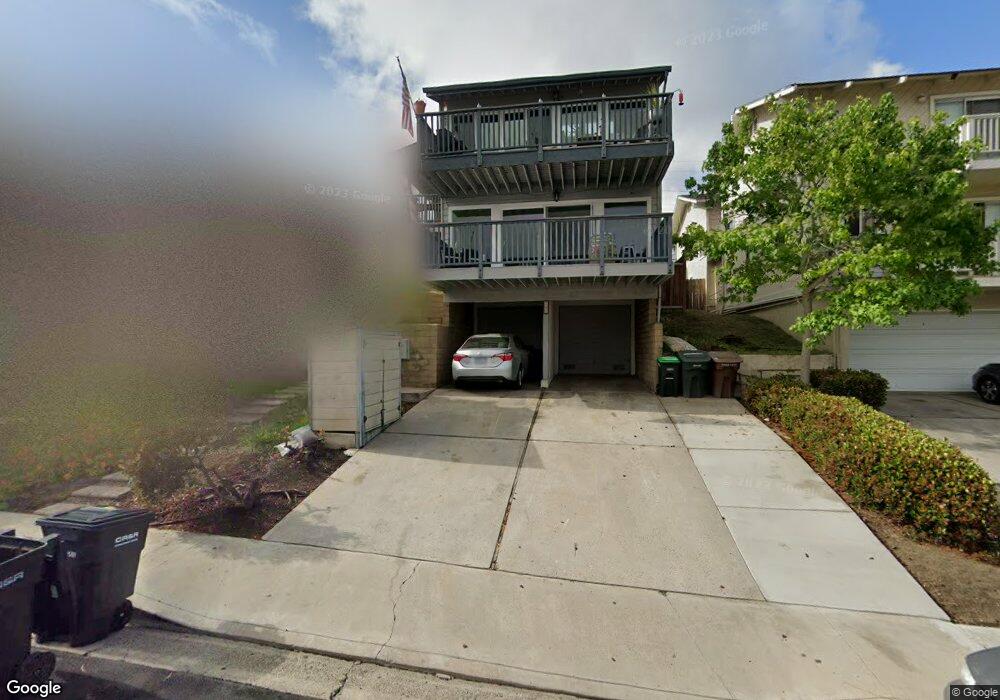

241 W El Portal Unit 2 San Clemente, CA 92672

Central San Clemente NeighborhoodEstimated Value: $1,370,000 - $1,493,354

3

Beds

2

Baths

1,563

Sq Ft

$899/Sq Ft

Est. Value

About This Home

This home is located at 241 W El Portal Unit 2, San Clemente, CA 92672 and is currently estimated at $1,405,839, approximately $899 per square foot. 241 W El Portal Unit 2 is a home located in Orange County with nearby schools including Las Palmas Elementary School, Bernice Ayer Middle School, and San Clemente High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 19, 2025

Sold by

Lee Carter W

Bought by

Smith Scott A and Smith Jacquelin E

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$1,080,000

Outstanding Balance

$1,074,494

Interest Rate

6.89%

Mortgage Type

New Conventional

Estimated Equity

$331,345

Purchase Details

Closed on

Dec 20, 2002

Sold by

Grunburg Richard

Bought by

Lee Carter W

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$304,000

Interest Rate

5.83%

Purchase Details

Closed on

Nov 18, 1999

Sold by

Garrison Philip W and Garrison Sharon L

Bought by

Grunburg Richard A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$194,750

Interest Rate

8.14%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Smith Scott A | $1,350,000 | Stewart Title Guaranty Company | |

| Lee Carter W | $380,000 | American Title Co | |

| Grunburg Richard A | $205,000 | Commonwealth Land Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Smith Scott A | $1,080,000 | |

| Previous Owner | Lee Carter W | $304,000 | |

| Previous Owner | Grunburg Richard A | $194,750 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,475 | $550,357 | $400,921 | $149,436 |

| 2024 | $5,475 | $539,566 | $393,060 | $146,506 |

| 2023 | $5,359 | $528,987 | $385,353 | $143,634 |

| 2022 | $5,257 | $518,615 | $377,797 | $140,818 |

| 2021 | $5,156 | $508,447 | $370,390 | $138,057 |

| 2020 | $5,105 | $503,234 | $366,592 | $136,642 |

| 2019 | $5,005 | $493,367 | $359,404 | $133,963 |

| 2018 | $4,909 | $483,694 | $352,357 | $131,337 |

| 2017 | $4,813 | $474,210 | $345,448 | $128,762 |

| 2016 | $4,721 | $464,912 | $338,674 | $126,238 |

| 2015 | $4,650 | $457,929 | $333,587 | $124,342 |

| 2014 | $4,561 | $448,959 | $327,052 | $121,907 |

Source: Public Records

Map

Nearby Homes

- 911 Buena Vista Unit 1

- 229 W Canada

- 244 W Escalones

- 221 Avenida de la Grulla

- 228 W Mariposa

- 210 W Escalones Unit A,B,C

- 1412 Buena Vista Unit 8

- 162 Avenida Florencia Unit 2

- 214 W Mariposa Unit B

- 227 W El Portal

- 1507 Calle Sacramento Unit B

- 137 Avenida Florencia

- 255 W Marquita Unit 1

- 412 Arenoso Ln Unit 104

- 1531 Buena Vista

- 121 Boca de la Playa Unit 1

- 309 W Avenida Palizada

- 423 Avenida Granada Unit 54

- 227 Avenida Serra

- 163 Calle Redondel

- 241 W El Portal

- 239 W El Portal Unit 2

- 239 W El Portal Unit A

- 241 W El Portal Unit B

- 241 W El Portal Unit A

- 239 W El Portal

- 237 W El Portal Unit A

- 237 W El Portal

- 243 W El Portal

- 235 W El Portal

- 248 Avenida Del Poniente Unit C

- 248 Avenida Del Poniente Unit B

- 248 Avenida Del Poniente Unit A

- 248 Avenida Del Poniente

- 246 Avenida Del Poniente

- 250 Avenida Del Poniente Unit B

- 250 Avenida Del Poniente Unit A

- 250 Avenida Del Poniente Unit C

- 250 Avenida Del Poniente

- 244 Avenida Del Poniente Unit B Upper