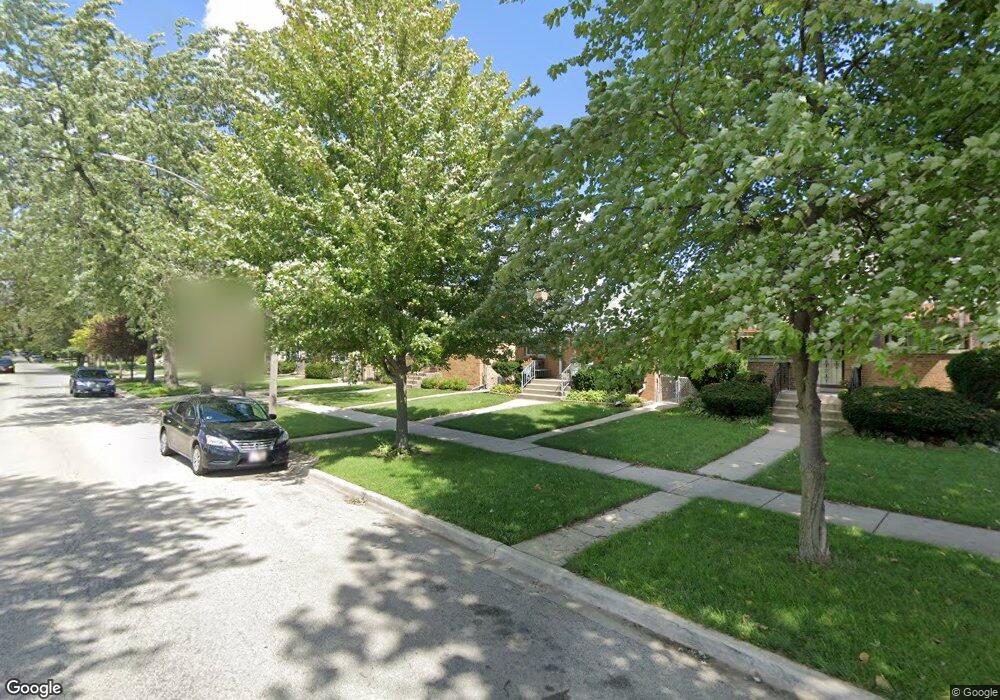

2429 Rhodes Ave River Grove, IL 60171

Estimated Value: $304,000 - $328,000

3

Beds

2

Baths

934

Sq Ft

$335/Sq Ft

Est. Value

About This Home

This home is located at 2429 Rhodes Ave, River Grove, IL 60171 and is currently estimated at $313,205, approximately $335 per square foot. 2429 Rhodes Ave is a home located in Cook County with nearby schools including Rhodes Elementary School and East Leyden High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 26, 2007

Sold by

Seiwert Gerard and Laudati Katherine A

Bought by

Mrozinska Marta

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$208,000

Outstanding Balance

$126,861

Interest Rate

6.4%

Mortgage Type

New Conventional

Estimated Equity

$186,344

Purchase Details

Closed on

Sep 2, 2006

Sold by

Foley Paul Vincent

Bought by

Seiwert Gerard and Laudati Katherine A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$177,750

Interest Rate

8.25%

Mortgage Type

Unknown

Purchase Details

Closed on

Apr 4, 1994

Sold by

Pioneer Bank & Trust Company

Bought by

Foley Paul Vincent

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$92,000

Interest Rate

7.66%

Purchase Details

Closed on

Sep 15, 1993

Sold by

Arnott Lydia

Bought by

Pioneer Bank & Trust Company

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mrozinska Marta | $260,000 | First American Title | |

| Seiwert Gerard | $237,000 | Ticor Title | |

| Foley Paul Vincent | $76,666 | Attorneys Title Guaranty Fun | |

| Pioneer Bank & Trust Company | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Mrozinska Marta | $208,000 | |

| Previous Owner | Seiwert Gerard | $177,750 | |

| Previous Owner | Foley Paul Vincent | $92,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $7,417 | $23,465 | $4,374 | $19,091 |

| 2023 | $7,968 | $23,465 | $4,374 | $19,091 |

| 2022 | $7,968 | $26,000 | $4,374 | $21,626 |

| 2021 | $5,603 | $16,919 | $3,124 | $13,795 |

| 2020 | $5,386 | $16,919 | $3,124 | $13,795 |

| 2019 | $5,491 | $19,161 | $3,124 | $16,037 |

| 2018 | $4,769 | $15,764 | $2,707 | $13,057 |

| 2017 | $5,636 | $18,239 | $2,707 | $15,532 |

| 2016 | $5,804 | $19,557 | $2,707 | $16,850 |

| 2015 | $6,117 | $17,282 | $2,395 | $14,887 |

| 2014 | $5,096 | $17,282 | $2,395 | $14,887 |

| 2013 | $4,681 | $18,695 | $2,395 | $16,300 |

Source: Public Records

Map

Nearby Homes

- 2511 Rhodes Ave

- 2504 Leyden Ave

- 2449 Leyden Ave

- 2436 Spruce St

- 2428 West St

- 2574 Clarke St

- 2440 River Rd Unit 3E

- 2419 Elm St

- 8715 Ridge St

- 2247 Elm St

- 8720 Palmer St

- 8522 Center St

- 8520 Center St

- 2202 River Rd

- 2728 Spruce St

- 8631 W Grand Ave Unit 2W

- 8631 W Grand Ave Unit 4W

- 8631 W Grand Ave Unit 4E

- 2641 Oak St

- 8824 Cherry Ave

- 2425 Rhodes Ave

- 2425 N Rhodes Ave

- 2431 Rhodes Ave

- 2431 N Rhodes Ave

- 2423 Rhodes Ave

- 2439 Rhodes Ave

- 2417 Rhodes Ave

- 2415 Rhodes Ave

- 2441 Rhodes Ave

- 2441 N Rhodes Ave

- 2428 Clarke St

- 2432 Clarke St

- 2420 Clarke St

- 2411 Rhodes Ave

- 2436 Clarke St

- 2445 Rhodes Ave

- 2416 Clarke St

- 2428 Rhodes Ave

- 2424 Rhodes Ave

- 2434 Rhodes Ave