2377 Hardesty Ct Columbus, OH 43204

Brookshire NeighborhoodEstimated Value: $121,000 - $143,000

2

Beds

1

Bath

828

Sq Ft

$157/Sq Ft

Est. Value

About This Home

This home is located at 2377 Hardesty Ct, Columbus, OH 43204 and is currently estimated at $129,699, approximately $156 per square foot. 2377 Hardesty Ct is a home located in Franklin County with nearby schools including Lindbergh Elementary School, Hilltonia Middle School, and Briggs High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 28, 2025

Sold by

Debarrientos Vilma Flores and Barrientos Vilma

Bought by

Demenjivar Norma Guadalupe Ba

Current Estimated Value

Purchase Details

Closed on

Dec 16, 2020

Sold by

Kifle Aden

Bought by

Debarrientos Ana Vilma Flores

Purchase Details

Closed on

Jun 14, 2016

Sold by

Gilliland Roy H

Bought by

Kifle Aden

Purchase Details

Closed on

Oct 29, 2015

Sold by

Myers Kelly and Saunders Tracy

Bought by

Gilliland Roy H

Purchase Details

Closed on

Oct 28, 2011

Sold by

Estate Of Jane A Haudenschild

Bought by

Myers Kelly and Saunders Tracy

Purchase Details

Closed on

Dec 29, 1967

Bought by

Haudenschild Jane A

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Demenjivar Norma Guadalupe Ba | -- | None Listed On Document | |

| Debarrientos Ana Vilma Flores | $85,000 | Northwest Select Ttl Agcy Ll | |

| Kifle Aden | $46,500 | None Available | |

| Gilliland Roy H | $24,000 | Crown Title | |

| Myers Kelly | -- | None Available | |

| Haudenschild Jane A | -- | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,894 | $42,210 | $8,750 | $33,460 |

| 2023 | $1,870 | $42,210 | $8,750 | $33,460 |

| 2022 | $2,169 | $27,860 | $3,080 | $24,780 |

| 2021 | $1,448 | $27,860 | $3,080 | $24,780 |

| 2020 | $1,076 | $20,690 | $3,080 | $17,610 |

| 2019 | $1,005 | $16,560 | $2,450 | $14,110 |

| 2018 | $501 | $16,560 | $2,450 | $14,110 |

| 2017 | $1,004 | $16,560 | $2,450 | $14,110 |

| 2016 | $557 | $8,410 | $3,890 | $4,520 |

| 2015 | $590 | $19,080 | $3,890 | $15,190 |

| 2014 | $1,183 | $19,080 | $3,890 | $15,190 |

| 2013 | $735 | $22,400 | $4,550 | $17,850 |

Source: Public Records

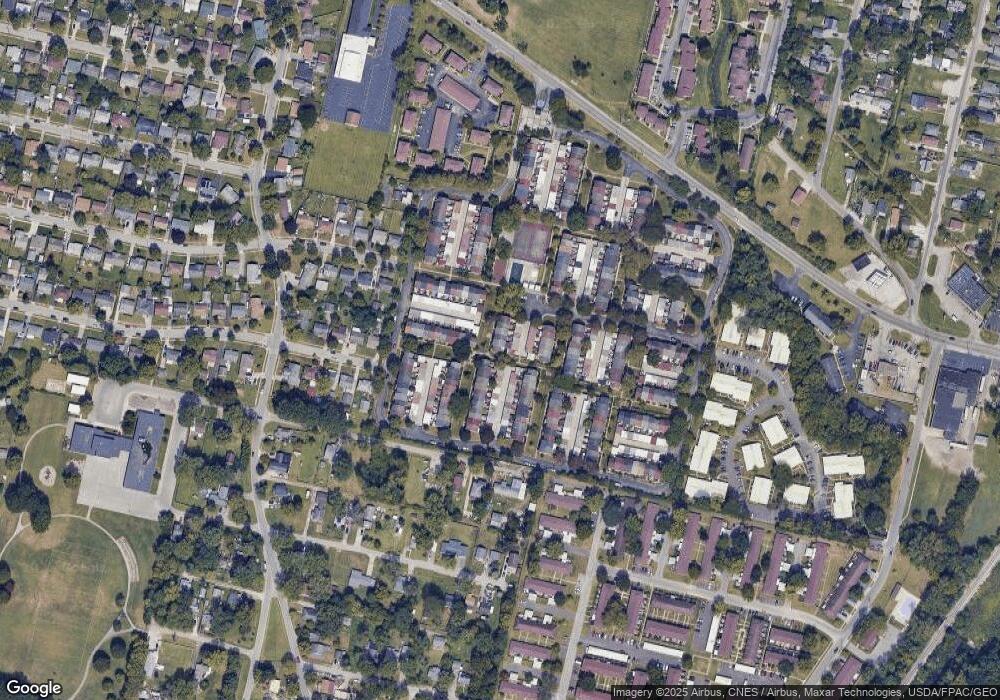

Map

Nearby Homes

- 2436 Hardesty Dr S Unit 4

- 2337 Hardesty Ct Unit 1

- 2382 Hardesty Dr S Unit Q-5

- 1119 Hardesty Place E Unit 1

- 2322 Hardesty Ct Unit I11

- 1085 Hardesty Place E Unit 4

- 2334 Hardesty Ct Unit 5

- 2362 Woodbrook Cir N Unit 81

- 2367 Hardesty Dr N Unit 1-1

- 2336 Woodbrook Cir N Unit 92 B

- 2547 Rosedale Ave

- 1258 Woodbrook Cir W Unit 199

- 2491 Vanderberg Ave

- 2610 Spaatz Ave

- 2180 Eakin Rd

- 2530 Vanderberg Ave

- 2538 Vanderberg Ave

- 815 S Wayne Ave

- 2579 Eakin Rd

- 0 S Central Ave

- 2377 Hardesty Ct Unit JB-1

- 2379 Hardesty Ct Unit 2

- 2444 Hardesty Dr S Unit 1

- 1074 Hardesty Place W Unit I

- 2446 Hardesty Dr S Unit 2

- 2448 Hardesty Dr S

- 2383 Hardesty Ct Unit JB4

- 2381 Hardesty Ct

- 2381 Hardesty Ct Unit 3

- 2381 Hardesty Ct Unit JB-3

- 2381 Hardesty Ct Unit JB-3

- 1076 Hardesty Place W Unit W2

- 2387 Hardesty Ct

- 1078 Hardesty Place W Unit 3

- 2450 Hardesty Dr S

- 2450 Hardesty Dr S Unit T-4

- 2385 Hardesty Ct

- 1080 Hardesty Place W

- 2452 Hardesty Dr S

- 2452 Hardesty Dr S Unit T5