230 Miami Trace Unit 6 Harrison, OH 45030

Estimated Value: $213,000 - $264,000

2

Beds

3

Baths

2,112

Sq Ft

$115/Sq Ft

Est. Value

About This Home

This home is located at 230 Miami Trace Unit 6, Harrison, OH 45030 and is currently estimated at $242,849, approximately $114 per square foot. 230 Miami Trace Unit 6 is a home located in Hamilton County with nearby schools including William Henry Harrison High School, St. John The Baptist School, and Summit Academy of Southwest Ohio.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 17, 2024

Sold by

Ehrman Mary

Bought by

Wortman Edward R and Wortman Angela

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$200,000

Outstanding Balance

$197,702

Interest Rate

6.79%

Mortgage Type

New Conventional

Estimated Equity

$45,147

Purchase Details

Closed on

Jan 13, 2010

Sold by

Ehrman Richard and Ehrman Mary

Bought by

Ehrman Mary

Purchase Details

Closed on

Sep 25, 2009

Sold by

Mcmanus Michael E and Mcmanus Theresa A

Bought by

Ehrman Richard and Ehrman Mary

Purchase Details

Closed on

Oct 30, 2007

Sold by

May Construction Of Cincinnati Inc

Bought by

Mcmanus Michael E and Mcmanus Theresa A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$118,900

Interest Rate

6.45%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Aug 20, 2007

Sold by

Miami Forest Llc

Bought by

May Construction Of Cincinnati Inc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Wortman Edward R | $250,000 | None Listed On Document | |

| Wortman Edward R | $250,000 | None Listed On Document | |

| Ehrman Mary | -- | Ltoc | |

| Ehrman Richard | $165,500 | Attorney | |

| Mcmanus Michael E | $166,000 | Advanced Land Title Agency | |

| May Construction Of Cincinnati Inc | $192,000 | Attorney |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Wortman Edward R | $200,000 | |

| Closed | Wortman Edward R | $200,000 | |

| Previous Owner | Mcmanus Michael E | $118,900 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,662 | $59,469 | $8,225 | $51,244 |

| 2024 | $2,201 | $59,469 | $8,225 | $51,244 |

| 2023 | $2,255 | $59,469 | $8,225 | $51,244 |

| 2022 | $2,390 | $55,451 | $7,000 | $48,451 |

| 2021 | $2,357 | $55,451 | $7,000 | $48,451 |

| 2020 | $2,393 | $55,451 | $7,000 | $48,451 |

| 2019 | $2,500 | $55,451 | $7,000 | $48,451 |

| 2018 | $2,514 | $55,451 | $7,000 | $48,451 |

| 2017 | $2,366 | $55,451 | $7,000 | $48,451 |

| 2016 | $2,053 | $52,714 | $6,370 | $46,344 |

| 2015 | $2,082 | $52,714 | $6,370 | $46,344 |

| 2014 | $1,985 | $52,714 | $6,370 | $46,344 |

| 2013 | $2,238 | $57,925 | $7,000 | $50,925 |

Source: Public Records

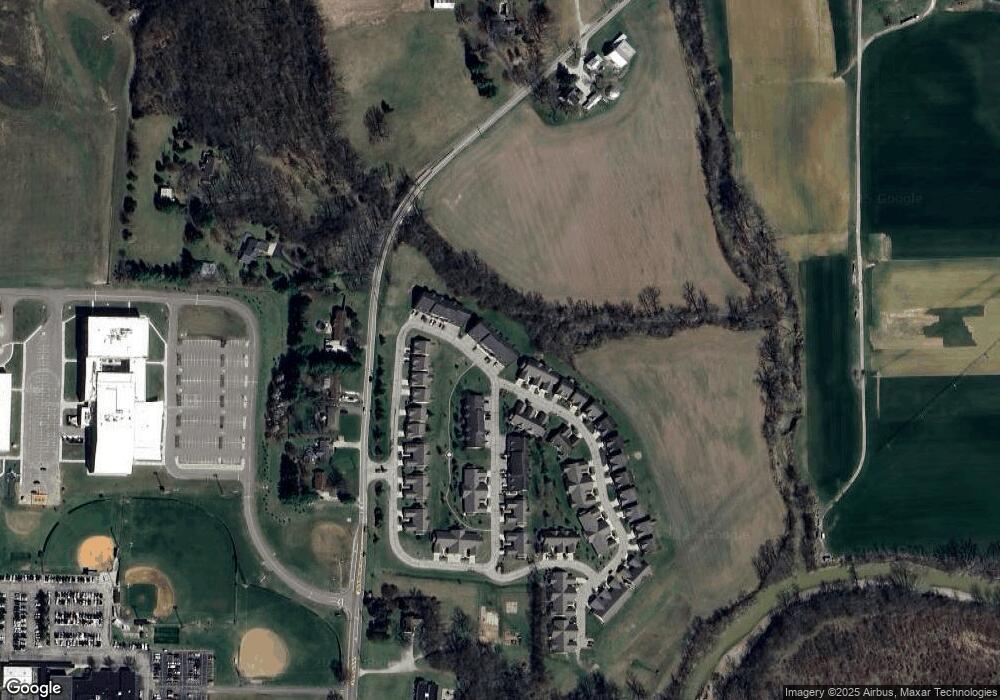

Map

Nearby Homes

- 210 Miami Trace

- 10390 Short Rd

- 120 Hickory Flats Dr

- 9452 Tebbs Ct

- 1198 South Branch

- 0 West Rd Unit 1867316

- 0 New Haven Rd Unit 1867315

- 10744 Edgewood Rd

- 0 Carolina Trace Rd Unit 1840792

- 130 Country View Dr

- 125 Hopping Ct

- 9505 Morris Dr

- 8039 Rock Island Dr

- 6075 Foothills Dr

- 6071 Foothills Dr

- 449 Lyness Ave

- 1270 Trailhead Place

- 1290 Trailhead Place

- 2430 Bartram Ln

- 8074 Rock Island Dr

- 220 Miami Trace

- 230 Miami Trace Unit 5

- 220 Miami Trace Unit 1220

- 230 Miami Trace Unit 1220

- 230 Miami Trace Unit 1220

- 220 Miami Trace Unit 1220

- 220 Miami Trace Unit 1220

- 230 Miami Trace Unit 7

- 220 Miami Trace Unit 2

- 230 Miami Trace Unit 8

- 220 Miami Trace Unit 4

- 220 Miami Trace Unit 3

- 230 Miami Trace

- 311 Miami Trace Unit 7

- 311 Miami Trace Unit 18

- 311 Miami Trace Unit 18

- 311 Miami Trace Unit 6

- 311 Miami Trace Unit 8

- 311 Miami Trace Unit 5

- 508 Miami Trace

Your Personal Tour Guide

Ask me questions while you tour the home.