2400 W Casper Ct La Habra, CA 90631

Estimated Value: $2,052,000 - $2,086,000

5

Beds

5

Baths

3,489

Sq Ft

$594/Sq Ft

Est. Value

About This Home

This home is located at 2400 W Casper Ct, La Habra, CA 90631 and is currently estimated at $2,071,601, approximately $593 per square foot. 2400 W Casper Ct is a home located in Orange County with nearby schools including Las Positas Elementary School, Imperial Middle School, and Sonora High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Aug 19, 2025

Sold by

Kim Eddie and Kim Esther

Bought by

Eddie And Esther Kim Family Trust and Kim

Current Estimated Value

Purchase Details

Closed on

Apr 6, 2010

Sold by

Us Bank National Association

Bought by

Kim Eddie and Kim Esther

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$712,000

Interest Rate

5.04%

Mortgage Type

New Conventional

Purchase Details

Closed on

Oct 28, 2009

Sold by

Gonzalez Rafael D and Gonzalez Sandra

Bought by

Us Bank National Association

Purchase Details

Closed on

Jan 31, 2000

Sold by

Westridge Development Ii Llc

Bought by

Gonzalez Rafael D and Gonzalez Sandra

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$507,855

Interest Rate

8.05%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Eddie And Esther Kim Family Trust | -- | None Listed On Document | |

| Kim Eddie | $925,000 | Lawyers Title | |

| Us Bank National Association | $908,175 | Accommodation | |

| Gonzalez Rafael D | $565,000 | Fidelity National Title Co | |

| Gonzalez Rafael D | $565,000 | Fidelity National Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Kim Eddie | $712,000 | |

| Previous Owner | Gonzalez Rafael D | $507,855 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $13,110 | $1,194,006 | $550,050 | $643,956 |

| 2024 | $13,110 | $1,170,595 | $539,265 | $631,330 |

| 2023 | $12,815 | $1,147,643 | $528,692 | $618,951 |

| 2022 | $12,695 | $1,125,141 | $518,326 | $606,815 |

| 2021 | $12,487 | $1,103,080 | $508,163 | $594,917 |

| 2020 | $12,370 | $1,091,770 | $502,953 | $588,817 |

| 2019 | $12,014 | $1,070,363 | $493,091 | $577,272 |

| 2018 | $11,810 | $1,049,376 | $483,423 | $565,953 |

| 2017 | $11,597 | $1,028,800 | $473,944 | $554,856 |

| 2016 | $11,317 | $1,008,628 | $464,651 | $543,977 |

| 2015 | $10,987 | $993,478 | $457,672 | $535,806 |

| 2014 | $10,658 | $974,018 | $448,707 | $525,311 |

Source: Public Records

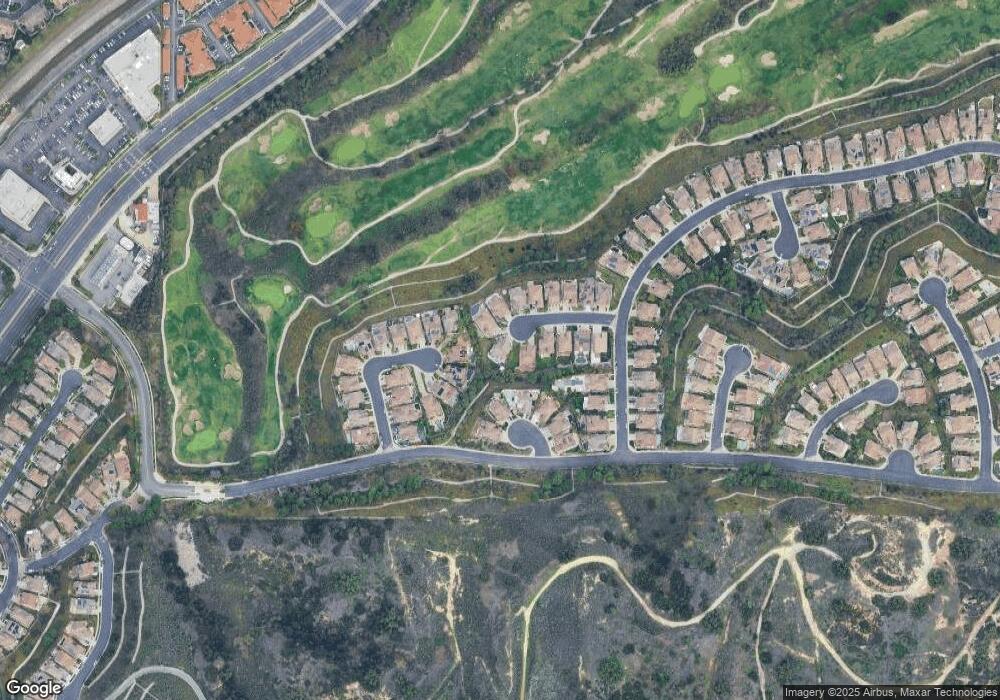

Map

Nearby Homes

- 2160 W Snead St

- 16521 Stonehaven Ct Unit 76

- 13621 Freemont Ct

- 16411 Fitzpatrick Ct Unit 266

- 2849 Hawks Pointe Dr

- 2161 S Ferrier Ct

- 1260 Summershade Dr

- 2430 Grayville Dr

- 16209 Eagleridge Ct

- 2000 S Mcspaden Ct

- 16344 Summershade Dr

- 2423 Coventry Cir

- 2041 S Sanders Ct

- 12428 Grayling Ave

- 2886 Muir Trail Dr

- 1420 Pine Tree Ct

- 2430 W Cajon Dr

- 3054 Colt Way Unit 209

- 12308 Fireside Dr

- 2252 Cheyenne Way Unit 83

- 2380 W Casper Ct

- 2420 W Casper Ct

- 1900 S Mangrum Ct

- 2421 W Casper Ct

- 1920 S Mangrum Ct

- 2360 W Casper Ct

- 1901 S Mangrum Ct

- 2040 S Nelson Ct

- 2401 W Casper Ct

- 2020 S Nelson Ct

- 1940 S Mangrum Ct

- 2340 W Casper Ct

- 2381 W Casper Ct

- 1921 S Mangrum Ct

- 2060 S Nelson Ct

- 2361 W Casper Ct

- 2000 S Nelson Ct

- 1941 S Mangrum Ct

- 1960 S Mangrum Ct

- 2320 W Casper Ct