23503 W 88th St Lenexa, KS 66227

Estimated Value: $483,000 - $513,000

4

Beds

4

Baths

2,284

Sq Ft

$218/Sq Ft

Est. Value

About This Home

This home is located at 23503 W 88th St, Lenexa, KS 66227 and is currently estimated at $497,641, approximately $217 per square foot. 23503 W 88th St is a home located in Johnson County with nearby schools including Canyon Creek Elementary School, Prairie Trail Middle School, and Olathe Northwest High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 5, 2020

Sold by

Sharbaugh Heather

Bought by

Sharbaugh Brian J

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$248,800

Outstanding Balance

$220,054

Interest Rate

3.2%

Mortgage Type

New Conventional

Estimated Equity

$277,587

Purchase Details

Closed on

Oct 5, 2012

Sold by

Sharbaugh Brian J and Phillipp Heahter K

Bought by

Sharbaugh Brian J and Philippsharbaugh Heather K

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$179,650

Interest Rate

3.61%

Mortgage Type

New Conventional

Purchase Details

Closed on

May 12, 2006

Sold by

Pulte Homes Of Greater Kansas City Inc

Bought by

Sharbaugh Brian J and Philipp Heather K

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$47,349

Interest Rate

6.14%

Mortgage Type

Stand Alone Second

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Sharbaugh Brian J | -- | Security 1St Title Llc | |

| Sharbaugh Brian J | -- | Hertiage Title | |

| Sharbaugh Brian J | -- | Multiple |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Sharbaugh Brian J | $248,800 | |

| Closed | Sharbaugh Brian J | $179,650 | |

| Closed | Sharbaugh Brian J | $47,349 | |

| Closed | Sharbaugh Brian J | $189,399 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $5,817 | $47,438 | $13,240 | $34,198 |

| 2023 | $5,791 | $46,242 | $11,029 | $35,213 |

| 2022 | $5,486 | $42,711 | $9,591 | $33,120 |

| 2021 | $5,486 | $37,525 | $8,722 | $28,803 |

| 2020 | $4,976 | $36,421 | $7,273 | $29,148 |

| 2019 | $4,961 | $36,041 | $6,064 | $29,977 |

| 2018 | $4,492 | $32,235 | $6,064 | $26,171 |

| 2017 | $4,322 | $30,337 | $5,050 | $25,287 |

| 2016 | $3,751 | $26,875 | $4,808 | $22,067 |

| 2015 | $3,702 | $26,530 | $4,808 | $21,722 |

| 2013 | -- | $23,264 | $4,808 | $18,456 |

Source: Public Records

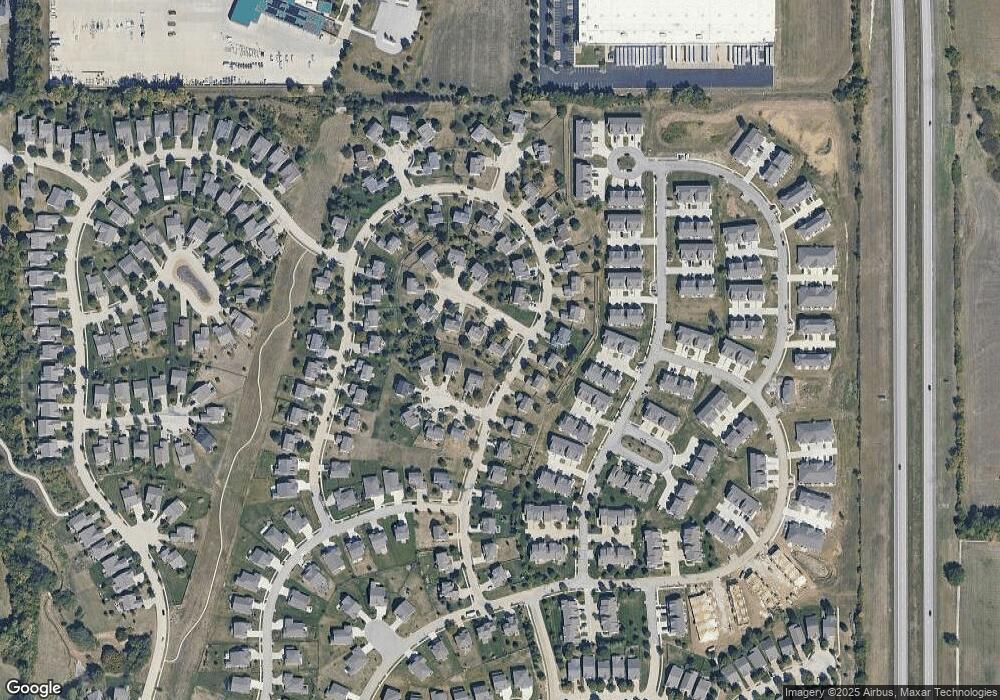

Map

Nearby Homes

- 8925 Inkster

- 23718 W 88th Terrace

- 8843 Quill St

- 8896 Findley St

- 8937 Sunray Dr

- 23435 W 89th Terrace

- 9280 Barth Rd

- 23304 W 90th St

- 3.5 acres near Gander & 91st Terrace

- 9140 Hedge Lane Terrace

- 9213 Kenton St

- 22641 W 87th Terrace

- 23614 W 92nd St

- The Hampton VI Plan at Prairie View at Creekside Woods

- The Sierra V Plan at Prairie View at Creekside Woods

- The Landon Plan at Prairie View at Creekside Woods

- The Mackenzie Plan at Prairie View at Creekside Woods

- The York Plan at Prairie View at Creekside Woods

- The Kelsey Plan at Prairie View at Creekside Woods

- The Grayson Reserve Plan at Prairie View at Creekside Woods

- 23507 W 88th St

- 23500 W 88th Terrace

- 23506 W 88th Terrace

- 8807 Dunraven St

- 23511 W 88th St

- 8742 Dunraven St

- 8801 Dunraven St

- 8813 Dunraven St

- 8747 Dunraven St

- 23508 W 88th St

- 8732 Dunraven St

- 8819 Dunraven St

- 8743 Dunraven St

- 23512 W 88th Terrace

- 23515 W 88th St

- 23501 W 88th Terrace

- 8739 Dunraven St

- 23514 W 88th St

- 8728 Dunraven St

- 8825 Dunraven St