2337 Shaylene Way Alpine, CA 91901

Estimated Value: $1,000,330 - $1,309,000

3

Beds

2

Baths

2,470

Sq Ft

$468/Sq Ft

Est. Value

About This Home

This home is located at 2337 Shaylene Way, Alpine, CA 91901 and is currently estimated at $1,156,833, approximately $468 per square foot. 2337 Shaylene Way is a home located in San Diego County with nearby schools including Granite Hills High School, The Heights Charter, and Liberty Charter High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 12, 2021

Sold by

Newport Devona D

Bought by

Devona D Newport Trust and Newport

Current Estimated Value

Purchase Details

Closed on

Mar 2, 2000

Sold by

Cardoza Linda D

Bought by

Whittenburg Gerald E and Newport Devona D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$252,700

Interest Rate

8.38%

Purchase Details

Closed on

Feb 29, 2000

Sold by

Cardoza Anthony R

Bought by

Cardoza Linda D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$252,700

Interest Rate

8.38%

Purchase Details

Closed on

Jan 23, 1989

Purchase Details

Closed on

Feb 2, 1988

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Devona D Newport Trust | -- | Shepard Kristan | |

| Whittenburg Gerald E | $325,000 | New Century Title Company | |

| Cardoza Linda D | -- | New Century Title Company | |

| -- | $255,000 | -- | |

| -- | $60,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Whittenburg Gerald E | $252,700 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,587 | $499,492 | $186,079 | $313,413 |

| 2024 | $5,587 | $489,699 | $182,431 | $307,268 |

| 2023 | $5,681 | $480,098 | $178,854 | $301,244 |

| 2022 | $5,637 | $470,686 | $175,348 | $295,338 |

| 2021 | $5,798 | $461,458 | $171,910 | $289,548 |

| 2020 | $5,522 | $456,728 | $170,148 | $286,580 |

| 2019 | $5,419 | $447,773 | $166,812 | $280,961 |

| 2018 | $5,302 | $438,994 | $163,542 | $275,452 |

| 2017 | $510 | $430,387 | $160,336 | $270,051 |

| 2016 | $5,011 | $421,949 | $157,193 | $264,756 |

| 2015 | $4,979 | $415,612 | $154,832 | $260,780 |

| 2014 | $4,858 | $407,472 | $151,800 | $255,672 |

Source: Public Records

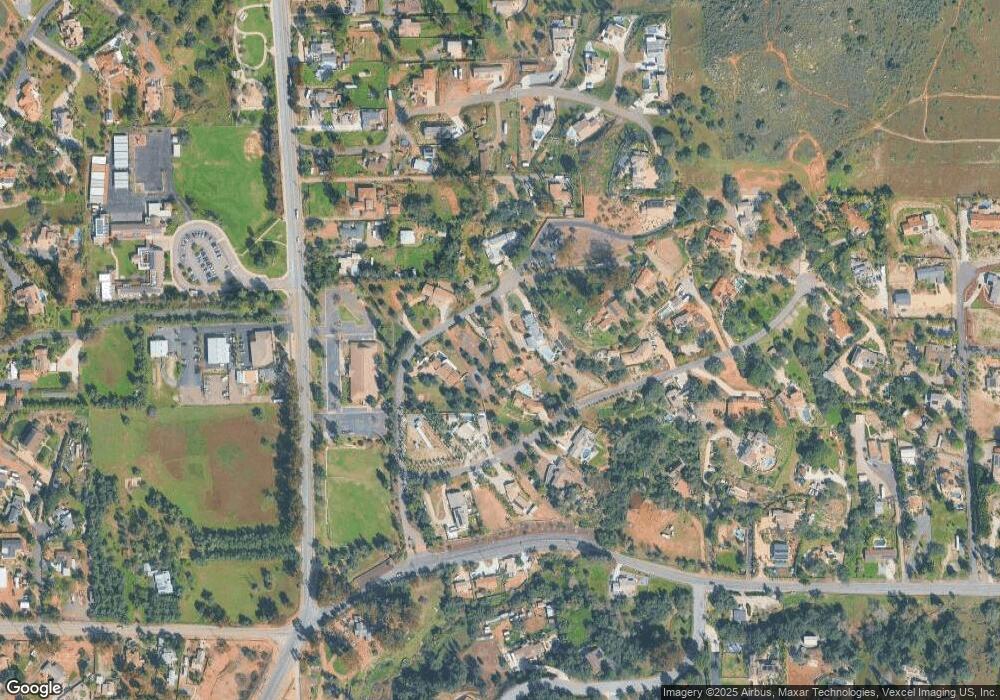

Map

Nearby Homes

- 2302 Shaylene Way

- 2016 S Grade Rd

- 2672 Big Wagon Rd

- 2412 Deland Dr

- 2622 Via Viejas Oeste

- 2005 Corte Asoleado

- 1528-44 Olivewood Ln Unit 403-350-02-00

- 2686 Via Viejas

- 2169 Corte Dorado Espuela Unit 29

- 1714 Foss Rd

- 2292 Marquand Ct

- 1434 Marshall Rd Unit 16

- 2157 Arnold Way Unit 312

- 2157 Arnold Way Unit 324

- 0 Peutz Way Unit 250039332

- 2368 Palo Danzante

- 2402 Pimlico Place

- 2170 Alpine Glen Place

- 2288 Boulders Ct

- 1491 Louise Dr

- 2313 Shaylene Way

- 2365 Shaylene Way

- 2350 Shaylene Way

- 1850 Via Del Torrie

- 2308 Shaylene Way

- 1899 Via Del Torrie

- 2303 Shaylene Way

- 2319 Tavern Rd

- 1998 Via Del Torrie

- 1841 Via Del Torrie

- 1867 Via Del Torrie

- 2323 Tavern Rd

- 1831 Via Del Torrie

- 2255 Tavern Rd

- 2255 Tavern Rd Unit Parcel 2 Map 21228

- 2255 Tavern Rd Unit 1

- 2303 Tavern Rd

- 2307 Tavern Rd

- 1881 Brady Jane Ln

- 2003 Via Del Torrie