23 Coventry A Unit 23 West Palm Beach, FL 33417

Century Village-West Palm Beach NeighborhoodEstimated Value: $102,487 - $142,000

2

Beds

2

Baths

814

Sq Ft

$148/Sq Ft

Est. Value

About This Home

This home is located at 23 Coventry A Unit 23, West Palm Beach, FL 33417 and is currently estimated at $120,122, approximately $147 per square foot. 23 Coventry A Unit 23 is a home located in Palm Beach County with nearby schools including Grassy Waters Elementary School, Bear Lakes Middle School, and Palm Beach Lakes High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 15, 2019

Sold by

Friedman Samuel

Bought by

Rosen Zion

Current Estimated Value

Purchase Details

Closed on

Feb 4, 2015

Sold by

Paisson Mats

Bought by

Friedman Samuel

Purchase Details

Closed on

Jun 8, 2010

Sold by

Auler Patricia and The Patricia Auler Revocable T

Bought by

Palsson Mats

Purchase Details

Closed on

Oct 13, 2004

Sold by

Auler Patricia

Bought by

Auler Patricia and Patricia Auler Revocable Trust

Purchase Details

Closed on

Nov 25, 2002

Sold by

Obrien John W and Obrien Rosemary F

Bought by

Auler Patricia

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$15,000

Interest Rate

6.3%

Purchase Details

Closed on

Aug 24, 2001

Sold by

Obrien John W and Obrien Rosemary F

Bought by

Obrien John W

Purchase Details

Closed on

Dec 5, 2000

Sold by

Benjamin And Leona M Miller Trs

Bought by

Obrien John W

Purchase Details

Closed on

Aug 11, 2000

Sold by

Miller Benjamin and Miller Leona M

Bought by

Miller Benjamin

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Rosen Zion | $67,000 | Trident Title | |

| Friedman Samuel | $30,000 | First Intl Title Inc | |

| Palsson Mats | $34,000 | Attorney | |

| Auler Patricia | -- | -- | |

| Auler Patricia | $37,000 | -- | |

| Obrien John W | -- | -- | |

| Obrien John W | $15,000 | -- | |

| Miller Benjamin | -- | -- | |

| Miller Benjamin | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Auler Patricia | $15,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,567 | $72,139 | -- | -- |

| 2024 | $1,567 | $65,581 | -- | -- |

| 2023 | $1,445 | $59,619 | $0 | $0 |

| 2022 | $1,294 | $54,199 | $0 | $0 |

| 2021 | $1,133 | $49,272 | $0 | $49,272 |

| 2020 | $1,137 | $49,272 | $0 | $49,272 |

| 2019 | $1,021 | $45,630 | $0 | $45,630 |

| 2018 | $894 | $38,630 | $0 | $38,630 |

| 2017 | $807 | $32,630 | $0 | $0 |

| 2016 | $802 | $31,630 | $0 | $0 |

| 2015 | $714 | $24,796 | $0 | $0 |

| 2014 | $665 | $22,542 | $0 | $0 |

Source: Public Records

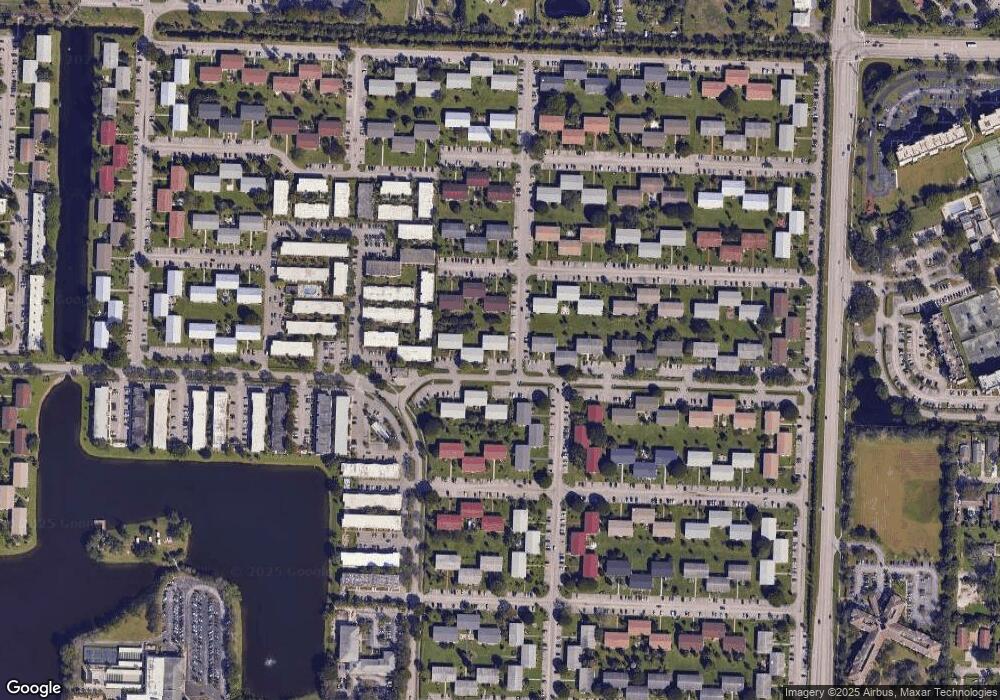

Map

Nearby Homes

- 184 Coventry H

- 148 Coventry G

- 160 Coventry G Unit 160

- 150 Coventry G Unit 150

- 163 Coventry G Unit 163

- 211 Coventry I Unit 211

- 213 Coventry I

- 36 Norwich B Unit B

- 201 Coventry I Unit 201

- 203 Coventry I

- 204 Salisbury I Unit 204

- 19 Norwich A Unit 19

- 52 Norwich C

- 95 Plymouth L

- 93 Coventry D Unit 93

- 198 Salisbury I

- 50 Coventry C Unit 50

- 221 Coventry J

- 56 Norwich C Unit 56

- 91 Coventry D

- 23 Coventry A Unit A

- 23 Coventry A

- 24 Coventry A Unit 24

- 22 Coventry A

- 20 Coventry A

- 21 Coventry A Unit A

- 21 Coventry A

- 12 Coventry A

- 11 Coventry A Unit 11

- 11 Coventry A Unit 33417 11-A

- 11 Coventry A

- 8 Coventry A Unit A

- 8 Coventry A

- 10 Coventry A

- 177 Waltham H

- 19 Coventry A

- 169 Waltham H

- 157 Coventry G

- 9 Coventry A Unit 90

- 9 Coventry A Unit 9