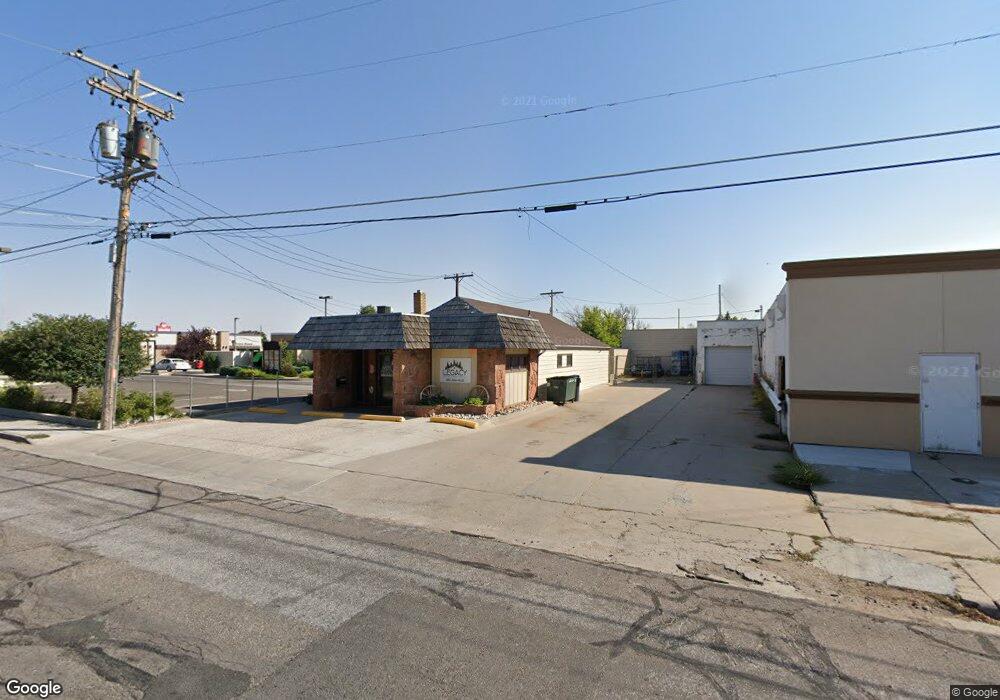

2409 E 15th St Cheyenne, WY 82001

Studio

--

Bath

2,696

Sq Ft

6,098

Sq Ft Lot

About This Home

This home is located at 2409 E 15th St, Cheyenne, WY 82001. 2409 E 15th St is a home located in Laramie County with nearby schools including Henderson Elementary School, Carey Junior High School, and East High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 18, 2019

Sold by

Copd Llc

Bought by

Legacy Property Solutions Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$168,750

Interest Rate

3.65%

Mortgage Type

Commercial

Purchase Details

Closed on

Aug 8, 2008

Sold by

Nibro Properties Llc

Bought by

Copd Llc

Purchase Details

Closed on

May 9, 2008

Sold by

American National Bank

Bought by

Nibro Properties Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$100,000

Interest Rate

5.86%

Mortgage Type

Commercial

Purchase Details

Closed on

Apr 15, 2008

Sold by

Fishers Inc

Bought by

American National Bank

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$100,000

Interest Rate

5.86%

Mortgage Type

Commercial

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Legacy Property Solutions Llc | -- | None Available | |

| Legacy Property Solutions Llc | -- | None Available | |

| Copd Llc | -- | None Available | |

| Nibro Properties Llc | -- | None Available | |

| American National Bank | $98,658 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Legacy Property Solutions Llc | $168,750 | |

| Previous Owner | Nibro Properties Llc | $100,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,921 | $27,499 | $8,164 | $19,335 |

| 2024 | $1,921 | $27,172 | $8,164 | $19,008 |

| 2023 | $1,934 | $27,354 | $8,164 | $19,190 |

| 2022 | $1,604 | $22,224 | $6,264 | $15,960 |

| 2021 | $1,454 | $20,103 | $6,264 | $13,839 |

| 2020 | $1,450 | $20,103 | $6,264 | $13,839 |

| 2019 | $1,454 | $20,133 | $6,264 | $13,869 |

| 2018 | $1,366 | $19,103 | $6,205 | $12,898 |

| 2017 | $1,389 | $19,251 | $6,205 | $13,046 |

| 2016 | $1,370 | $18,971 | $6,205 | $12,766 |

| 2015 | $1,417 | $19,619 | $6,205 | $13,414 |

| 2014 | $1,407 | $19,359 | $6,205 | $13,154 |

Source: Public Records

Map

Nearby Homes

- 2407 E 16th St

- 2314 E 15th St

- 1517 Fremont Ave

- 1602 Crook Ave

- 1518 Hot Springs Ave

- 3849 E Lincolnway

- 1501 Carbon Ave

- 1410 Carbon Ave Unit A-D

- 2521 E 12th St

- 2123 E 18th St

- 2107 E 12th St

- 1502 Willow Dr

- 2007 E 17th St

- 1841 Crook Ave

- 2119 E 11th St

- 2111 Garrett St

- 1911 E 17th St

- 1719 Walnut Dr

- 2621 E 10th St

- 903 Hot Springs Ave

- 2400 E Lincolnway Unit F

- 2400 E Lincolnway Unit E

- 2400 E Lincolnway Unit D

- 2400 E Lincolnway Unit C

- 2400 E Lincolnway Unit B

- 2400 E Lincolnway Unit A

- 2400 E Lincolnway

- 2404 E Lincolnway

- 2420 E 15th St

- 2410 E 15th St

- 2408 E 15th St

- 2406 E 15th St

- 1507 Crook Ave

- 1516 Fremont Ave

- 1514 Fremont Ave

- 1512 Fremont Ave

- 1510 Fremont Ave

- 1508 Fremont Ave

- 1506 Fremont Ave

- 1502 Crook Ave