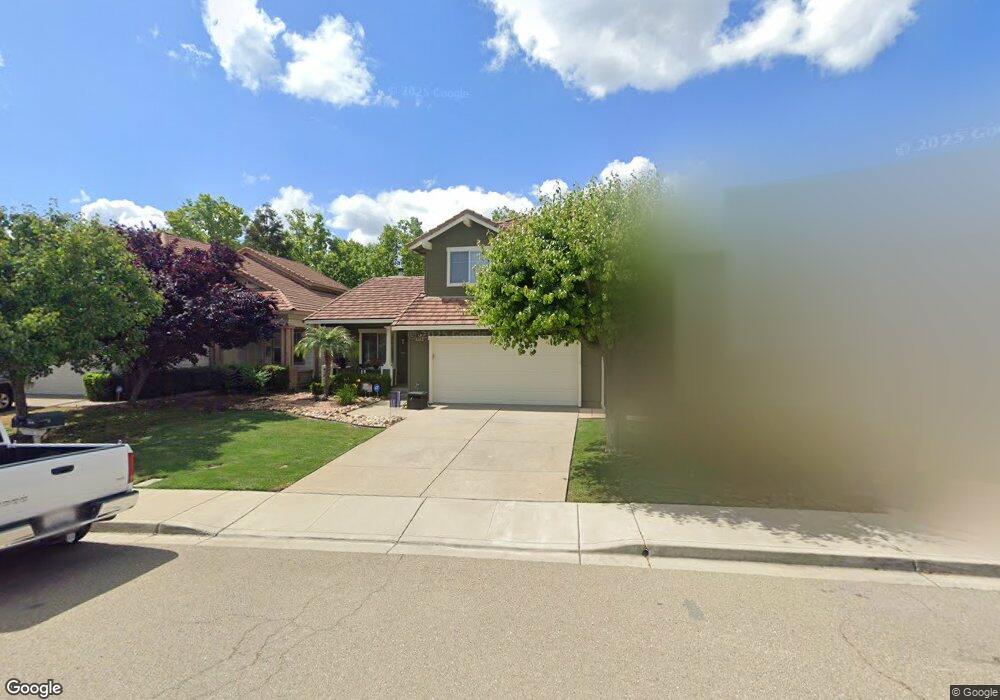

2316 Grassland Way Antioch, CA 94531

Deer Valley NeighborhoodEstimated Value: $564,000 - $601,000

3

Beds

3

Baths

1,508

Sq Ft

$384/Sq Ft

Est. Value

About This Home

This home is located at 2316 Grassland Way, Antioch, CA 94531 and is currently estimated at $579,568, approximately $384 per square foot. 2316 Grassland Way is a home located in Contra Costa County with nearby schools including Jack London Elementary School, Black Diamond Middle School, and Deer Valley High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 3, 2003

Sold by

Theus Chan Denise

Bought by

Kim Christopher A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$240,000

Outstanding Balance

$96,249

Interest Rate

4.62%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$483,319

Purchase Details

Closed on

May 24, 1995

Sold by

Hldc Acquisition Inc

Bought by

Theus Chan Denise

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$139,162

Interest Rate

8.43%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Kim Christopher A | $300,000 | First American Title | |

| Theus Chan Denise | $140,500 | First American Title Guarant |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Kim Christopher A | $240,000 | |

| Previous Owner | Theus Chan Denise | $139,162 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,321 | $451,133 | $152,063 | $299,070 |

| 2024 | $5,321 | $442,288 | $149,082 | $293,206 |

| 2023 | $5,133 | $433,616 | $146,159 | $287,457 |

| 2022 | $5,055 | $425,115 | $143,294 | $281,821 |

| 2021 | $4,907 | $416,781 | $140,485 | $276,296 |

| 2019 | $4,799 | $404,420 | $136,319 | $268,101 |

| 2018 | $4,622 | $396,492 | $133,647 | $262,845 |

| 2017 | $4,434 | $379,500 | $127,920 | $251,580 |

| 2016 | $3,893 | $329,500 | $111,066 | $218,434 |

| 2015 | $3,940 | $312,000 | $105,167 | $206,833 |

| 2014 | $4,296 | $310,000 | $104,493 | $205,507 |

Source: Public Records

Map

Nearby Homes

- 4529 Pronghorn Way

- 4528 Fallow Way

- 4437 Buckskin Dr

- 2508 Larch Way

- 4305 Calsite Ct

- 2101 Asilomar Dr

- 4101 Galenez Way

- 2640 Point Andrus Ct

- 4204 Limestone Dr

- 2705 Asilomar Dr

- 2201 Mark Twain Dr

- 2205 Mark Twain Dr

- 2003 Barkwood Ct

- 4632 Country Hills Dr

- 4008 Galenez Way

- 941 Bluerock Dr

- 4030 Sheffield Dr

- 921 Clay Ct

- 4420 Wolverine Way

- 4437 Deerfield Dr

- 2320 Grassland Way

- 2312 Grassland Way

- 2308 Grassland Way

- 2324 Grassland Way

- 2405 Hooftrail Way

- 2304 Grassland Way

- 2317 Huntsman Way

- 2328 Grassland Way

- 4400 Whitehoof Way

- 2313 Huntsman Way

- 2409 Hooftrail Way

- 2300 Grassland Way

- 2325 Huntsman Way

- 2400 Hooftrail Way

- 2309 Huntsman Way

- 4404 Whitehoof Way

- 2404 Hooftrail Way

- 2413 Hooftrail Way

- 2305 Huntsman Way

- 2408 Hooftrail Way