2375 Hyacinth Rd Alpine, CA 91901

Estimated Value: $824,229 - $914,000

4

Beds

2

Baths

1,845

Sq Ft

$467/Sq Ft

Est. Value

About This Home

This home is located at 2375 Hyacinth Rd, Alpine, CA 91901 and is currently estimated at $862,307, approximately $467 per square foot. 2375 Hyacinth Rd is a home located in San Diego County with nearby schools including Granite Hills High School, The Heights Charter, and Liberty Charter High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 9, 2020

Sold by

Bruns John L

Bought by

Sacks Jeff C and Sacks Jennifer C

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$473,400

Outstanding Balance

$420,559

Interest Rate

3.2%

Mortgage Type

New Conventional

Estimated Equity

$441,748

Purchase Details

Closed on

Jun 27, 2000

Sold by

Baum Robert T and Baum Hebert A

Bought by

Bruns John L and Bruns Madelyn M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$216,250

Interest Rate

8.2%

Mortgage Type

Stand Alone First

Purchase Details

Closed on

Oct 30, 1995

Sold by

Rjt Investments Inc

Bought by

Baum Robert T and Hebert Heidi A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$181,450

Interest Rate

7.42%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Sacks Jeff C | $526,000 | First American Ttl San Diego | |

| Bruns John L | $273,000 | Chicago Title Co | |

| Baum Robert T | $191,500 | Chicago Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Sacks Jeff C | $473,400 | |

| Previous Owner | Bruns John L | $216,250 | |

| Previous Owner | Baum Robert T | $181,450 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,940 | $569,355 | $187,696 | $381,659 |

| 2024 | $6,940 | $558,192 | $184,016 | $374,176 |

| 2023 | $7,017 | $547,248 | $180,408 | $366,840 |

| 2022 | $6,938 | $536,519 | $176,871 | $359,648 |

| 2021 | $7,122 | $526,000 | $173,403 | $352,597 |

| 2020 | $5,112 | $376,124 | $123,994 | $252,130 |

| 2019 | $5,014 | $368,750 | $121,563 | $247,187 |

| 2018 | $4,867 | $361,521 | $119,180 | $242,341 |

| 2017 | $4,754 | $354,434 | $116,844 | $237,590 |

| 2016 | $4,550 | $347,485 | $114,553 | $232,932 |

| 2015 | $4,523 | $342,267 | $112,833 | $229,434 |

| 2014 | $4,423 | $335,563 | $110,623 | $224,940 |

Source: Public Records

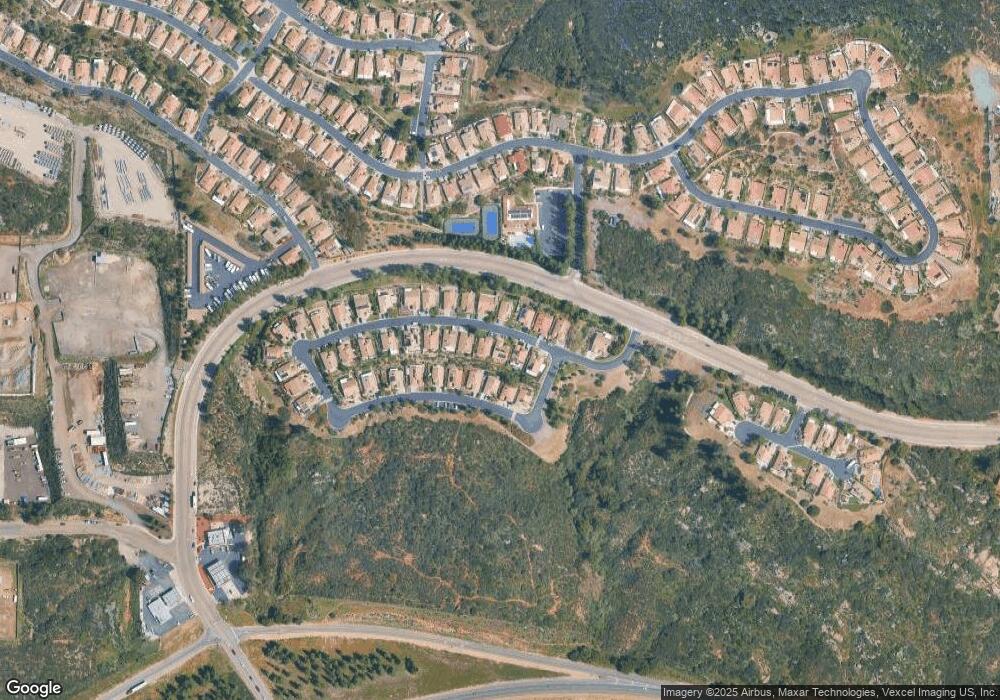

Map

Nearby Homes

- 2501 Columbine Dr

- 2617 Lobelia Rd

- 2288 Boulders Ct

- 2389 Victoria Cir

- 2638 W Victoria Dr

- 2170 Alpine Glen Place

- 2406 Mcdougal Place

- 1165 Midway Dr

- 2157 Arnold Way Unit 312

- 2157 Arnold Way Unit 324

- 0 Peutz Way Unit 250039332

- 1434 Marshall Rd Unit 16

- 1528-44 Olivewood Ln Unit 403-350-02-00

- 2292 Marquand Ct

- 602 Starbright Ln

- 1478 Peutz Valley Rd

- 2400 Alpine Blvd Unit 6

- 2400 Alpine Blvd Unit 106

- 2400 Alpine Blvd Unit 25

- 2400 Alpine Blvd Unit 136

- 2363 Hyacinth Rd

- 2379 Hyacinth Rd

- 2361 Hyacinth Rd

- 2385 Hyacinth Rd

- 2368 Hyacinth Rd

- 1974 Verbena Terrace

- 2374 Hyacinth Rd

- 1958 Verbena Terrace

- 2362 Hyacinth Rd

- 2380 Hyacinth Rd

- 1982 Verbena Terrace

- 2355 Hyacinth Rd

- 1950 Verbena Terrace

- 2356 Hyacinth Rd

- 2386 Hyacinth Rd

- 1942 Verbena Terrace

- 2343 Hyacinth Rd

- 2350 Hyacinth Rd

- 2344 Hyacinth Rd

- 1934 Verbena Terrace