23 Medina Way Unit 322 Rancho Mirage, CA 92270

Estimated Value: $486,000 - $673,000

3

Beds

2

Baths

1,680

Sq Ft

$351/Sq Ft

Est. Value

About This Home

This home is located at 23 Medina Way Unit 322, Rancho Mirage, CA 92270 and is currently estimated at $590,120, approximately $351 per square foot. 23 Medina Way Unit 322 is a home located in Riverside County with nearby schools including James Earl Carter Elementary School, Colonel Mitchell Paige Middle School, and Palm Desert High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 11, 2021

Sold by

Mackay Kelly

Bought by

Kelly Mackay Revocable Living Trust

Current Estimated Value

Purchase Details

Closed on

Nov 21, 2006

Sold by

Harrington Kathleen M

Bought by

Harrington Kathleen M

Purchase Details

Closed on

Feb 26, 2002

Sold by

Reed William D and Reed Shirley M

Bought by

Harrington Kathleen M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$210,400

Interest Rate

7.08%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

May 3, 1999

Sold by

Reed William D M D and Reed Shirley M

Bought by

Reed William D and Reed Shirley M

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Kelly Mackay Revocable Living Trust | -- | None Available | |

| Harrington Kathleen M | -- | None Available | |

| Harrington Kathleen M | $263,000 | Old Republic Title Company | |

| Reed William D | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Harrington Kathleen M | $210,400 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,192 | $388,496 | $97,115 | $291,381 |

| 2023 | $5,192 | $373,412 | $93,345 | $280,067 |

| 2022 | $4,951 | $366,091 | $91,515 | $274,576 |

| 2021 | $4,838 | $358,914 | $89,721 | $269,193 |

| 2020 | $4,753 | $355,235 | $88,802 | $266,433 |

| 2019 | $4,668 | $348,270 | $87,061 | $261,209 |

| 2018 | $4,586 | $341,442 | $85,354 | $256,088 |

| 2017 | $4,499 | $334,748 | $83,681 | $251,067 |

| 2016 | $4,397 | $328,186 | $82,041 | $246,145 |

| 2015 | $4,414 | $323,258 | $80,809 | $242,449 |

| 2014 | $4,345 | $316,927 | $79,227 | $237,700 |

Source: Public Records

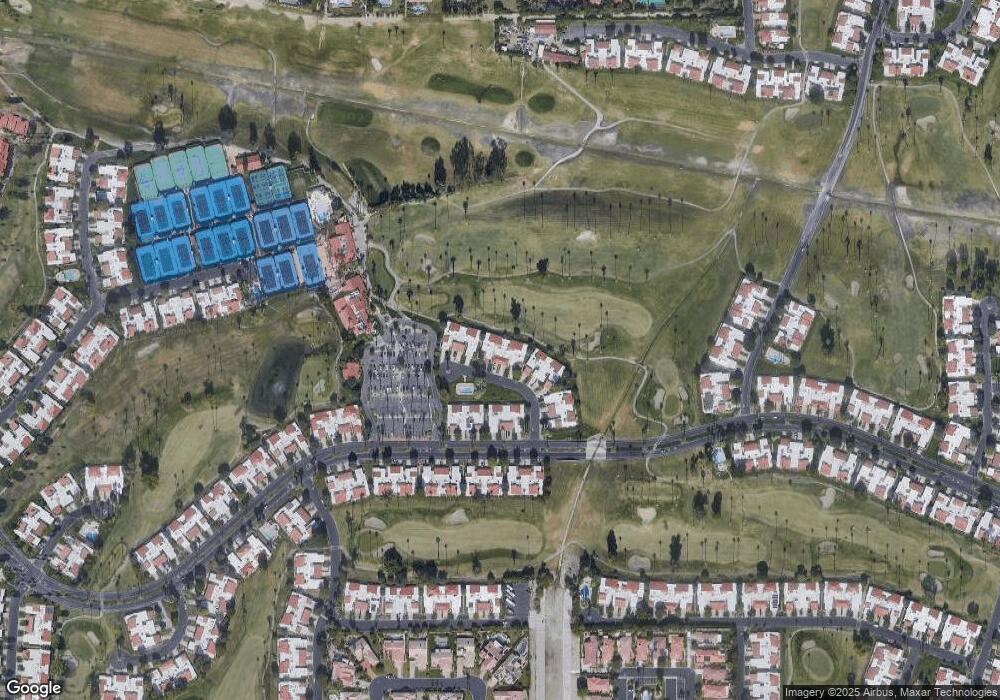

Map

Nearby Homes

- 44 San Sebastian Dr Unit 375

- 17 Toledo Dr

- 41 White Sun Way

- 25 Vistara Dr

- 11 Calle Encinitas

- 28 Clancy Ln S

- 72408 Desert Dr

- 15 Florentina Dr

- 72424 Desert Dr

- 119 Don Quixote Dr

- 133 Torremolinos Dr

- 60 El Toro Dr

- 72374 Rancho Rd

- 122 Giralda Cir

- 109 Torremolinos Dr

- 72806 Fleetwood Cir

- 72834 Fleetwood Cir

- 111 Juan Cir

- 72400 Tanglewood Ln

- 69 Don Quixote Dr

- 25 Medina Way

- 21 Medina Way

- 19 Medina Way

- 27 Medina Way

- 29 Medina Way

- 17 Medina Way

- 31 Medina Way

- 15 Medina Way

- 33 Medina Way

- 11 Medina Way

- 112 Avenida Las Palmas

- 9 Medina Way Unit 328

- 114 Avenida Las Palmas

- 102 Avenida Las Palmas

- 110 Avenida Las Palmas

- 108 Avenida Las Palmas Unit 313

- 106 Avenida Las Palmas

- 116 Avenida Las Palmas

- 7 Medina Way

- 5 Medina Way