2312 168th St West Point, IA 52656

Estimated Value: $183,000 - $308,000

3

Beds

2

Baths

1,716

Sq Ft

$141/Sq Ft

Est. Value

About This Home

This home is located at 2312 168th St, West Point, IA 52656 and is currently estimated at $242,346, approximately $141 per square foot. 2312 168th St is a home located in Lee County with nearby schools including Fort Madison High School, Holy Trinity Catholic Elementary, and Holy Trinity Elementary.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 17, 2013

Sold by

Steffensmeier Holly Beth

Bought by

Schmitt Ben

Current Estimated Value

Purchase Details

Closed on

Apr 15, 2011

Sold by

The Secretary Of Hud

Bought by

Schmitt Ben and Steffensmier Holly

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$89,016

Interest Rate

4.92%

Mortgage Type

Future Advance Clause Open End Mortgage

Purchase Details

Closed on

Sep 26, 2005

Sold by

Fedler Edmund G and Fedler Delores E

Bought by

Fedler Jeffery J and Fedler Summer M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$103,100

Interest Rate

5.83%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Schmitt Ben | -- | None Available | |

| Schmitt Ben | -- | -- | |

| Fedler Jeffery J | $103,500 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Schmitt Ben | $89,016 | |

| Previous Owner | Fedler Jeffery J | $103,100 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,368 | $204,220 | $12,730 | $191,490 |

| 2023 | $2,186 | $204,220 | $12,730 | $191,490 |

| 2022 | $1,874 | $155,000 | $12,730 | $142,270 |

| 2021 | $1,874 | $155,000 | $12,730 | $142,270 |

| 2020 | $1,868 | $144,590 | $13,490 | $131,100 |

| 2019 | $1,808 | $144,590 | $13,490 | $131,100 |

| 2018 | $1,908 | $138,710 | $0 | $0 |

| 2017 | $1,908 | $132,080 | $0 | $0 |

| 2016 | $1,730 | $132,080 | $0 | $0 |

| 2015 | $1,730 | $130,920 | $0 | $0 |

| 2014 | $1,210 | $98,410 | $0 | $0 |

Source: Public Records

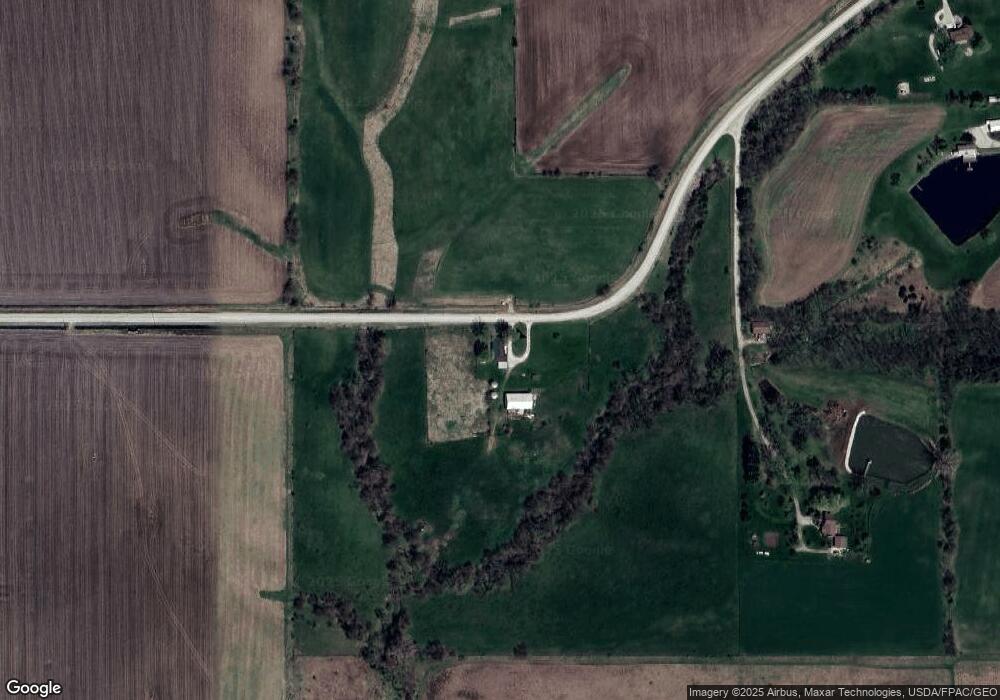

Map

Nearby Homes

- 2280 Windmill Way

- 607 Bel Air Dr

- 811 Avenue C

- 2257 Burt Rd

- 2113 204th Ave

- 1794 150th St

- 2229 235th St

- 2657 Clearview Heights Rd

- 00 180th St

- 2942 Four Seasons Rd

- 5635 Bluff Rd

- 808 Park St

- 603 Fruit St

- 6119 Reve Ct

- 2794 221st St

- 115 Lynn St

- 808 Pershing St

- 720 Pershing St

- 2798 River Hills Rd

- 4601 River Bend Sub Lot 4

- 2332 168th St

- 2338 168th St

- 131 Country Lane Rd

- 132 Country Lane Rd

- 117 Country Lane Rd

- 2280 County Road 103

- 116 Country Lane Rd

- 2256 168th St

- 102 Avenue D

- 106 Avenue D

- 202 Avenue C

- 115 Country Lane Rd

- 206 Avenue C

- 401 Franklin 3rd St

- 405 Franklin 3rd St

- 206 Franklin 3rd St

- 202 Franklin 3rd St

- 107 Franklin Broadway St

- 98 Franklin 4th St

- 203 Franklin 2nd St