2406 Halyard Way Discovery Bay, CA 94505

Estimated Value: $631,000 - $686,000

4

Beds

3

Baths

1,892

Sq Ft

$345/Sq Ft

Est. Value

About This Home

This home is located at 2406 Halyard Way, Discovery Bay, CA 94505 and is currently estimated at $653,451, approximately $345 per square foot. 2406 Halyard Way is a home located in Contra Costa County with nearby schools including Discovery Bay Elementary School, Excelsior Middle School, and Liberty High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 23, 2002

Sold by

Oakland Theodore E and Oakland Kelly R

Bought by

Southwick Christopher

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$279,000

Outstanding Balance

$102,610

Interest Rate

4.25%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$550,841

Purchase Details

Closed on

May 21, 2000

Sold by

Pischke Arlin R and Pischke Danielle

Bought by

Oakland Theodore E and Oakland Kelly R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$204,000

Interest Rate

8.99%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Jul 27, 1995

Sold by

Centex Real Estate Corp

Bought by

Pischke Arlin R and Pischke Danielle R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$172,300

Interest Rate

7.62%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Southwick Christopher | $310,000 | American Title | |

| Oakland Theodore E | $255,000 | Chicago Title Co | |

| Pischke Arlin R | $181,000 | First American Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Southwick Christopher | $279,000 | |

| Previous Owner | Oakland Theodore E | $204,000 | |

| Previous Owner | Pischke Arlin R | $172,300 | |

| Closed | Oakland Theodore E | $51,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,338 | $490,961 | $130,338 | $360,623 |

| 2024 | $7,223 | $481,335 | $127,783 | $353,552 |

| 2023 | $7,223 | $471,898 | $125,278 | $346,620 |

| 2022 | $7,103 | $462,646 | $122,822 | $339,824 |

| 2021 | $6,938 | $453,575 | $120,414 | $333,161 |

| 2019 | $6,825 | $440,124 | $116,844 | $323,280 |

| 2018 | $6,572 | $431,495 | $114,553 | $316,942 |

| 2017 | $6,350 | $415,500 | $110,307 | $305,193 |

| 2016 | $6,012 | $405,500 | $107,652 | $297,848 |

| 2015 | $5,273 | $346,000 | $91,856 | $254,144 |

| 2014 | $5,035 | $326,500 | $86,679 | $239,821 |

Source: Public Records

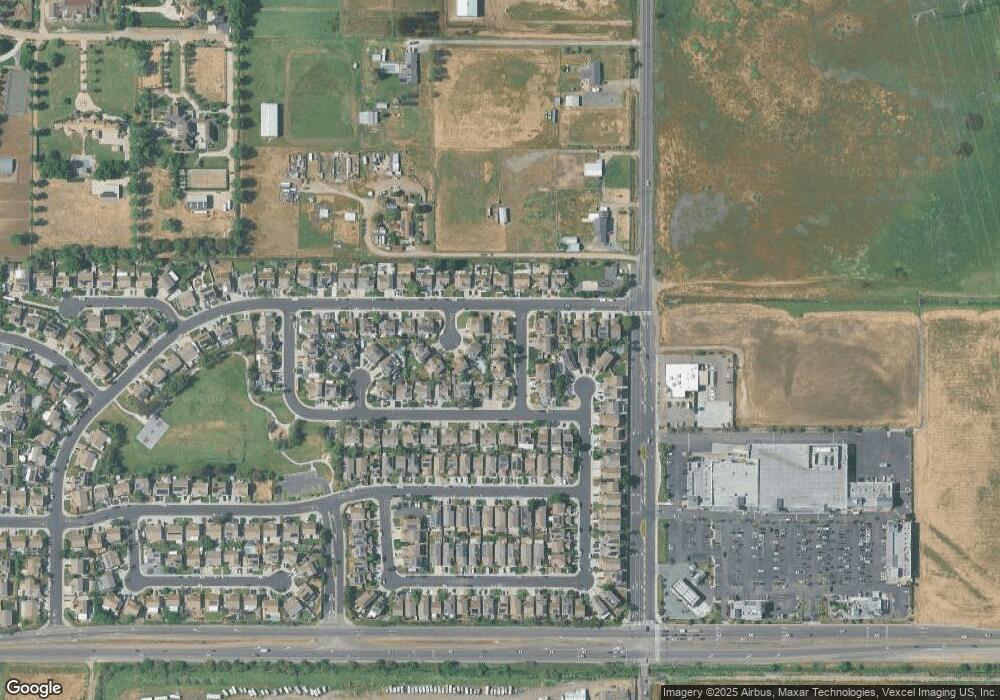

Map

Nearby Homes

- 3713 Yacht Dr

- 3681 Yacht Dr

- 3164 Bixler Rd

- 2265 Newport Ct

- 2015 Newport Dr

- 2391 Newport Dr

- 2012 Windward Point

- 1989 Newport Dr

- 1901 Newport Dr

- 2063 Windward Point

- 3335 Kellogg Creek Rd

- 1944 Windward Point

- 1008 Bluebell Cir

- 351 Astible St

- 362 Astible St

- 359 Astible St

- 339 Astible St

- 347 Astible St

- 343 Astible St

- 339 Astilbe St

- 2410 Halyard Way

- 4078 Regatta Dr

- 21 Rudder Ct

- 29 Rudder Ct

- 2405 Halyard Way

- 2551 Foghorn Way

- 2547 Foghorn Way

- 2401 Halyard Way

- 2409 Halyard Way

- 2543 Foghorn Way

- 2413 Halyard Way

- 4092 Regatta Dr

- 124 Yacht Ct

- 30 Rudder Ct

- 4079 Regatta Dr

- 4075 Regatta Dr

- 2539 Foghorn Way

- 4062 Regatta Dr

- 4071 Regatta Dr

- 4087 Regatta Dr