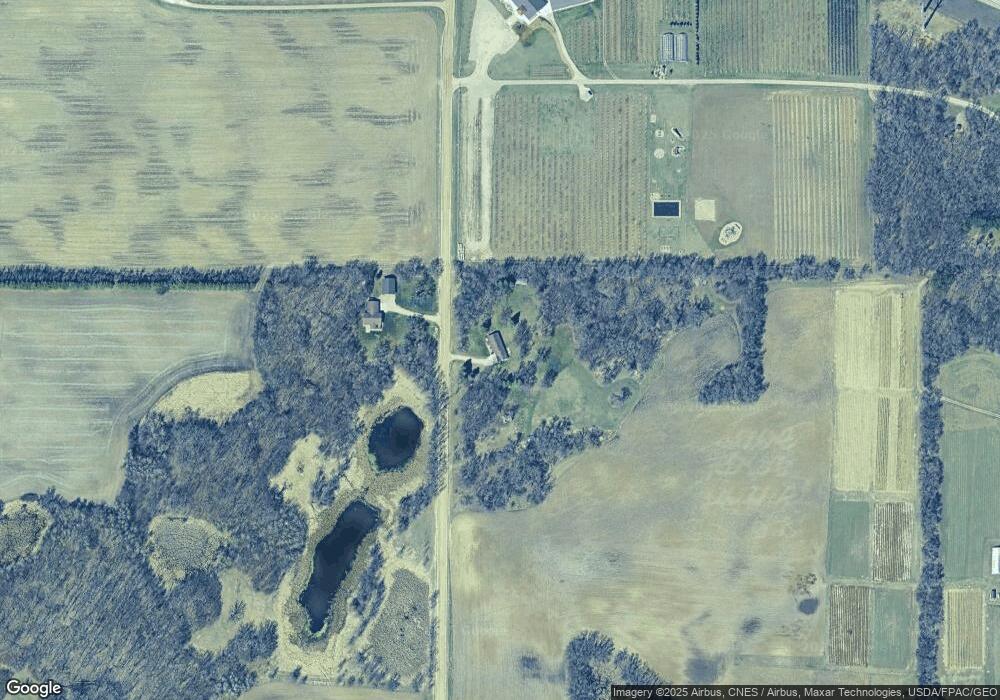

2303 Englund Rd SW Alexandria, MN 56308

Estimated Value: $337,588 - $411,000

--

Bed

--

Bath

1,344

Sq Ft

$276/Sq Ft

Est. Value

About This Home

This home is located at 2303 Englund Rd SW, Alexandria, MN 56308 and is currently estimated at $370,897, approximately $275 per square foot. 2303 Englund Rd SW is a home located in Douglas County with nearby schools including Lincoln Elementary School, Discovery Middle School, and Alexandria Area High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 30, 2024

Sold by

Christensen Jan L and Christensen Merida M

Bought by

Christensen Family Revocable Living Trust and Christensen

Current Estimated Value

Purchase Details

Closed on

Jul 21, 2017

Sold by

Christensen Jan L and Christensen Merida M

Bought by

Christensen Jan L and Christensen Merida M

Purchase Details

Closed on

Dec 30, 2004

Sold by

Trousil Frank A and Trousil Lori J

Bought by

Christensen Jan L and Christensen Merida M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$144,400

Interest Rate

5.82%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Christensen Family Revocable Living Trust | $500 | None Listed On Document | |

| Christensen Jan L | -- | Alexandria Title | |

| Christensen Jan L | $17,991 | Alexandria Title | |

| Christensen Jan L | $169,900 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Christensen Jan L | $144,400 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,358 | $305,200 | $54,000 | $251,200 |

| 2024 | $2,358 | $295,700 | $50,100 | $245,600 |

| 2023 | $2,260 | $262,700 | $42,600 | $220,100 |

| 2022 | $1,882 | $239,700 | $38,200 | $201,500 |

| 2021 | $1,808 | $203,500 | $35,200 | $168,300 |

| 2020 | $1,774 | $189,900 | $32,900 | $157,000 |

| 2019 | $1,682 | $183,000 | $31,900 | $151,100 |

| 2018 | $1,444 | $178,800 | $31,900 | $146,900 |

| 2017 | $1,320 | $166,000 | $32,500 | $133,500 |

| 2016 | $1,348 | $147,731 | $21,534 | $126,197 |

| 2015 | $1,342 | $0 | $0 | $0 |

| 2014 | -- | $144,300 | $22,200 | $122,100 |

Source: Public Records

Map

Nearby Homes

- 7060 10th Ave SW

- 7687 Lindgren Way SW

- Lot 1 B2 Dixie Ln

- 7890 Lawnys Cir SW

- Lot 5 B4 Brittney's Place

- 1346 Faith Hill Dr

- Lot 7 B4 Brittney's Place

- 4760 Country Shores SW

- 550 Eldo Ln SW

- 5023 W Lake Mary Dr SW

- 8951 Twin Point Rd SW Unit 69

- 1380 90th St SW

- 5950 County Road 8 NW

- 2402 Reeds Villa Rd SW

- 7755 Canary Rd SW

- TBD NW Sundance Cir NW

- xxxx Woodsmen Ln SW

- TBD Nevada St SW

- 1702 Brophy Landing NW

- 213 Cowdry Heights NW

- 2298 Englund Rd SW

- TBD Magnuson Rd SW

- 5769 Magnuson Rd SW

- 1860 Englund Rd SW

- 1575 Baker Rd SW

- 1336 Baker Rd SW

- 1600 Englund Rd SW

- 6841 Magnuson Rd SW

- 5559 Mud Lake Ln SW

- 5721 Mud Lake Ln SW

- 3376 Englund Rd SW

- 7101 Magnuson Rd SW

- xxxx Magnuson Rd SW

- 5658 Mud Lake Ln SW

- TBD 10th Ave SW

- 681 Cihlar's Point Cir SW

- 5471 Mud Lake Ln SW

- Lot # 1 Mud Lake Ln SW

- 5718 Mud Lake Ln SW

- 6020 10th Ave SW