230 Ripple Creek Dr SW Marietta, GA 30060

Southwestern Marietta NeighborhoodEstimated Value: $396,000 - $443,000

4

Beds

3

Baths

2,736

Sq Ft

$151/Sq Ft

Est. Value

About This Home

This home is located at 230 Ripple Creek Dr SW, Marietta, GA 30060 and is currently estimated at $411,987, approximately $150 per square foot. 230 Ripple Creek Dr SW is a home located in Cobb County with nearby schools including LaBelle Elementary School, Smitha Middle School, and Osborne High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 28, 2025

Sold by

Rodriguez Luis and Rodriguez Dianne

Bought by

Luis And Dianne Rodriguez Revocable Trust and Rodriguez

Current Estimated Value

Purchase Details

Closed on

Sep 20, 2007

Sold by

Silva Sandro D

Bought by

Rodriguez Luis and Rodriguez Dianne

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$215,000

Interest Rate

6.57%

Mortgage Type

New Conventional

Purchase Details

Closed on

Jun 21, 2006

Sold by

Silva Sandro De Almeida

Bought by

Silva Sando De Almeida and Almeida Obirazilda

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$222,466

Interest Rate

9.88%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Luis And Dianne Rodriguez Revocable Trust | -- | None Listed On Document | |

| Luis And Dianne Rodriguez Revocable Trust | -- | None Listed On Document | |

| Rodriguez Luis | $215,000 | -- | |

| Silva Sando De Almeida | -- | -- | |

| Silva Sando De Almeida | $234,200 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Rodriguez Luis | $215,000 | |

| Previous Owner | Silva Sando De Almeida | $222,466 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,938 | $158,504 | $26,800 | $131,704 |

| 2024 | $3,941 | $158,504 | $26,800 | $131,704 |

| 2023 | $3,399 | $158,504 | $26,800 | $131,704 |

| 2022 | $3,339 | $129,636 | $26,800 | $102,836 |

| 2021 | $2,538 | $93,012 | $26,800 | $66,212 |

| 2020 | $2,489 | $91,012 | $24,800 | $66,212 |

| 2019 | $2,139 | $79,484 | $13,200 | $66,284 |

| 2018 | $2,139 | $79,484 | $13,200 | $66,284 |

| 2017 | $1,612 | $65,004 | $13,200 | $51,804 |

| 2016 | $1,244 | $52,168 | $13,680 | $38,488 |

| 2015 | $1,277 | $52,168 | $13,680 | $38,488 |

| 2014 | $1,288 | $52,168 | $0 | $0 |

Source: Public Records

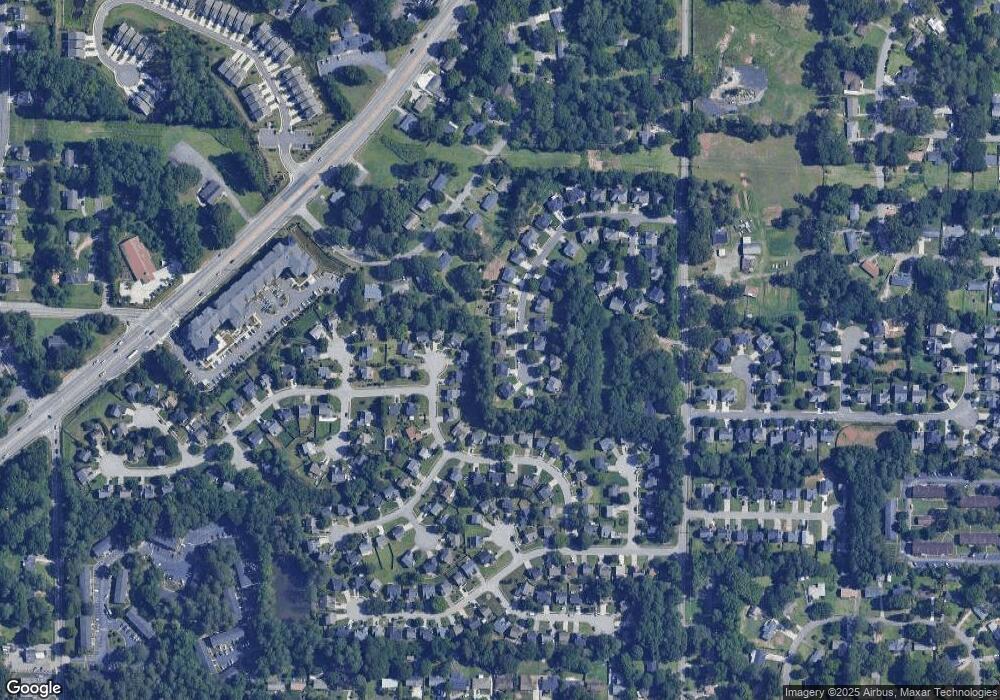

Map

Nearby Homes

- 152 Summer Lake Dr SW

- 1809 Austell Rd SW

- 2036 Favor Rd SW

- 1763 Sandtown Rd SW

- 2078 Olive Springs Rd SE

- 2245 Panstone Dr SW

- 166 Zelma St SW

- 1958 Judy Cir SE

- 1840 Judy Cir SE

- 29 Burke St SE

- 2354 Holly Hill Ct SW

- 1615 Arden Dr SW

- 55 Cochran Rd SE

- 2177 Wakita Dr SE

- 1631 Knox Dr SE

- 71 Cochran Rd SE

- 141 Dunleith Pkwy SW

- 224 Ripple Creek Dr SW

- 236 Ripple Creek Dr SW

- 2105 Summer Wind Dr SW

- 2103 Summer Wind Dr SW

- 218 Ripple Creek Dr SW

- 223 Ripple Creek Dr SW

- 223 Ripple Creek Dr SW

- 242 Ripple Creek Dr SW Unit 242

- 242 Ripple Creek Dr SW

- 2107 Summer Wind Dr SW

- 229 Ripple Creek Dr SW

- 248 Ripple Creek Dr SW

- 2109 Summer Wind Dr SW

- 212 Ripple Creek Dr SW

- 235 Ripple Creek Dr SW

- 215 Ripple Creek Dr SW

- 241 Ripple Creek Dr SW

- 2111 Summer Wind Dr SW

- 206 Ripple Creek Dr SW

- 207 Ripple Creek Dr SW