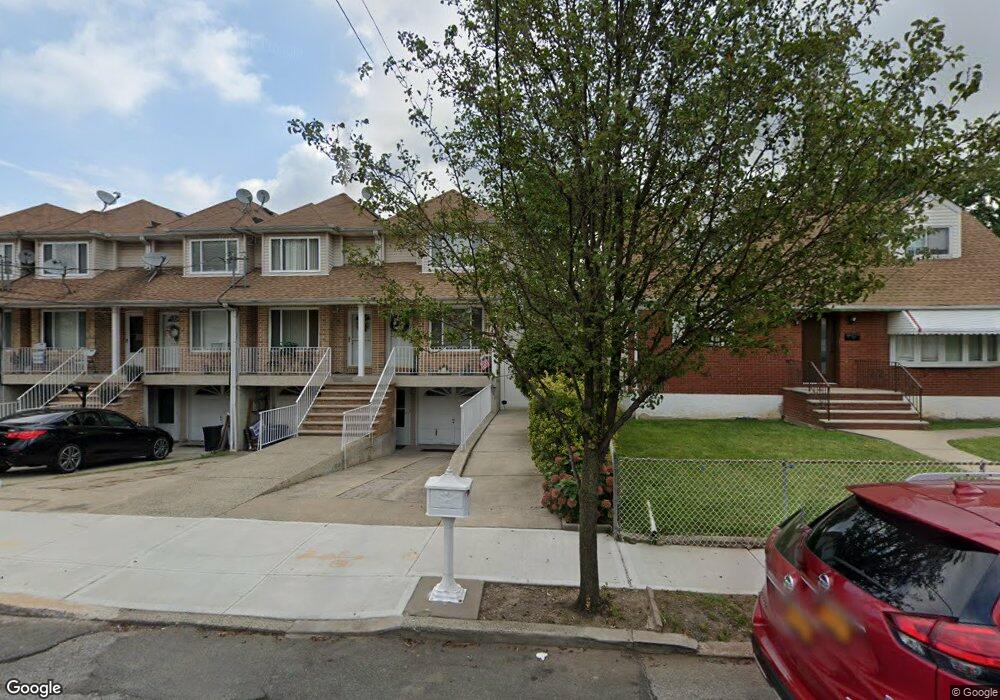

235-239 Dubois Ave Staten Island, NY 10310

Westerleigh NeighborhoodEstimated Value: $699,191 - $848,000

--

Bed

--

Bath

6,480

Sq Ft

$121/Sq Ft

Est. Value

About This Home

This home is located at 235-239 Dubois Ave, Staten Island, NY 10310 and is currently estimated at $783,798, approximately $120 per square foot. 235-239 Dubois Ave is a home located in Richmond County with nearby schools including P.S. 19 The Curtis School, Intermediate School 27, and Susan E Wagner High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 28, 2007

Sold by

Quinto Candice

Bought by

Jorgo Kaci Niko and Jorgo Kaci

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$412,300

Outstanding Balance

$260,388

Interest Rate

6.17%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$523,410

Purchase Details

Closed on

Jan 5, 2004

Sold by

Cantalupo Construction Corp

Bought by

Quinto Candice

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$268,000

Interest Rate

5.88%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Sep 24, 2002

Sold by

Perfetto Claudio and Perfetto Antonietta

Bought by

Cantalupo Construction Corp

Purchase Details

Closed on

Mar 26, 2002

Sold by

Mulvihill Donald J and Katsoris Constance N

Bought by

Perfetto Claudio and Perfetto Antonietta

Purchase Details

Closed on

Jan 16, 1996

Sold by

Mulvihill Equipment Company

Bought by

Mulvihill Frank J

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Jorgo Kaci Niko | $434,000 | None Available | |

| Quinto Candice | $339,690 | -- | |

| Cantalupo Construction Corp | -- | First American Title Ins Co | |

| Perfetto Claudio | $560,000 | First American Title Ins Co | |

| Mulvihill Frank J | $16,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Jorgo Kaci Niko | $412,300 | |

| Previous Owner | Quinto Candice | $268,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,063 | $46,320 | $8,287 | $38,033 |

| 2024 | $6,076 | $41,460 | $9,189 | $32,271 |

| 2023 | $5,768 | $29,802 | $9,419 | $20,383 |

| 2022 | $5,326 | $36,900 | $12,060 | $24,840 |

| 2021 | $5,279 | $38,880 | $12,060 | $26,820 |

| 2020 | $5,319 | $33,540 | $12,060 | $21,480 |

| 2019 | $5,214 | $36,420 | $12,060 | $24,360 |

| 2018 | $4,765 | $24,835 | $11,268 | $13,567 |

| 2017 | $4,477 | $23,430 | $9,289 | $14,141 |

| 2016 | $4,109 | $22,104 | $10,758 | $11,346 |

| 2015 | -- | $22,104 | $12,081 | $10,023 |

| 2014 | -- | $21,937 | $11,788 | $10,149 |

Source: Public Records

Map

Nearby Homes

- 246 Dubois Ave

- 886 Delafield Ave

- 176 Dubois Ave

- 172-174 Llewellyn Place

- 200 Llewellyn Place

- 79 Mundy Ave

- 837 Delafield Ave Unit A

- 371 Jewett Ave

- 61 Greenleaf Ave

- 322 Jewett Ave

- 771 Delafield Ave

- 109 Lyceum Ct

- 286 Jewett Ave

- 21 Dryden Ct

- 448 Clove Rd

- 138 Kingsley Ave

- 122 Kingsley Ave

- 62 Lyceum Ct

- 433 Clove Rd

- 78 Burnside Ave

- 233 Dubois Ave

- 235 Dubois Ave Unit 239

- 231 Dubois Ave

- 229 Dubois Ave

- 237 Dubois Ave

- 227 Dubois Ave Unit 2

- 227 Dubois Ave

- 241 Dubois Ave

- 221 Dubois Ave

- 219 Dubois Ave

- 245 Dubois Ave

- 217 Dubois Ave

- 170 Greenleaf Ave Unit A

- 170 Greenleaf Ave Unit A

- 170 Greenleaf Ave Unit B

- 1128 Forest Ave

- 170A Greenleaf Ave

- 178 Greenleaf Ave Unit 2

- 178 Greenleaf Ave

- 170B Greenleaf Ave