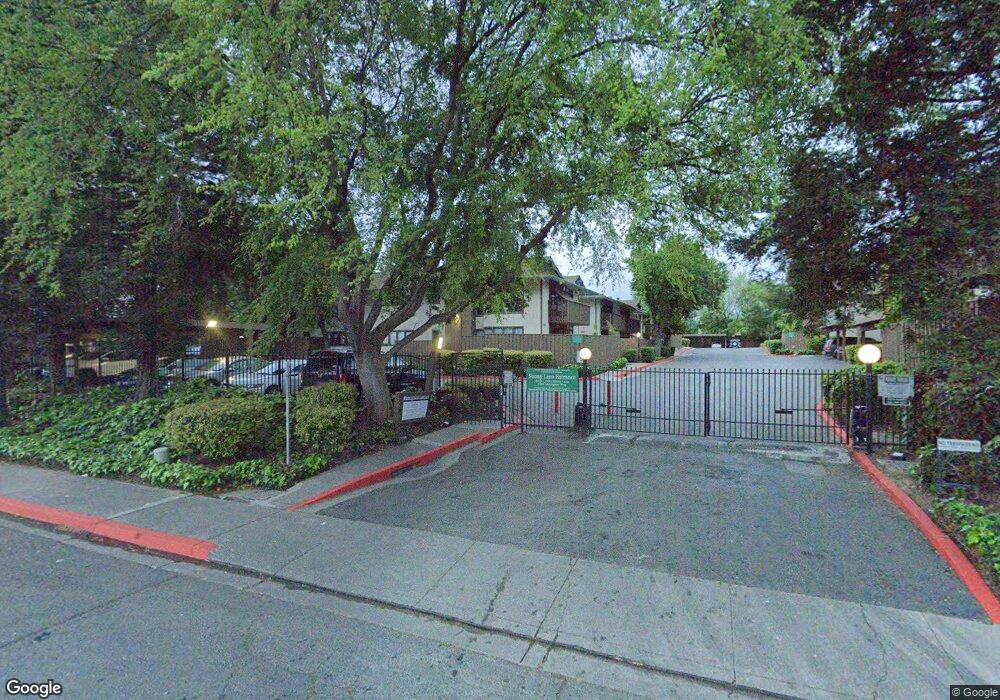

2405 Sunny Ln Unit 12 Antioch, CA 94509

North Antioch NeighborhoodEstimated Value: $213,000 - $297,000

2

Beds

1

Bath

845

Sq Ft

$290/Sq Ft

Est. Value

About This Home

This home is located at 2405 Sunny Ln Unit 12, Antioch, CA 94509 and is currently estimated at $245,002, approximately $289 per square foot. 2405 Sunny Ln Unit 12 is a home located in Contra Costa County with nearby schools including Marsh Elementary School, Park Middle School, and Antioch High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 28, 2011

Sold by

The Bank Of New York Mellon

Bought by

Reichenberg Joel and Reichenberg Jacklein

Current Estimated Value

Purchase Details

Closed on

May 26, 2011

Sold by

Shabaka Michael

Bought by

The Bank Of New York Mellon

Purchase Details

Closed on

Dec 20, 2005

Sold by

James G Lawrence and James Audrey L

Bought by

Shabaka Michael

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$200,000

Interest Rate

9.5%

Mortgage Type

Fannie Mae Freddie Mac

Purchase Details

Closed on

Apr 21, 2005

Sold by

James G Lawrence and James Audrey L

Bought by

James G Lawrence and James Audrey L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$133,000

Interest Rate

1.37%

Mortgage Type

Stand Alone Refi Refinance Of Original Loan

Purchase Details

Closed on

Oct 19, 2002

Sold by

James G Lawrence and James Audrey L

Bought by

James G Lawrence and James Audrey L

Purchase Details

Closed on

Aug 2, 2002

Sold by

Simmons Alfred

Bought by

James G Lawrence and James Audrey L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$117,000

