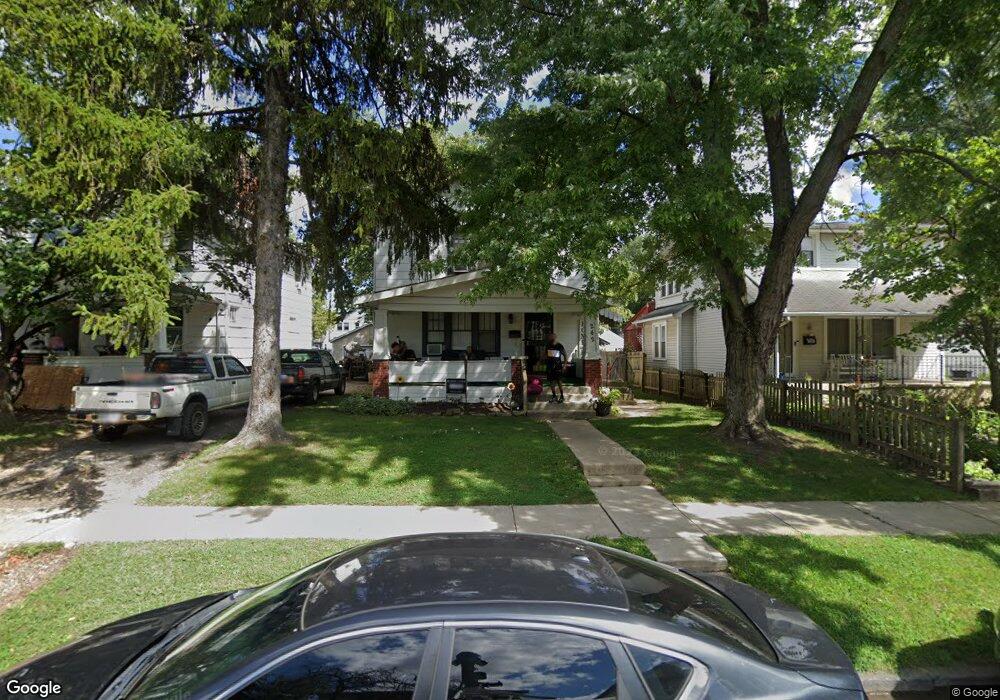

242 N Warren Ave Unit 244 Columbus, OH 43204

North Hilltop NeighborhoodEstimated Value: $142,000 - $158,000

3

Beds

2

Baths

1,822

Sq Ft

$82/Sq Ft

Est. Value

About This Home

This home is located at 242 N Warren Ave Unit 244, Columbus, OH 43204 and is currently estimated at $149,760, approximately $82 per square foot. 242 N Warren Ave Unit 244 is a home located in Franklin County with nearby schools including West Broad Elementary School, Westmoor Middle School, and West High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 25, 2007

Sold by

Deutsche Bank National Trust Co

Bought by

Edwards Investment Group

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$40,000

Outstanding Balance

$25,352

Interest Rate

6.77%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$124,408

Purchase Details

Closed on

Apr 16, 2007

Sold by

Freeman Thomas

Bought by

Deutsche Bank National Trust Co and Morgan Stanley Abs Capital I Inc Trust 2

Purchase Details

Closed on

Mar 5, 2002

Sold by

The Provident Bank

Bought by

Freeman Thomas

Purchase Details

Closed on

Aug 13, 2001

Sold by

Lintner Larry T

Bought by

Provident Bank

Purchase Details

Closed on

May 28, 1999

Sold by

Pearson Jeffrey M and Oreilly Erin

Bought by

Lintner Larry T

Purchase Details

Closed on

Dec 2, 1992

Bought by

Pearson Jeffrey M

Purchase Details

Closed on

Dec 16, 1991

Purchase Details

Closed on

Oct 1, 1981

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Edwards Investment Group | $30,000 | Resource | |

| Deutsche Bank National Trust Co | $36,000 | None Available | |

| Freeman Thomas | $33,500 | -- | |

| Provident Bank | $40,000 | -- | |

| Lintner Larry T | $56,000 | -- | |

| Pearson Jeffrey M | $39,900 | -- | |

| -- | $25,000 | -- | |

| -- | $27,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Edwards Investment Group | $40,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,923 | $41,970 | $5,570 | $36,400 |

| 2023 | $1,899 | $41,965 | $5,565 | $36,400 |

| 2022 | $1,168 | $21,980 | $3,010 | $18,970 |

| 2021 | $1,170 | $21,980 | $3,010 | $18,970 |

| 2020 | $1,172 | $21,980 | $3,010 | $18,970 |

| 2019 | $1,140 | $18,340 | $2,520 | $15,820 |

| 2018 | $1,097 | $18,340 | $2,520 | $15,820 |

| 2017 | $1,149 | $18,340 | $2,520 | $15,820 |

| 2016 | $1,158 | $17,050 | $4,200 | $12,850 |

| 2015 | $1,055 | $17,050 | $4,200 | $12,850 |

| 2014 | $1,057 | $17,050 | $4,200 | $12,850 |

| 2013 | $613 | $20,055 | $4,935 | $15,120 |

Source: Public Records

Map

Nearby Homes

- 200-202 N Harris Ave

- 298 N Burgess Ave

- 166 N Harris Ave

- 118 N Ogden Ave

- 127 N Burgess Ave

- 87 N Warren Ave

- 104-106 N Hague Ave

- 78 N Burgess Ave

- 75 N Terrace Ave

- 149 N Eureka Ave

- 2578 Elliott Ave

- 188 N Eureka Ave

- 285 N Wayne Ave

- 184 N Roys Ave

- 120 N Eureka Ave Unit 122

- 274 N Wayne Ave

- 162 S Roys Ave

- 65 N Chase Ave

- 2360 Westwood Dr

- 146 N Wayne Ave

- 242-244 N Warren Ave

- 248 N Warren Ave

- 238 N Warren Ave

- 254 N Warren Ave

- 232 N Warren Ave Unit 234

- 249 N Ogden Ave

- 243 N Ogden Ave

- 222 N Warren Ave

- 253 N Ogden Ave Unit 255

- 237 N Ogden Ave

- 259 N Ogden Ave

- 243 N Warren Ave

- 237 N Warren Ave

- 233 N Ogden Ave

- 249 N Warren Ave

- 233 N Warren Ave

- 253 N Warren Ave

- 216 N Warren Ave

- 227 N Ogden Ave

- 227 N Warren Ave