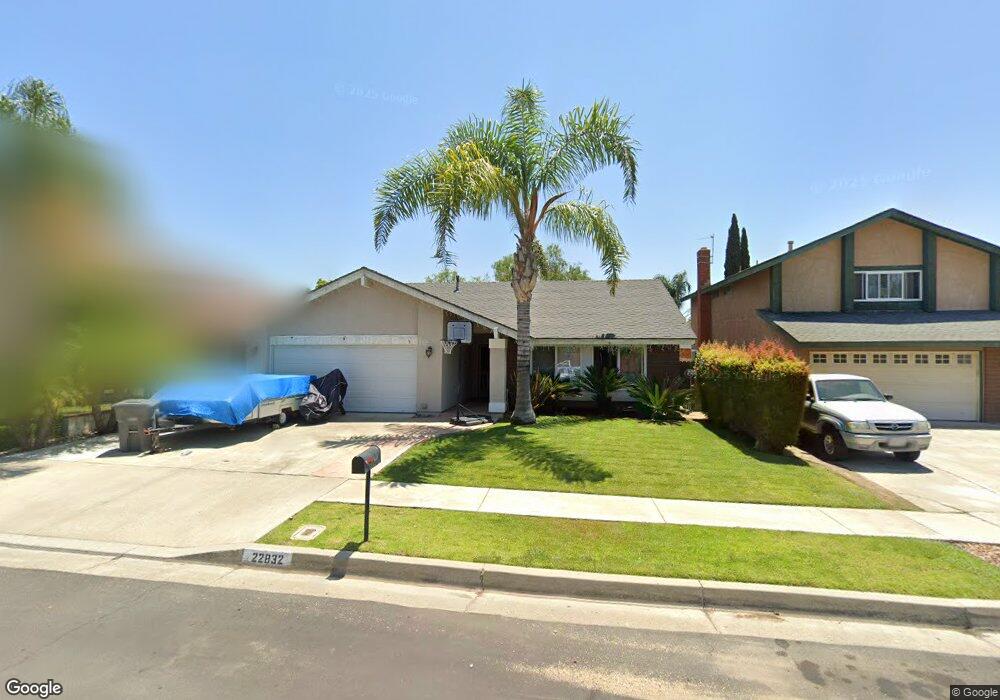

22832 Foxborough Way Lake Forest, CA 92630

Estimated Value: $1,107,000 - $1,216,000

3

Beds

2

Baths

1,329

Sq Ft

$861/Sq Ft

Est. Value

About This Home

This home is located at 22832 Foxborough Way, Lake Forest, CA 92630 and is currently estimated at $1,144,314, approximately $861 per square foot. 22832 Foxborough Way is a home located in Orange County with nearby schools including La Madera Elementary School, Los Alisos Intermediate School, and El Toro High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 13, 2020

Sold by

Gonzales Gilbert J and Gonzales Tina A

Bought by

Gonzales Gilbert J and Gonzales Athena A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$279,750

Outstanding Balance

$248,938

Interest Rate

2.8%

Mortgage Type

New Conventional

Estimated Equity

$895,376

Purchase Details

Closed on

Jan 8, 2007

Sold by

James William M and James Judith E

Bought by

Gonzales Gilbert J and Gonzales Tina A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$370,000

Interest Rate

6.09%

Mortgage Type

Seller Take Back

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Gonzales Gilbert J | -- | Western Resources Title Co | |

| Gonzales Gilbert J | $570,000 | Southland Title Corporation |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Gonzales Gilbert J | $279,750 | |

| Closed | Gonzales Gilbert J | $370,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,888 | $763,671 | $618,497 | $145,174 |

| 2024 | $7,888 | $748,698 | $606,370 | $142,328 |

| 2023 | $7,702 | $734,018 | $594,480 | $139,538 |

| 2022 | $7,565 | $719,626 | $582,824 | $136,802 |

| 2021 | $7,415 | $705,516 | $571,396 | $134,120 |

| 2020 | $7,117 | $676,000 | $554,448 | $121,552 |

| 2019 | $7,114 | $676,000 | $554,448 | $121,552 |

| 2018 | $6,695 | $635,460 | $523,097 | $112,363 |

| 2017 | $6,692 | $635,460 | $523,097 | $112,363 |

| 2016 | $6,582 | $623,000 | $512,840 | $110,160 |

| 2015 | $6,102 | $576,000 | $465,840 | $110,160 |

| 2014 | $5,243 | $496,100 | $385,940 | $110,160 |

Source: Public Records

Map

Nearby Homes

- 22718 Via Castilla

- 22962 Springwater

- 22862 Bonita Ln

- 25331 Via Viejo

- 25312 Pizarro Rd

- 22461 Silver Spur

- 26025 Via Pera Unit J3

- 26068 Via Pera

- 26158 Via Pera Unit E4

- 133 Aliso Ridge Loop

- 25482 Coral Wood St

- 25496 Coral Wood St

- 25614 Mont Pointe Unit 3D

- 25885 Trabuco Rd Unit 206

- 25885 Trabuco Rd Unit 91

- 25885 Trabuco Rd Unit 306

- 25885 Trabuco Rd Unit 33

- 25885 Trabuco Rd Unit 226

- 25885 Trabuco Rd Unit 271

- 25644 Mont Pointe Unit 1A

- 22822 Foxborough Way

- 22836 Foxborough Way

- 22816 Foxborough Way

- 22931 Broadleaf

- 22935 Broadleaf

- 22921 Broadleaf

- 22941 Broadleaf

- 22842 Foxborough Way

- 25581 Toledo Way

- 22812 Foxborough Way

- 22915 Broadleaf

- 25622 Dartmouth Cir

- 22951 Broadleaf

- 22846 Foxborough Way

- 22911 Broadleaf

- 22961 Broadleaf

- 22802 Foxborough Way

- 25586 Toledo Way

- 25571 Toledo Way

- 25612 Dartmouth Cir