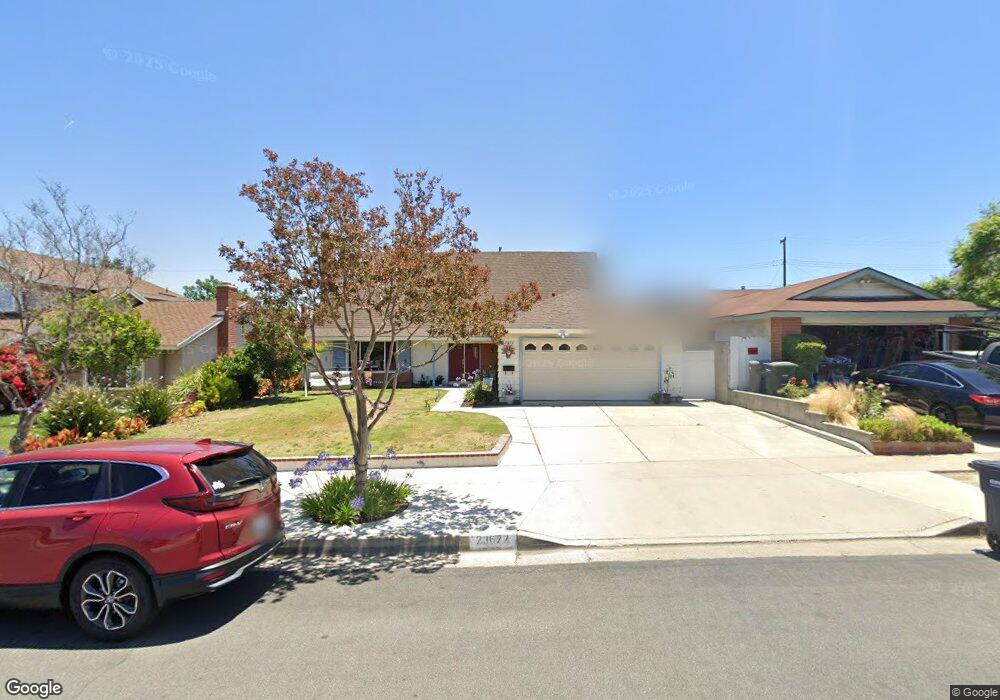

23672 Dune Mear Rd Lake Forest, CA 92630

Estimated Value: $1,208,000 - $1,256,000

4

Beds

2

Baths

2,117

Sq Ft

$581/Sq Ft

Est. Value

About This Home

This home is located at 23672 Dune Mear Rd, Lake Forest, CA 92630 and is currently estimated at $1,230,497, approximately $581 per square foot. 23672 Dune Mear Rd is a home located in Orange County with nearby schools including Olivewood Elementary School, Serrano Intermediate School, and El Toro High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 3, 2014

Sold by

Tellez Olivia V

Bought by

Tellez Olivia

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$100,100

Outstanding Balance

$75,191

Interest Rate

4.26%

Mortgage Type

New Conventional

Estimated Equity

$1,155,306

Purchase Details

Closed on

Sep 16, 2013

Sold by

Tellez Federico

Bought by

Tellez Olivia

Purchase Details

Closed on

Jun 29, 1995

Sold by

Nieman Donald N and Nieman Kathleen M

Bought by

Tellez Federico and Tellez Olivia

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$200,000

Interest Rate

7.71%

Mortgage Type

Assumption

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Tellez Olivia | -- | Wfg Title Company | |

| Tellez Olivia | -- | None Available | |

| Tellez Federico | $200,000 | Investors Title Company |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Tellez Olivia | $100,100 | |

| Previous Owner | Tellez Federico | $200,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,430 | $338,270 | $182,479 | $155,791 |

| 2024 | $3,430 | $331,638 | $178,901 | $152,737 |

| 2023 | $3,350 | $325,136 | $175,393 | $149,743 |

| 2022 | $3,290 | $318,761 | $171,954 | $146,807 |

| 2021 | $3,225 | $312,511 | $168,582 | $143,929 |

| 2020 | $3,196 | $309,307 | $166,853 | $142,454 |

| 2019 | $3,132 | $303,243 | $163,582 | $139,661 |

| 2018 | $3,074 | $297,298 | $160,375 | $136,923 |

| 2017 | $3,013 | $291,469 | $157,230 | $134,239 |

| 2016 | $2,963 | $285,754 | $154,147 | $131,607 |

| 2015 | $2,927 | $281,462 | $151,831 | $129,631 |

| 2014 | $2,791 | $275,949 | $148,857 | $127,092 |

Source: Public Records

Map

Nearby Homes

- 2122 Ronda Granada Unit Q

- 2122 Ronda Granada Unit P

- 2148 Ronda Granada Unit A

- 2121 Ronda Granada Unit N

- 2091 Ronda Granada Unit D

- 2153 Ronda Granada Unit A

- 2123 Ronda Granada Unit A

- 2123 Ronda Granada Unit G

- 2133 Via Puerta

- 2111 Via Puerta Unit T

- 2104 Ronda Granada Unit A

- 2103 Ronda Granada Unit B

- 2139 Ronda Granada Unit B

- 2137 Ronda Granada Unit A

- 2082 Ronda Granada Unit D

- 2107 Ronda Granada

- 2119 Via Puerta Unit Q

- 2119 Via Puerta Unit N

- 2119 Via Puerta

- 2118 Via Puerta

- 23662 Dune Mear Rd

- 23676 Dune Mear Rd

- 23652 Dune Mear Rd

- 23682 Dune Mear Rd

- 23701 Cavanaugh Rd

- 23691 Cavanaugh Rd

- 23711 Cavanaugh Rd

- 23642 Dune Mear Rd

- 23692 Dune Mear Rd

- 23671 Dune Mear Rd

- 23721 Cavanaugh Rd

- 23681 Dune Mear Rd

- 23651 Dune Mear Rd

- 23671 Cavanaugh Rd

- 23691 Dune Mear Rd

- 23731 Cavanaugh Rd

- 23632 Dune Mear Rd

- 23641 Dune Mear Rd

- 23702 Dune Mear Rd

- 23661 Cavanaugh Rd

Your Personal Tour Guide

Ask me questions while you tour the home.