2413 SE 14th St Homestead, FL 33035

Keys Gate NeighborhoodEstimated Value: $368,000 - $407,000

4

Beds

3

Baths

1,883

Sq Ft

$203/Sq Ft

Est. Value

About This Home

This home is located at 2413 SE 14th St, Homestead, FL 33035 and is currently estimated at $382,554, approximately $203 per square foot. 2413 SE 14th St is a home located in Miami-Dade County with nearby schools including Homestead Middle School, Arthur And Polly Mays Conservatory Of The Arts, and Homestead Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 13, 2020

Sold by

Jorge Jorge Abraham Abraham

Bought by

Louis Dagobert Jean

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$228,129

Outstanding Balance

$202,665

Interest Rate

3.2%

Mortgage Type

VA

Estimated Equity

$179,889

Purchase Details

Closed on

Jul 12, 2013

Sold by

Hsbc Bank Usa National Association

Bought by

Jorge Jorge Abraham

Purchase Details

Closed on

Apr 11, 2013

Sold by

Valdes Enrique

Bought by

Hsbc Bank Usa Na

Purchase Details

Closed on

Apr 12, 2011

Sold by

Bastidas Heriberto

Bought by

Keys Gate Community Association Inc

Purchase Details

Closed on

May 8, 2007

Sold by

Shoma Homes At Keys Cove Phase Ii Inc

Bought by

Bastidas Heriberto and Valdes Enrique

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$281,889

Interest Rate

8%

Mortgage Type

Negative Amortization

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Louis Dagobert Jean | $223,000 | Homepartners Title Svcs Llc | |

| Jorge Jorge Abraham | $108,800 | Attorney | |

| Hsbc Bank Usa Na | $105,300 | None Available | |

| Keys Gate Community Association Inc | $4,100 | None Available | |

| Bastidas Heriberto | $316,100 | The Greater Title Svcs Inc |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Louis Dagobert Jean | $228,129 | |

| Previous Owner | Bastidas Heriberto | $281,889 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,487 | $204,642 | -- | -- |

| 2024 | $2,249 | $198,875 | -- | -- |

| 2023 | $2,249 | $193,083 | $0 | $0 |

| 2022 | $5,219 | $187,460 | $0 | $0 |

| 2021 | $5,308 | $182,000 | $0 | $0 |

| 2020 | $5,227 | $173,000 | $0 | $0 |

| 2019 | $5,035 | $173,000 | $0 | $0 |

| 2018 | $4,657 | $150,000 | $0 | $0 |

| 2017 | $4,032 | $112,602 | $0 | $0 |

| 2016 | $3,892 | $102,366 | $0 | $0 |

| 2015 | $3,629 | $93,060 | $0 | $0 |

| 2014 | $3,499 | $84,600 | $0 | $0 |

Source: Public Records

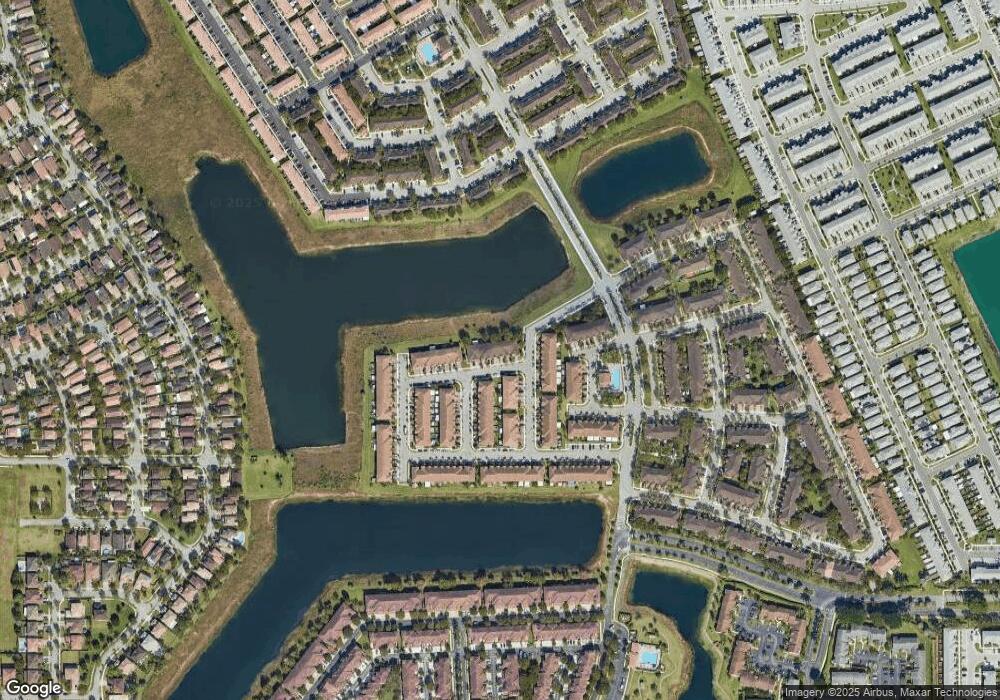

Map

Nearby Homes

- 1463 SE 24th Terrace

- 1426 SE 24th Terrace

- 1447 SE 24th Ave

- 2450 SE 14th Ct Unit 2450

- 2410 SE 15th St

- 1452 SE 24th Ave

- 2463 SE 15th Ct

- 1386 SE 23rd Terrace

- 2499 SE 14th St

- 1486 SE 25th Ave

- 1490 SE 25th Ave

- 2495 SE 13th Ct

- 2497 SE 13th Ct

- 2557 SE 14th St

- 2504 SE 15th Ct

- 1366 SE 26th Ave

- 1416 SE 26th Ave

- 2367 SE 19th St

- 1473 SE 25th Terrace

- 1491 SE 25th Terrace

- 2413 SE 14th St

- 2411 SE 14th St

- 2415 SE 14th St

- 2417 SE 14th St

- 2409 SE 14th St

- 2407 SE 14th St Unit 2407

- 2407 SE 14th St

- 2407 SE 14th St

- 2407 SE 14th St

- 2407 SE 14th St

- 2407 SE 14th St

- 2405 SE 14th St

- 2403 SE 14th St

- 2413 SE 14 St

- 2413 SE 14 St

- 1423 SE 24th Ave

- 1420 SE 24th Terrace

- 2397 SE 14th St

- 1429 SE 24th Ave

- 2393 SE 14th St