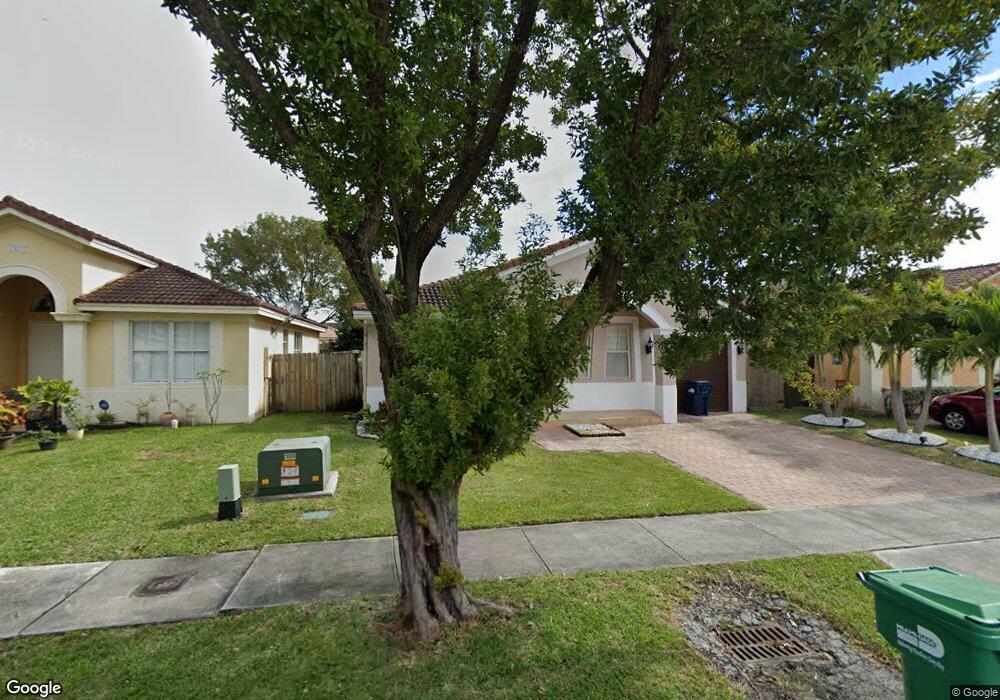

24035 SW 110th Ct Unit 1 Homestead, FL 33032

Estimated Value: $514,377 - $583,000

1

Bed

1

Bath

380

Sq Ft

$1,434/Sq Ft

Est. Value

About This Home

This home is located at 24035 SW 110th Ct Unit 1, Homestead, FL 33032 and is currently estimated at $544,844, approximately $1,433 per square foot. 24035 SW 110th Ct Unit 1 is a home located in Miami-Dade County with nearby schools including Goulds Elementary School, Arthur And Polly Mays Conservatory Of The Arts, and Cutler Bay Middle.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 27, 2025

Sold by

Rueda Salomon and Barros Ligia

Bought by

Barros Ligia

Current Estimated Value

Purchase Details

Closed on

Jul 29, 2021

Sold by

Barros Ligia and Rueda Salomon

Bought by

Rueda Salomon and Barros Ligia

Purchase Details

Closed on

Nov 3, 2015

Sold by

Silva Carlos and Rexach Luis Castillo

Bought by

Barros Ligia

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$157,102

Interest Rate

4.37%

Mortgage Type

FHA

Purchase Details

Closed on

Mar 29, 2007

Sold by

Silva Carlos

Bought by

Silva Carlos and Castillo Rexach Luis

Purchase Details

Closed on

May 12, 2006

Sold by

Lucky Start At Bluewaters Llc

Bought by

Silva Carlos

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$282,780

Interest Rate

10.25%

Mortgage Type

Fannie Mae Freddie Mac

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Barros Ligia | -- | A Plus Title | |

| Barros Ligia | -- | A Plus Title | |

| Rueda Salomon | -- | Pinnacle Title Services | |

| Barros Ligia | $160,000 | Independence Title Inc | |

| Silva Carlos | -- | None Available | |

| Silva Carlos | $314,300 | Professional Title & Escrow |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Barros Ligia | $157,102 | |

| Previous Owner | Silva Carlos | $282,780 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $8,399 | $378,740 | $161,250 | $217,490 |

| 2024 | $8,072 | $381,393 | $161,250 | $220,143 |

| 2023 | $8,072 | $357,170 | $134,375 | $222,795 |

| 2022 | $4,571 | $194,561 | $0 | $0 |

| 2021 | $4,508 | $188,895 | $0 | $0 |

| 2020 | $4,472 | $186,287 | $0 | $0 |

| 2019 | $4,405 | $182,099 | $0 | $0 |

| 2018 | $4,252 | $178,704 | $0 | $0 |

| 2017 | $4,272 | $175,029 | $0 | $0 |

| 2016 | $4,170 | $171,429 | $0 | $0 |

| 2015 | $4,115 | $110,647 | $0 | $0 |

| 2014 | $3,843 | $100,589 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 24055 SW 109th Ct

- 11161 SW 241st St

- 112 Ave 240 St

- 10846 SW 240th Ln

- 11014 SW 237th Ln

- 11084 SW 237th Ln

- 24386 SW 109th Ct

- 10978 SW 243rd Ln

- 23731 SW 110th Ave

- 23712 SW 110th Ave

- 11291 SW 240th Ln

- 10846 SW 242nd St

- 24363 SW 109th Ave

- 10848 SW 243rd St

- 10806 SW 240th Ln

- 10828 SW 243rd St

- 23813 SW 108th Ct

- 24453 SW 110th Place

- 23744 SW 108th Ct

- 11279 SW 238th St

- 24035 SW 110th Ct

- 24025 SW 110 Ct

- 24045 SW 110th Ct

- 24025 SW 110th Ct

- 24015 SW 110th Ct

- 11001 SW 241st St

- 24034 SW 109th Path

- 24046 SW 110th Ct

- 24034 SW 109 Pa

- 24026 SW 110th Ct

- 24005 SW 110th Ct

- 24036 SW 110th Ct

- 24036 SW 110 Ct

- 24024 SW 109 Pa

- 24044 SW 109 Pa

- 10991 SW 241st St

- 24046 SW 110 Ct

- 11011 SW 241st St

- 24016 SW 110th Ct