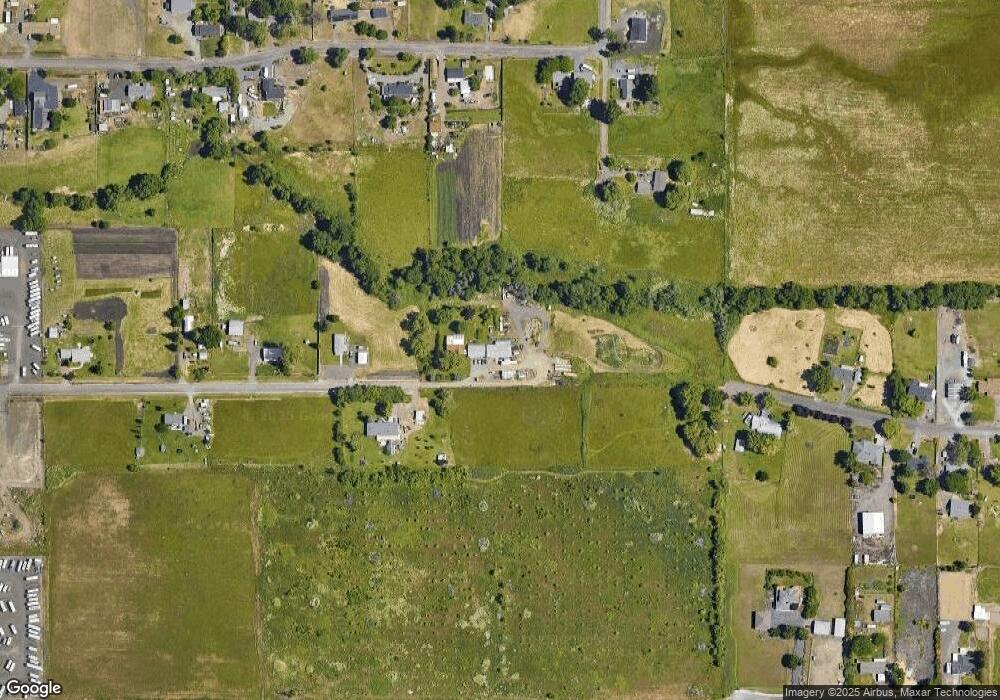

2365 Lotus Ln Central Point, OR 97502

Estimated Value: $464,000 - $531,000

3

Beds

2

Baths

1,736

Sq Ft

$285/Sq Ft

Est. Value

About This Home

This home is located at 2365 Lotus Ln, Central Point, OR 97502 and is currently estimated at $494,502, approximately $284 per square foot. 2365 Lotus Ln is a home located in Jackson County with nearby schools including Kennedy Elementary School, Hedrick Middle School, and North Medford High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 26, 2019

Sold by

Morgan Paul A

Bought by

Morgan Paul A and Morgan Michelle M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$266,500

Outstanding Balance

$235,916

Interest Rate

3.7%

Mortgage Type

New Conventional

Estimated Equity

$258,586

Purchase Details

Closed on

Jul 20, 2007

Sold by

Nelson Claressa A

Bought by

Morgan Paul A

Purchase Details

Closed on

Dec 21, 2005

Sold by

Morgan Paul

Bought by

Morgan Paul A and Nelson Claressa

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$240,000

Interest Rate

6.75%

Mortgage Type

Fannie Mae Freddie Mac

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Morgan Paul A | -- | Ticor Title | |

| Morgan Paul A | -- | None Available | |

| Morgan Paul A | -- | Ticor Title | |

| Morgan Paul A | $300,000 | Ticor Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Morgan Paul A | $266,500 | |

| Previous Owner | Morgan Paul A | $240,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,347 | $270,110 | $130,920 | $139,190 |

| 2024 | $3,347 | $262,250 | $82,570 | $179,680 |

| 2023 | $3,243 | $254,620 | $80,170 | $174,450 |

| 2022 | $3,167 | $254,620 | $80,170 | $174,450 |

| 2021 | $3,087 | $247,210 | $77,840 | $169,370 |

| 2020 | $3,014 | $240,010 | $75,570 | $164,440 |

| 2019 | $2,944 | $226,240 | $71,240 | $155,000 |

| 2018 | $2,870 | $219,660 | $69,170 | $150,490 |

| 2017 | $2,823 | $219,660 | $69,170 | $150,490 |

| 2016 | $2,769 | $207,060 | $65,210 | $141,850 |

| 2015 | $2,653 | $207,060 | $65,210 | $141,850 |

| 2014 | $2,580 | $195,180 | $61,470 | $133,710 |

Source: Public Records

Map

Nearby Homes

- 6348 Crater Lake Hwy

- 1729 E Gregory Rd

- 2507 Agate Meadows

- 2956 Agate Meadows Cir

- 1182 E Justice Rd

- 3131 Avenue A

- 2618 Carr St

- 7573 24th St

- 3228 Ramie Ln

- 7635 Coloma St

- 2909 Ingalls Dr

- 7689 Calaveras St

- 3025 Ingalls Dr

- 5011 Highway 62

- 1816 E Vilas Rd

- 9889 SE Pavati Dr

- 3420 Sonny Way

- 7967 Ajax St

- 3432 Sonny Way

- 3444 Sonny Way Unit lots 30-41