23315 Old Wagon Rd Unit B Escondido, CA 92027

Estimated Value: $1,109,000 - $1,267,000

2

Beds

1

Bath

1,000

Sq Ft

$1,209/Sq Ft

Est. Value

About This Home

This home is located at 23315 Old Wagon Rd Unit B, Escondido, CA 92027 and is currently estimated at $1,208,690, approximately $1,208 per square foot. 23315 Old Wagon Rd Unit B is a home located in San Diego County with nearby schools including Valley Center Middle School, Valley Center High School, and Oak Glen High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 24, 2021

Sold by

Robey Donald H and Blackson-Robey Brenda

Bought by

Andrea Bernard Family Trust and Bernard

Current Estimated Value

Purchase Details

Closed on

Jul 24, 2021

Sold by

Robey Donald H and Blackson Robey Brenda

Bought by

Bernard Andrea and The Andrea Bernard Family Trus

Purchase Details

Closed on

Dec 14, 1999

Sold by

Patrick Bennett J and Patrick Marilyn S

Bought by

Robey Donald H and Blackson Robey Brenda

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$176,050

Interest Rate

7.87%

Purchase Details

Closed on

Jun 3, 1985

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Andrea Bernard Family Trust | $1,025,000 | First American Title | |

| Bernard Andrea | $1,025,000 | First American Ttl San Diego | |

| Robey Donald H | $181,500 | Chicago Title Co | |

| -- | $108,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Robey Donald H | $176,050 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $11,875 | $1,087,737 | $451,013 | $636,724 |

| 2024 | $11,875 | $1,066,410 | $442,170 | $624,240 |

| 2023 | $11,640 | $1,045,500 | $433,500 | $612,000 |

| 2022 | $11,436 | $310,174 | $158,315 | $151,859 |

| 2021 | $3,791 | $310,174 | $158,315 | $151,859 |

| 2020 | $3,746 | $306,994 | $156,692 | $150,302 |

| 2019 | $3,748 | $300,975 | $153,620 | $147,355 |

| 2018 | $3,647 | $295,074 | $150,608 | $144,466 |

| 2017 | $3,568 | $289,289 | $147,655 | $141,634 |

| 2016 | $3,564 | $283,617 | $144,760 | $138,857 |

| 2015 | $3,527 | $279,358 | $142,586 | $136,772 |

| 2014 | $3,443 | $273,886 | $139,793 | $134,093 |

Source: Public Records

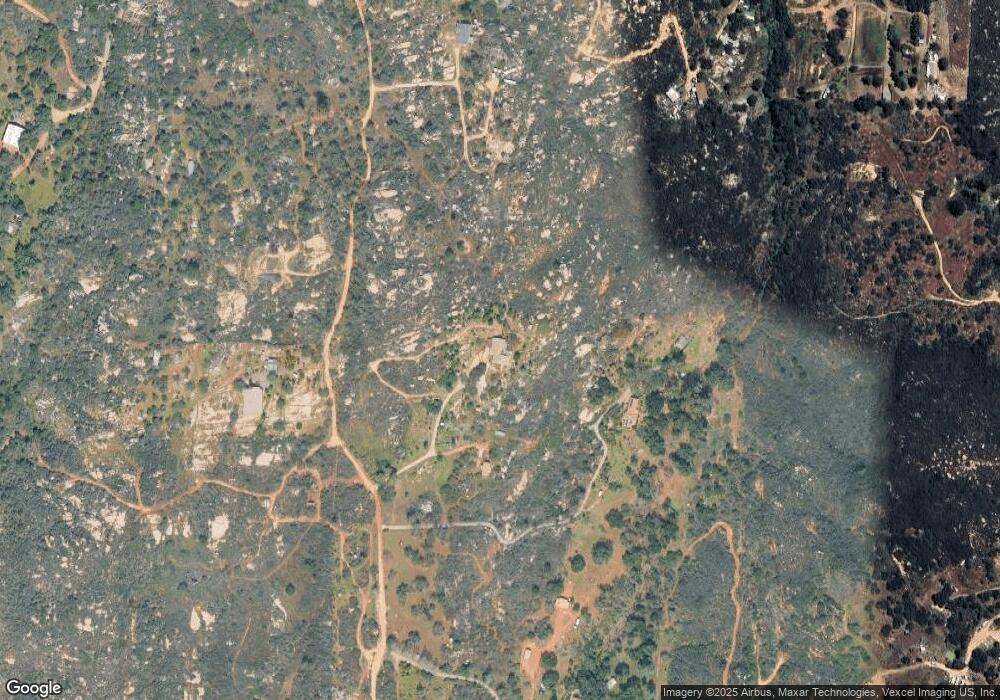

Map

Nearby Homes

- 0 Old Wagon Rd Unit PTP2508259

- 0 Rockwood Rd Unit NDP2509282

- 16757 Old Guejito Grade Rd

- 23898 Crown Hill Ln

- 2218 Orange Grove Place

- 2217 Orange Grove Place

- 3136 Ferncreek Ln

- 2385 Amber Oak Ln

- 3083 Sprucewood Ln

- 2475 Quail Creek Place

- 285 Oak Valley Ln

- 273 Oak Valley Ln

- 2706 Vistamonte Glen

- 2682 Canyon Crest Dr

- 1529 Cloverdale Rd

- 3252 Hidden Estate Ln Unit 8

- 2744 Vistamonte Glen

- 3034 Mountain View Dr

- 3225 Hidden Estates Ln

- 17484 Rockwood Rd

- 23315 Old Wagon Rd

- 23305 Old Wagon Rd

- 23352 Old Wagon Rd

- .000 Old Wagon Rd

- .000 Old Wagon Rd

- 23491 Old Wagon Rd

- 23243 Old Wagon Rd

- 23541 Old Wagon Rd

- 000 Old Wagon Rd

- 23539 Old Wagon Rd

- 0000 Old Wagon Rd Unit 1

- 23649 Old Wagon Rd

- 23530 Old Manzanita Rd

- 1881 Bucks Glen

- Biltmore E 2 Biltmore Ave E Unit 2

- 23456 Old Wagon Rd

- 23450 Old Wagon Rd

- 0 Zoo Rd Unit TR23090302

- 0 Zoo Rd Unit TR22062766

- 0 Citrus Ave Unit 110042904