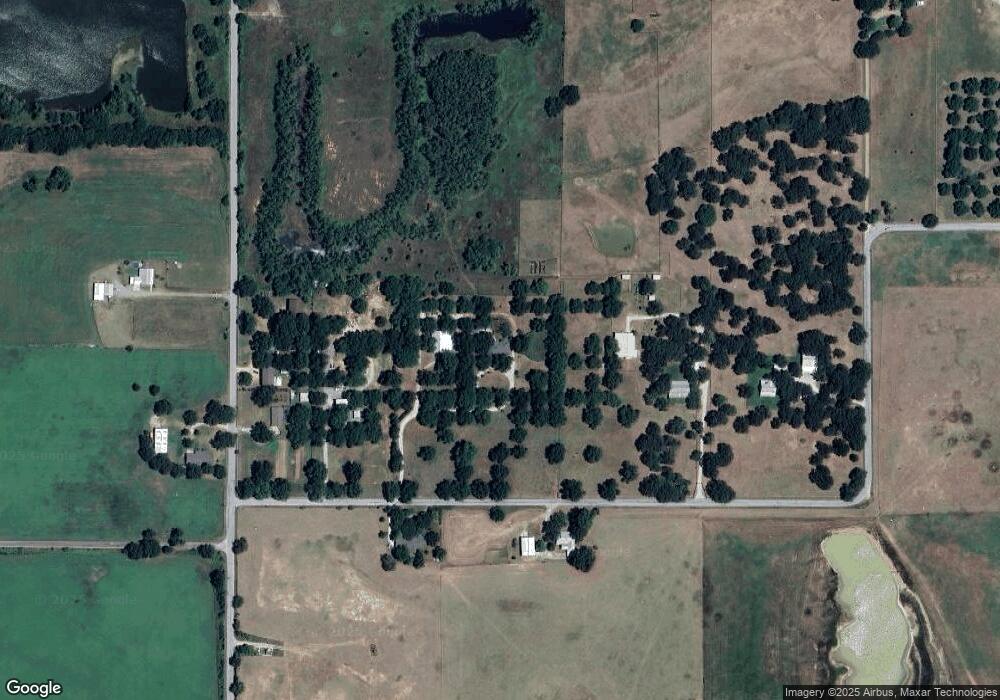

Map

Nearby Homes

- 340 County Road 3336

- 886 County Road 3341

- The Silverwood Plan at Honeysuckle Ranch

- The Sydney Plan at Honeysuckle Ranch

- The Caddo Plan at Honeysuckle Ranch

- The Salado Plan at Honeysuckle Ranch

- The Bradford Plan at Honeysuckle Ranch

- The Cibolo Plan at Honeysuckle Ranch

- The Leona II Plan at Honeysuckle Ranch

- The Carter Plan at Honeysuckle Ranch

- The Renner Plan at Honeysuckle Ranch

- The Colorado II Plan at Honeysuckle Ranch

- The Campbell Plan at Honeysuckle Ranch

- The Aubrey Plan at Honeysuckle Ranch

- The Aylin Plan at Honeysuckle Ranch

- The Sapphire Ranch II Plan at Honeysuckle Ranch

- 485 Honeysuckle

- 165 Lonicera Ln

- 109 Bluebonnett

- 169 Lonicera Ln

- 2238 County Road 3250

- 2259 County Road 3250

- 2293 County Road 3250

- 743 County Road 3241

- 2204 County Road 3250

- 762 County Road 3241

- 000 County Rd 3241

- 000 Cr 3241

- 0 County Road 3241 Unit 13111928

- 0 County Road 3241 Unit 11399157

- 2060 County Road 3250

- 2060 County Road 3250

- 2454 County Road 3250

- 127 County Road 3332

- 127 County Road 3332

- 2027 County Road 3250

- 2027 County Road 3250

- 263 County Road 3332

- 2004 County Road 3250

- 373 County Road 3332