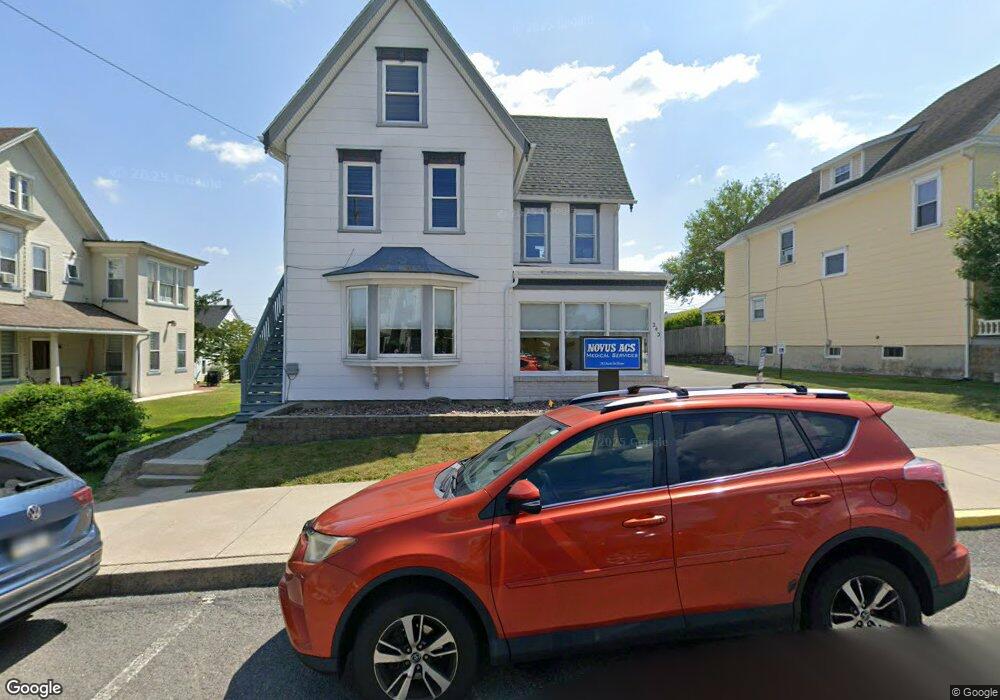

243 S 3rd St Lehighton, PA 18235

Estimated Value: $226,103 - $398,000

4

Beds

2

Baths

2,344

Sq Ft

$127/Sq Ft

Est. Value

About This Home

This home is located at 243 S 3rd St, Lehighton, PA 18235 and is currently estimated at $298,526, approximately $127 per square foot. 243 S 3rd St is a home located in Carbon County with nearby schools including Lehighton Area High School, Sts. Peter & Paul School, and Valley Ridge Academy.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 12, 2019

Sold by

Rheiner John L and Breiner Bruce F

Bought by

Novus Re Llc

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$136,000

Outstanding Balance

$106,324

Interest Rate

3.6%

Mortgage Type

Future Advance Clause Open End Mortgage

Estimated Equity

$192,202

Purchase Details

Closed on

Sep 10, 2008

Sold by

Eidem Kathleen A

Bought by

Rheiner John L and Breiner Bruce F

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$207,000

Interest Rate

6.58%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Novus Re Llc | $205,000 | Santanasto Abstract & Setmnt | |

| Rheiner John L | $212,000 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Novus Re Llc | $136,000 | |

| Previous Owner | Rheiner John L | $207,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,486 | $43,700 | $5,300 | $38,400 |

| 2024 | $3,311 | $43,700 | $5,300 | $38,400 |

| 2023 | $3,278 | $43,700 | $5,300 | $38,400 |

| 2022 | $3,278 | $43,700 | $5,300 | $38,400 |

| 2021 | $3,163 | $43,700 | $5,300 | $38,400 |

| 2020 | $3,087 | $43,700 | $5,300 | $38,400 |

| 2019 | $2,955 | $43,700 | $5,300 | $38,400 |

| 2018 | $2,890 | $43,700 | $5,300 | $38,400 |

| 2017 | $2,868 | $43,700 | $5,300 | $38,400 |

| 2016 | -- | $43,700 | $5,300 | $38,400 |

| 2015 | -- | $43,700 | $5,300 | $38,400 |

| 2014 | -- | $43,700 | $5,300 | $38,400 |

Source: Public Records

Map

Nearby Homes

- 236 S 2nd St

- 230 S 2nd St

- 196 S 3rd St

- 193 S 4th St

- 193 S 4th St Unit 191-193

- 142 Bankway St

- 12 2nd Ave

- 522 Iron St

- 117 N 4th St

- 639 Iron St

- 215 N 4th St

- 231 Coal St

- 410 S 8th St

- 344 Ochre St

- 0 Fairyland Rd Unit PM-136987

- 438 White St

- 230 Carbon St

- 470 N 8th St

- 0 Emily Plan at Summit Point Unit PACC2005480

- 0 Copper Beech Plan at Summit Ridge Unit PACC2005478