2347 Roland Dr Bailey, CO 80421

Estimated Value: $666,466 - $705,000

4

Beds

2

Baths

2,534

Sq Ft

$270/Sq Ft

Est. Value

About This Home

This home is located at 2347 Roland Dr, Bailey, CO 80421 and is currently estimated at $683,617, approximately $269 per square foot. 2347 Roland Dr is a home located in Park County with nearby schools including Deer Creek Elementary School, Fitzsimmons Middle School, and Platte Canyon High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 26, 2016

Sold by

Timmerman Donald S and Timmerman Angela M

Bought by

Montgomery Nona and Walz Bev

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$256,000

Outstanding Balance

$203,814

Interest Rate

3.58%

Mortgage Type

New Conventional

Estimated Equity

$479,803

Purchase Details

Closed on

May 23, 2014

Sold by

Friday Steven D and Friday Patsy L

Bought by

Timmerman Donald S and Timmerman Angela M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$235,653

Interest Rate

4.25%

Mortgage Type

FHA

Purchase Details

Closed on

May 26, 2006

Sold by

Olympus Mortgage Co

Bought by

Friday Steven D and Friday Patsy L

Purchase Details

Closed on

Mar 30, 2006

Sold by

Olympus Mortgage Co

Bought by

Ameriquest Funding Ii Reo Subsidiary

Purchase Details

Closed on

Feb 2, 2006

Sold by

Valdez Carlos and Valdez Christina

Bought by

Olympus Mortgage Co

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Montgomery Nona | $328,000 | Land Title Guarantee Company | |

| Timmerman Donald S | $240,000 | Fidelity National Title Ins | |

| Friday Steven D | $201,500 | None Available | |

| Ameriquest Funding Ii Reo Subsidiary | $51,000 | None Available | |

| Olympus Mortgage Co | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Montgomery Nona | $256,000 | |

| Previous Owner | Timmerman Donald S | $235,653 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,282 | $38,580 | $5,510 | $33,070 |

| 2023 | $2,282 | $38,580 | $5,510 | $33,070 |

| 2022 | $1,955 | $30,878 | $3,466 | $27,412 |

| 2021 | $1,939 | $31,770 | $3,570 | $28,200 |

| 2020 | $1,775 | $27,930 | $2,290 | $25,640 |

| 2019 | $1,751 | $27,930 | $2,290 | $25,640 |

| 2018 | $1,414 | $27,930 | $2,290 | $25,640 |

| 2017 | $1,412 | $21,850 | $2,070 | $19,780 |

| 2016 | $1,236 | $19,040 | $2,420 | $16,620 |

| 2015 | $1,247 | $19,040 | $2,420 | $16,620 |

| 2014 | $906 | $0 | $0 | $0 |

Source: Public Records

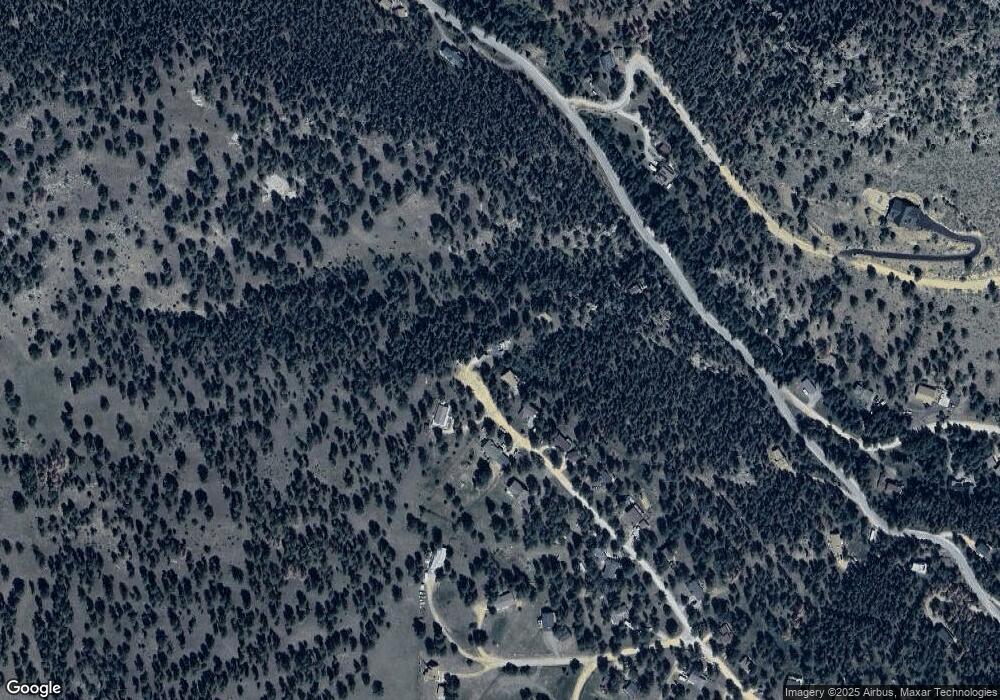

Map

Nearby Homes

- 1077 Roland Dr

- 1999 Roland Dr

- 303 Kudu Trail

- 571 Wisp Creek Dr

- 114 Star Ln

- 663 Brookside Dr

- 29 Cedar Ln

- 0 Hwy 285 Unit 6681598

- 665 Impala Trail

- 279 Wisp Creek Dr

- 24 Sunlight Ln

- 73 Sunlight Ln

- 42 Catamount Ridge Rd

- 65 Doe Cir

- 12 High View Ln

- 364 Sleepy Hollow Dr

- 65 Silver Springs Rd

- 80 Fawn Rd

- 64057 Us Highway 285

- 000 Dick Mountain Dr