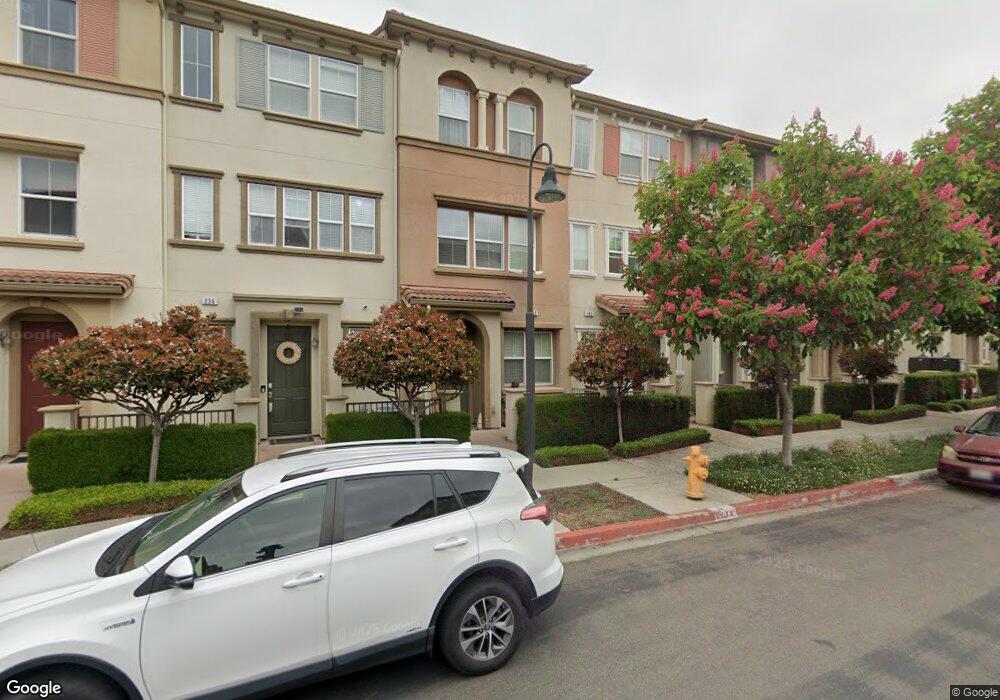

236 Sullivan Way Hayward, CA 94541

Burbank NeighborhoodEstimated Value: $787,000 - $816,000

3

Beds

3

Baths

1,651

Sq Ft

$485/Sq Ft

Est. Value

About This Home

This home is located at 236 Sullivan Way, Hayward, CA 94541 and is currently estimated at $801,444, approximately $485 per square foot. 236 Sullivan Way is a home located in Alameda County with nearby schools including Burbank Elementary School, Winton Middle School, and Hayward High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 21, 2018

Sold by

Scheid Jordan

Bought by

Scheid Krysten Ordonez

Current Estimated Value

Purchase Details

Closed on

Jun 18, 2018

Sold by

Ordonez Katherine S and Ordonez Krysten S

Bought by

Ordonez Katherine S and Scheid Krysten Ordonez

Purchase Details

Closed on

Dec 16, 2013

Sold by

Thomas Ruth

Bought by

Ordonez Katherine S and Ordonez Krysten S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$399,000

Outstanding Balance

$297,281

Interest Rate

4.13%

Mortgage Type

New Conventional

Estimated Equity

$504,163

Purchase Details

Closed on

Nov 4, 2010

Sold by

Kb Home South Bay Inc

Bought by

Thomas Ruth

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$295,339

Interest Rate

4.75%

Mortgage Type

FHA

Purchase Details

Closed on

Aug 4, 2010

Sold by

Kb Home South Bay Inc

Bought by

Sienna At Parkside Owners Association

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Scheid Krysten Ordonez | -- | None Available | |

| Ordonez Katherine S | -- | None Available | |

| Ordonez Katherine S | $420,000 | First American Title Company | |

| Thomas Ruth | $303,500 | First American Title Company | |

| Sienna At Parkside Owners Association | -- | First American Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Ordonez Katherine S | $399,000 | |

| Previous Owner | Thomas Ruth | $295,339 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,335 | $514,840 | $154,452 | $360,388 |

| 2024 | $7,335 | $504,747 | $151,424 | $353,323 |

| 2023 | $7,218 | $494,851 | $148,455 | $346,396 |

| 2022 | $7,075 | $485,150 | $145,545 | $339,605 |

| 2021 | $7,016 | $475,641 | $142,692 | $332,949 |

| 2020 | $6,949 | $470,764 | $141,229 | $329,535 |

| 2019 | $6,998 | $461,537 | $138,461 | $323,076 |

| 2018 | $6,626 | $452,490 | $135,747 | $316,743 |

| 2017 | $6,496 | $443,620 | $133,086 | $310,534 |

| 2016 | $6,178 | $434,921 | $130,476 | $304,445 |

| 2015 | $6,073 | $428,391 | $128,517 | $299,874 |

| 2014 | $5,605 | $420,000 | $126,000 | $294,000 |

Source: Public Records

Map

Nearby Homes

- 252 Sullivan Way

- 273 Sullivan Way

- 2050 Jubilee Dr

- 414 Palmer Ave

- 1042 Old Oak Ln

- 1110 Red Wing Dr

- 610 Staley Ave

- 626 Moss Way

- 622 Moss Way

- 589 Staley Ave

- 200 Old Oak Ln Unit 3

- 2315 Gibbons St

- 266 Smalley Ave

- 350 Smalley Ave

- 22939 Santa Clara St

- 22592 Sonoma St

- 439 Holly Ln

- 353 Laurel Ave Unit 15

- 357 Laurel Ave Unit 4

- 188 Laurel Ave

- 234 Sullivan Way Unit 618

- 238 Sullivan Way

- 240 Sullivan Way Unit 621

- 242 Sullivan Way

- 246 Sullivan Way

- 1052 Martin Luther King Dr

- 202 Sullivan Way Unit 589

- 204 Sullivan Way

- 206 Sullivan Way

- 208 Sullivan Way

- 210 Sullivan Way

- 212 Sullivan Way

- 1032 Martin Luther King Dr

- 1030 Martin Luther King Dr

- 1026 Martin Luther King Dr

- 1034 Martin Luther King Dr

- 245 Sullivan Way

- 1056 Martin Luther King Dr

- 1054 Martin Luther King Dr

- 257 Sullivan Way