Interest Rate

6.51%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Jul 11, 2000

Sold by

Kaur Kiran

Bought by

Simmons Alfred

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$85,405

Interest Rate

8.55%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Apr 27, 1999

Sold by

Youth For Christ Ministries

Bought by

Kaur Kiran

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$63,450

Interest Rate

6.98%

Mortgage Type

FHA

Purchase Details

Closed on

Feb 26, 1999

Sold by

Hud

Bought by

Youth For Christ Ministries

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$63,450

Interest Rate

6.98%

Mortgage Type

FHA

Purchase Details

Closed on

Aug 13, 1998

Sold by

First Mtg Corp

Bought by

Hud

Purchase Details

Closed on

Aug 11, 1998

Sold by

Figaroa Robert A and Figaroa Gina M

Bought by

First Mtg Corp

Purchase Details

Closed on

Apr 28, 1994

Sold by

Figaroa Robert A

Bought by

Figaroa Robert A and Figaroa Gina M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$71,800

Interest Rate

8.3%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Reichenberg Joel | $45,500 | Landsafe Title | |

| The Bank Of New York Mellon | $38,475 | Landsafe Default Inc | |

| Shabaka Michael | $250,000 | Fidelity National Title | |

| James G Lawrence | -- | First American Title | |

| James G Lawrence | -- | First American Title | |

| James G Lawrence | -- | -- | |

| James G Lawrence | $163,000 | American Title Co | |

| Simmons Alfred | $95,000 | Fidelity National Title Co | |

| Kaur Kiran | $65,000 | North American Title Co | |

| Youth For Christ Ministries | $37,000 | North American Title Co | |

| Hud | -- | United Title Company | |

| First Mtg Corp | $76,863 | United Title Company | |

| Figaroa Robert A | -- | Fidelity National Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Shabaka Michael | $200,000 | |

| Previous Owner | James G Lawrence | $133,000 | |

| Previous Owner | James G Lawrence | $117,000 | |

| Previous Owner | Simmons Alfred | $85,405 | |

| Previous Owner | Kaur Kiran | $63,450 | |

| Previous Owner | Youth For Christ Ministries | $44,300 | |

| Previous Owner | Figaroa Robert A | $71,800 | |

| Closed | Kaur Kiran | $3,250 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,155 | $57,137 | $11,297 | $45,840 |

| 2024 | $1,115 | $56,018 | $11,076 | $44,942 |

| 2023 | $1,115 | $54,920 | $10,859 | $44,061 |

| 2022 | $1,105 | $53,845 | $10,647 | $43,198 |

| 2021 | $1,062 | $52,790 | $10,439 | $42,351 |

| 2019 | $1,021 | $51,226 | $10,130 | $41,096 |

| 2018 | $984 | $50,223 | $9,932 | $40,291 |

| 2017 | $950 | $49,239 | $9,738 | $39,501 |

| 2016 | $909 | $48,275 | $9,548 | $38,727 |

| 2015 | $887 | $47,551 | $9,405 | $38,146 |

| 2014 | $854 | $46,620 | $9,221 | $37,399 |

Source: Public Records

Map

Nearby Homes

- 1701 Mahogany Way Unit 38

- 1701 Mahogany Way Unit 47

- 1707 Mahogany Way Unit 63

- 1718 Springwood Way

- 2416 Shadow Ln Unit 74

- 2404 Lemontree Ct Unit 1

- 1228 Buchanan Rd

- 1412 Buchanan Rd

- 2410 Shadow Ln Unit 92

- 2301 Lemontree Way Unit 1

- 2205 Lemontree Way Unit 3

- 2304 Peppertree Way Unit 4

- 2104 Lemontree Way Unit 1

- 2113 Lemontree Way Unit 3

- 2118 Peppertree Way Unit 4

- 2401 Peppertree Ct Unit 4

- 2405 Peppertree Ct Unit 4

- 2400 Horizon Ln Unit 136

- 2209 Peppertree Way Unit 1

- 1810 San Jose Dr

- 2405 Sunny Ln

- 2405 Sunny Ln Unit 11

- 2405 Sunny Ln Unit 10

- 2405 Sunny Ln Unit 9

- 2405 Sunny Ln Unit 8

- 2405 Sunny Ln Unit 7

- 2405 Sunny Ln Unit 6

- 2405 Sunny Ln Unit 5

- 2405 Sunny Ln Unit 4

- 2405 Sunny Ln Unit 3

- 2405 Sunny Ln Unit 2

- 2405 Sunny Ln Unit 1

- 2405 Sunny Ln Unit 16

- 2405 Sunny Ln Unit 15

- 2405 Sunny Ln Unit 14

- 2405 Sunny Ln Unit 13

- 2400 Sunny Ln Unit 21

- 2400 Sunny Ln Unit 20

- 2400 Sunny Ln Unit 19

- 2400 Sunny Ln Unit 18