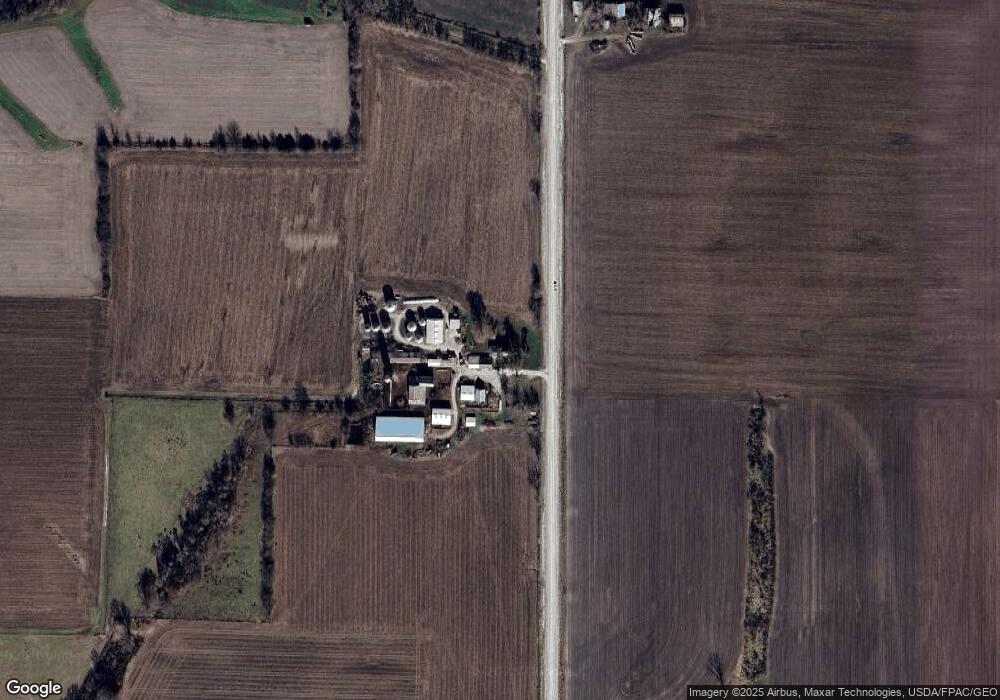

2284 Saint Paul Rd West Point, IA 52656

Estimated Value: $164,000 - $912,467

2

Beds

1

Bath

1,668

Sq Ft

$234/Sq Ft

Est. Value

About This Home

This home is located at 2284 Saint Paul Rd, West Point, IA 52656 and is currently estimated at $389,867, approximately $233 per square foot. 2284 Saint Paul Rd is a home located in Lee County with nearby schools including Fort Madison High School, Holy Trinity Catholic Elementary-St. Paul, and Holy Trinity Catholic Elementary.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 15, 2013

Sold by

Flanagan Marty

Bought by

Meierotto Martin L and Meierotto Julie Jo

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$484,000

Outstanding Balance

$248,382

Interest Rate

4.3%

Mortgage Type

Future Advance Clause Open End Mortgage

Estimated Equity

$141,485

Purchase Details

Closed on

Nov 8, 2005

Sold by

Conrad Susan K and Fullenkamp Thomas F

Bought by

Meierotto Martin L and Meierotto Julie J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$182,000

Interest Rate

6.17%

Mortgage Type

Farmers Home Administration

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Meierotto Martin L | $537,000 | None Available | |

| Meierotto Martin L | $121,000 | None Available | |

| Meierotto Martin L | $121,000 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Meierotto Martin L | $484,000 | |

| Previous Owner | Meierotto Martin L | $182,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,032 | $128,260 | $45,470 | $82,790 |

| 2023 | $2,002 | $128,260 | $45,470 | $82,790 |

| 2022 | $1,396 | $86,860 | $34,680 | $52,180 |

| 2021 | $1,396 | $85,400 | $34,680 | $50,720 |

| 2020 | $1,272 | $79,030 | $32,650 | $46,380 |

| 2019 | $1,106 | $79,030 | $32,650 | $46,380 |

| 2018 | $1,144 | $89,510 | $0 | $0 |

| 2017 | $1,144 | $108,970 | $0 | $0 |

| 2016 | $1,184 | $108,970 | $0 | $0 |

| 2015 | $1,184 | $138,780 | $0 | $0 |

| 2014 | $1,534 | $138,780 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 2280 Windmill Way

- 811 Avenue C

- 607 Bel Air Dr

- 2257 Burt Rd

- 1794 150th St

- 2113 204th Ave

- 00 180th St

- 1847 Salem Rd

- 3035 New London Rd

- 2532 305th St

- 2942 Four Seasons Rd

- 808 Park St

- 603 Fruit St

- 808 Pershing St

- 3016 189th St

- 3025 189th St

- 720 Pershing St

- 2229 235th St

- 115 Lynn St

- 19774 Country Road 79