2328 S Evans Way Franktown, CO 80116

Estimated Value: $679,000 - $884,000

3

Beds

2

Baths

1,668

Sq Ft

$476/Sq Ft

Est. Value

About This Home

This home is located at 2328 S Evans Way, Franktown, CO 80116 and is currently estimated at $793,284, approximately $475 per square foot. 2328 S Evans Way is a home located in Douglas County with nearby schools including Franktown Elementary School, Sagewood Middle School, and Ponderosa High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 7, 2004

Sold by

Morequity Inc

Bought by

Black Erick D and Black Robbie M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$252,000

Outstanding Balance

$117,458

Interest Rate

5%

Mortgage Type

Unknown

Estimated Equity

$675,826

Purchase Details

Closed on

Feb 10, 2004

Sold by

Bomeke Connie E

Bought by

Morequity Inc

Purchase Details

Closed on

Apr 18, 2001

Sold by

Bomeke Theodore F and Bomeke Connie E

Bought by

Bomeke Connie E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$250,000

Interest Rate

6.99%

Purchase Details

Closed on

Apr 17, 2001

Sold by

Bomeke Theodore F and Bomeke Connie E

Bought by

Bomeke Connie B

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$250,000

Interest Rate

6.99%

Purchase Details

Closed on

Jan 19, 1983

Sold by

Mayers John J and Mayers Lana E

Bought by

Bomeke Theodore F and Bomeke Connie E

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Black Erick D | $280,000 | -- | |

| Morequity Inc | -- | -- | |

| Bomeke Connie E | -- | -- | |

| Bomeke Connie B | -- | -- | |

| Bomeke Theodore F | $129,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Black Erick D | $252,000 | |

| Previous Owner | Bomeke Connie B | $250,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,181 | $52,190 | $31,550 | $20,640 |

| 2023 | $4,227 | $52,190 | $31,550 | $20,640 |

| 2022 | $3,232 | $38,600 | $20,540 | $18,060 |

| 2021 | $3,349 | $38,600 | $20,540 | $18,060 |

| 2020 | $3,109 | $36,670 | $18,540 | $18,130 |

| 2019 | $3,124 | $36,670 | $18,540 | $18,130 |

| 2018 | $2,719 | $31,350 | $14,230 | $17,120 |

| 2017 | $2,531 | $31,350 | $14,230 | $17,120 |

| 2016 | $2,120 | $25,750 | $9,430 | $16,320 |

| 2015 | $2,169 | $25,750 | $9,430 | $16,320 |

| 2014 | $2,141 | $23,760 | $9,150 | $14,610 |

Source: Public Records

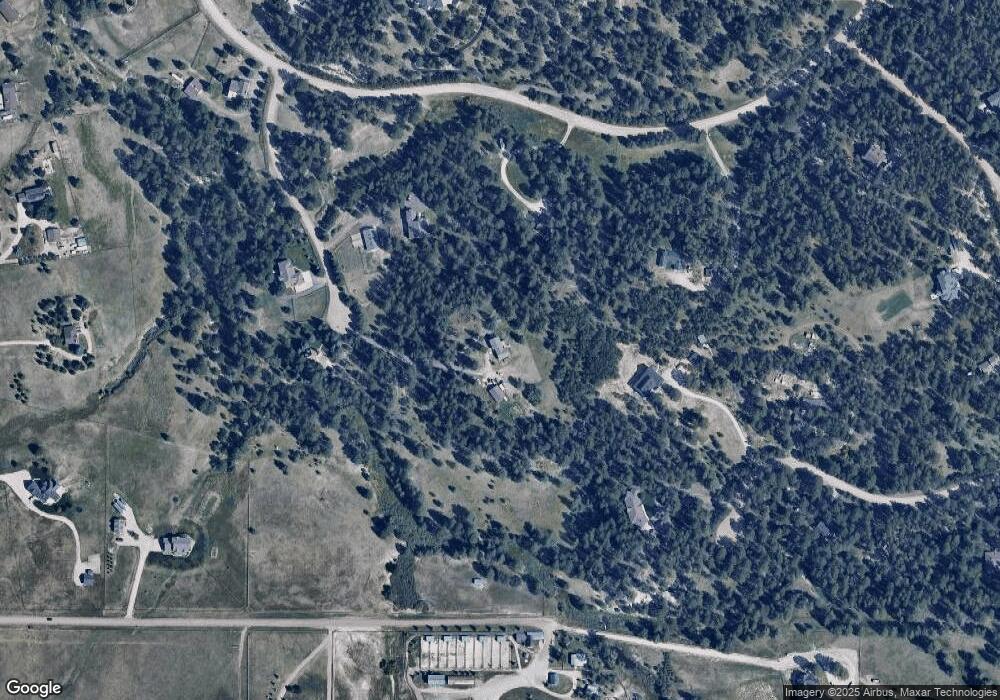

Map

Nearby Homes

- 1972 Gold Camp Way

- 11274 E Manitou Rd

- 2072 Summit St

- 1559 Apex Rd

- 1571 Arrowpoint Ct

- 1561 Arrowpoint Ct

- 1555 Arrowpoint Ct

- 30999 Kootney St

- 1341 Tomichi Dr

- 210 High Meadows Loop

- 0 Kootney St

- 1133 Tomichi Dr

- 10400 Pine Valley Dr

- 31203 Longhorn Cir

- 9250 Steeplechase Dr

- 856 Woodridge Rd

- 1750 Arrowpoint Ct

- 1721 Arrowpoint Ct

- 1724 Arrowpoint Ct

- 11044 Conestoga Place

- 2254 S Evans Way

- 2001 Gold Camp Way

- 2329 S Evans Way

- 2409 S Placer St

- 2275 S Evans Way

- 2463 Placer St

- 2051 Gold Camp Way Unit 5

- 2379 S Placer St

- 10767 Patterson Cir

- 10874 Patterson Cir

- 1901 Gold Camp Way

- 2016 Gold Camp Way

- 1922 Gold Camp Way

- 2340 S Tarryall Way

- 2076 Gold Camp Way

- 2055 Placer St

- 2388 S Tarryall Way

- 2288 S Tarryall Way

- 2155 Placer St

- 11076 Patterson Cir