2357 Gavinley Way Unit 50 Columbus, OH 43220

Northcrest NeighborhoodEstimated Value: $244,000 - $290,000

2

Beds

2

Baths

1,566

Sq Ft

$166/Sq Ft

Est. Value

About This Home

This home is located at 2357 Gavinley Way Unit 50, Columbus, OH 43220 and is currently estimated at $259,862, approximately $165 per square foot. 2357 Gavinley Way Unit 50 is a home located in Franklin County with nearby schools including Daniel Wright Elementary School, Ann Simpson Davis Middle School, and Dublin Scioto High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 24, 2006

Sold by

Woo Kyu W and Woo Young Soon

Bought by

Papou Aleh and Papova Ina

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$129,980

Outstanding Balance

$76,222

Interest Rate

6.62%

Mortgage Type

Fannie Mae Freddie Mac

Estimated Equity

$183,640

Purchase Details

Closed on

Feb 8, 2000

Sold by

Miketa Deborah K

Bought by

Woo Kyu W and Woo Young Soon

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$73,600

Interest Rate

8.21%

Mortgage Type

Balloon

Purchase Details

Closed on

Jan 22, 1993

Bought by

Miketa Deborah K

Purchase Details

Closed on

Jan 20, 1993

Purchase Details

Closed on

Jan 19, 1993

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Papou Aleh | $134,000 | Ohio Title | |

| Woo Kyu W | $92,000 | -- | |

| Miketa Deborah K | $63,500 | -- | |

| -- | $91,600 | -- | |

| -- | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Papou Aleh | $129,980 | |

| Previous Owner | Woo Kyu W | $73,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,020 | $66,470 | $14,000 | $52,470 |

| 2023 | $3,964 | $66,465 | $14,000 | $52,465 |

| 2022 | $3,185 | $49,630 | $6,580 | $43,050 |

| 2021 | $3,236 | $49,630 | $6,580 | $43,050 |

| 2020 | $3,217 | $49,630 | $6,580 | $43,050 |

| 2019 | $2,906 | $39,690 | $5,250 | $34,440 |

| 2018 | $2,726 | $39,690 | $5,250 | $34,440 |

| 2017 | $2,683 | $39,690 | $5,250 | $34,440 |

| 2016 | $2,519 | $35,000 | $6,790 | $28,210 |

| 2015 | $2,534 | $35,000 | $6,790 | $28,210 |

| 2014 | $2,537 | $35,000 | $6,790 | $28,210 |

| 2013 | $1,288 | $35,000 | $6,790 | $28,210 |

Source: Public Records

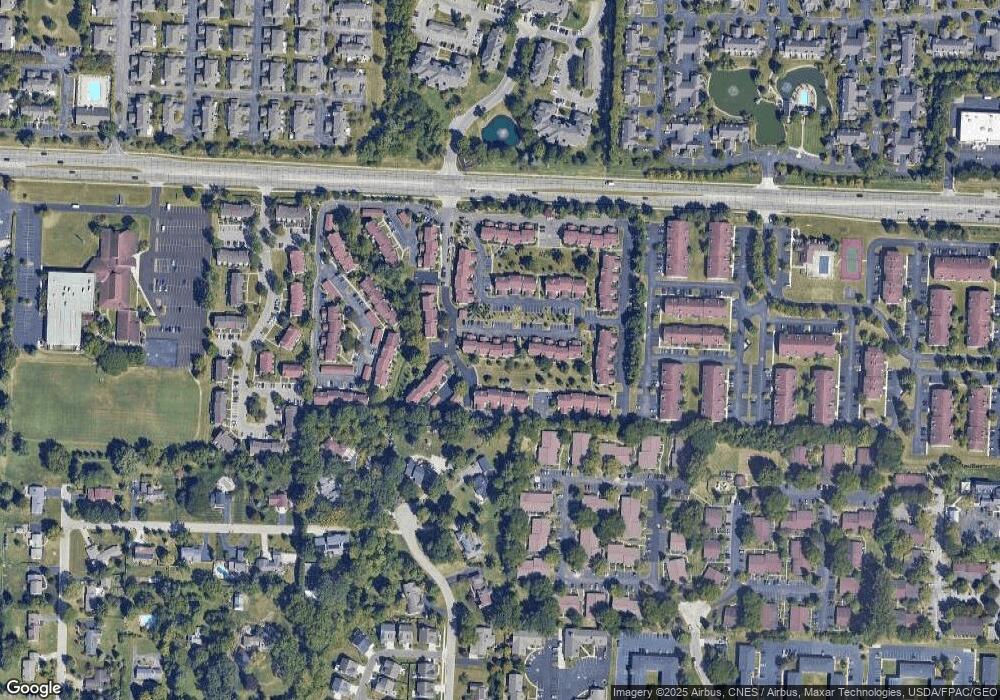

Map

Nearby Homes

- 5283 Ruthton Rd Unit 19

- 5294 Brandy Oaks Ln

- 5273 Brandy Oaks Ln

- 2491 Calais Way

- 5268 Captains Ct

- 2540 Dahlia Way Unit 26D

- 2585 Trottersway Dr Unit 2585

- 2229 Teardrop Ave Unit 35E

- 5322 Darlington Rd Unit E

- 2560 Trotterslane Dr

- 5000 Slate Run Woods Ct

- 2579 Trotterslane Dr

- 2622 Trottersway Dr

- 5624 Wigmore Dr Unit 50B

- 2744 Greystone Dr Unit E

- 2260 Lila Way Unit 62D

- 2165 Partlow Dr

- 5646 Dorsey Dr

- 2198 Sandston Rd

- 2231 Atlee Ct Unit 12

- 2363 Gavinley Way Unit 47

- 2325 Mccauley Ct Unit 10

- 2323 Gavinley Way Unit 60

- 2349 Mccauley Ct Unit 8

- 2351 Mccauley Ct Unit 7

- 2317 Mccauley Ct Unit 14

- 5285 Ruthton Rd

- 2355 Gavinley Way Unit 51

- 5281 Ruthton Rd Unit 20

- 2323 Mccauley Ct Unit 11

- 2365 Gavinley Way Unit 46

- 2321 Mccauley Ct Unit 12

- 5286 Wood Run Blvd

- 2325 Gavinley Way

- 5288 Wood Run Blvd

- 5292 Wood Run Blvd

- 5279 Ruthton Rd

- 2315 Mccauley Ct Unit 15

- 2357 Mccauley Ct

- 5247 Ruthton Rd Unit 65