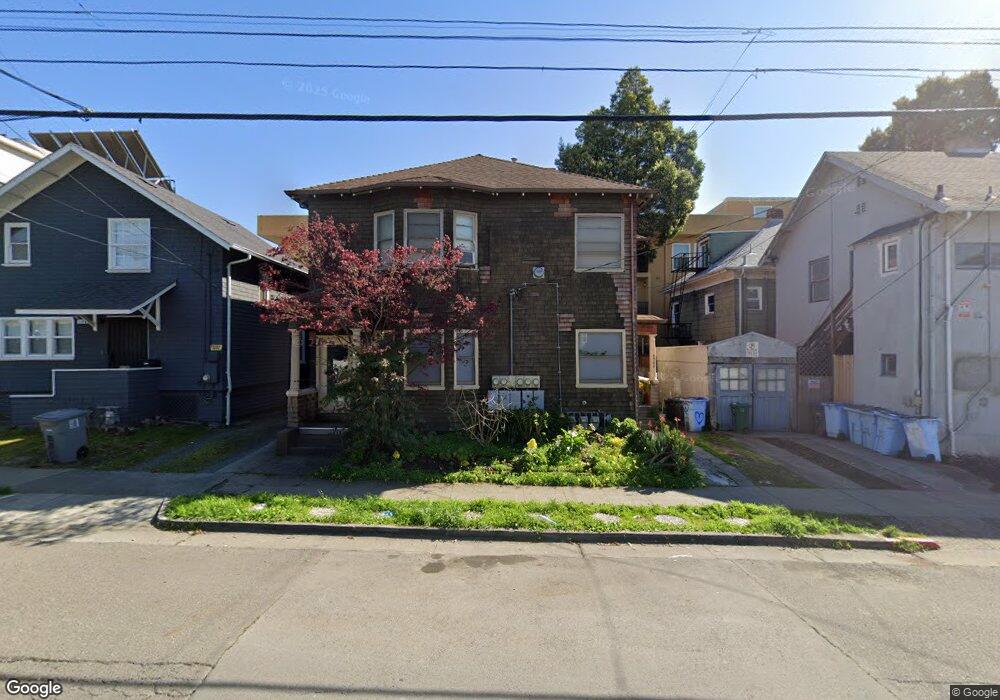

2306 Haste St Berkeley, CA 94704

South Berkeley NeighborhoodEstimated Value: $560,642 - $637,000

1

Bed

1

Bath

800

Sq Ft

$746/Sq Ft

Est. Value

About This Home

This home is located at 2306 Haste St, Berkeley, CA 94704 and is currently estimated at $596,661, approximately $745 per square foot. 2306 Haste St is a home located in Alameda County with nearby schools including Emerson Elementary School, Malcolm X Elementary School, and John Muir Elementary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 2, 2021

Sold by

Jones Sandra

Bought by

Gellerman Karen

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$384,000

Outstanding Balance

$342,850

Interest Rate

2.6%

Mortgage Type

New Conventional

Estimated Equity

$253,811

Purchase Details

Closed on

Jan 22, 2009

Sold by

Suchman Daniel and Suchman Doreen

Bought by

Jones Sandra

Purchase Details

Closed on

Jan 14, 2009

Sold by

Jones Sandra

Bought by

Jones Sandra

Purchase Details

Closed on

Jan 10, 2009

Sold by

Izumi Allan K and Izumi Dana K

Bought by

Jones Sandra

Purchase Details

Closed on

Nov 11, 2008

Sold by

Crary Mildred Rodgers and Crary Frank J

Bought by

Jones Sandra

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Gellerman Karen | $480,000 | Old Republic Title Company | |

| Jones Sandra | -- | None Available | |

| Jones Sandra | -- | None Available | |

| Jones Sandra | -- | None Available | |

| Jones Sandra | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Gellerman Karen | $384,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $8,553 | $589,918 | $176,975 | $412,943 |

| 2024 | $8,553 | $578,353 | $173,506 | $404,847 |

| 2023 | $8,379 | $567,017 | $170,105 | $396,912 |

| 2022 | $8,243 | $555,900 | $166,770 | $389,130 |

| 2021 | $5,662 | $336,550 | $102,885 | $240,665 |

| 2020 | $5,360 | $340,030 | $101,831 | $238,199 |

| 2019 | $5,146 | $333,365 | $99,835 | $233,530 |

| 2018 | $5,056 | $326,830 | $97,878 | $228,952 |

| 2017 | $4,861 | $320,422 | $95,959 | $224,463 |

| 2016 | $4,696 | $314,141 | $94,078 | $220,063 |

| 2015 | $4,632 | $309,424 | $92,665 | $216,759 |

| 2014 | $4,598 | $303,366 | $90,851 | $212,515 |

Source: Public Records

Map

Nearby Homes

- 2537 Ellsworth St

- 2550 Dana St Unit 2F

- 2415 Blake St

- 2535 Chilton Way

- 2543 Chilton Way

- 2509 Dwight Way

- 2401 Carleton St

- 2702 Dana St

- 2319 Ward St

- 2409 College Ave

- 2601 College Ave Unit 203

- 2601 College Ave Unit 208

- 1901 Parker St Unit 3

- 1819 Carleton St

- 2243 Ashby Ave

- 2611 Piedmont Ave Unit 4

- 2533 Grant St

- 2701 Grant St

- 2907 Channing Way

- 2110 Ashby Ave

- 2308 Haste St

- 2308 Haste St Unit A

- 2308 Haste St Unit C

- 2310 Haste St

- 2427 Ellsworth St

- 2425 Ellsworth St

- 2429 Ellsworth St

- 2307 Haste St

- 2415 Ellsworth St

- 2426 Ellsworth St

- 2440 Ellsworth St

- 2420 Ellsworth St

- 2428 Ellsworth St

- 2321 Dwight Way

- 2436 Ellsworth St

- 2245 Dwight Way

- 2236 Haste St

- 2237 Haste St

- 2243 Dwight Way Unit A

- 2243 Dwight Way