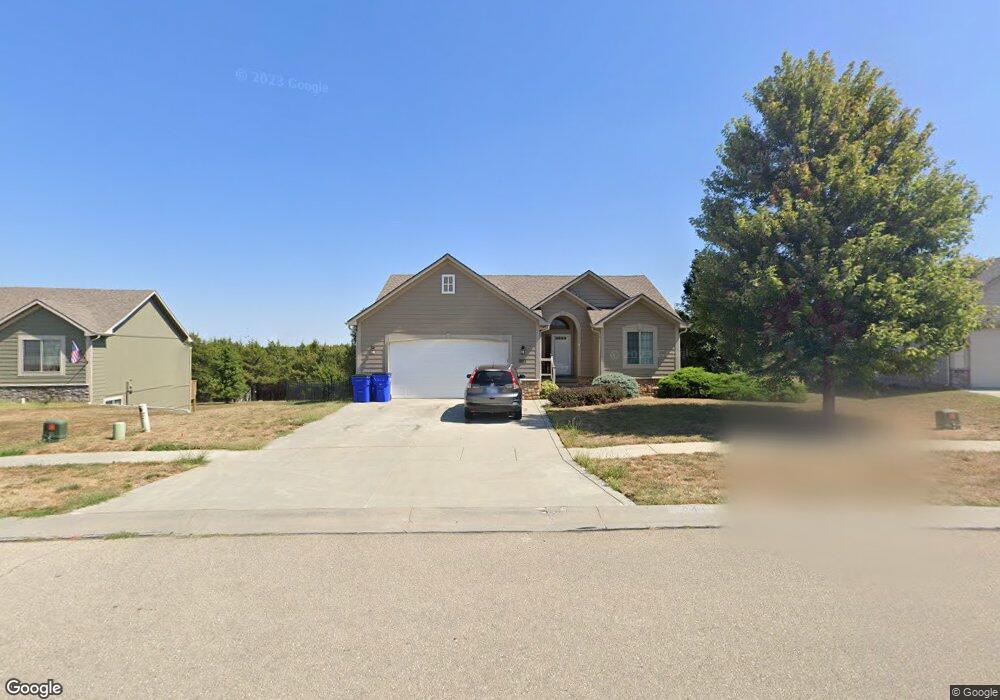

2433 Deer Trail Junction City, KS 66441

Estimated Value: $291,000 - $314,000

5

Beds

3

Baths

2,570

Sq Ft

$117/Sq Ft

Est. Value

About This Home

This home is located at 2433 Deer Trail, Junction City, KS 66441 and is currently estimated at $299,445, approximately $116 per square foot. 2433 Deer Trail is a home located in Geary County with nearby schools including Eisenhower Elementary School, Junction City Middle School, and Junction City Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 23, 2025

Sold by

Irby Burl Leo and Irby April D

Bought by

Canfield Jonathan and Canfield Stephanie

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$288,930

Outstanding Balance

$287,928

Interest Rate

6.76%

Mortgage Type

VA

Estimated Equity

$11,517

Purchase Details

Closed on

Aug 24, 2012

Sold by

Bunting Eric A and Bunting Alicia M

Bought by

Irby Burl Leo

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$220,958

Interest Rate

3.49%

Mortgage Type

VA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Canfield Jonathan | -- | Junction City Abstract Title | |

| Canfield Jonathan | -- | Junction City Abstract Title | |

| Irby Burl Leo | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Canfield Jonathan | $288,930 | |

| Closed | Canfield Jonathan | $288,930 | |

| Previous Owner | Irby Burl Leo | $220,958 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,566 | $33,238 | $4,394 | $28,844 |

| 2024 | $5,973 | $31,064 | $4,160 | $26,904 |

| 2023 | $6,061 | $29,869 | $4,048 | $25,821 |

| 2022 | $0 | $27,656 | $3,813 | $23,843 |

| 2021 | $0 | $25,271 | $3,639 | $21,632 |

| 2020 | $5,684 | $24,909 | $3,583 | $21,326 |

| 2019 | $5,614 | $24,447 | $2,726 | $21,721 |

| 2018 | $5,660 | $24,845 | $2,726 | $22,119 |

| 2017 | $5,617 | $24,357 | $3,221 | $21,136 |

| 2016 | $5,728 | $24,783 | $1,387 | $23,396 |

| 2015 | $5,538 | $24,610 | $1,463 | $23,147 |

| 2014 | $5,372 | $24,598 | $1,842 | $22,756 |

Source: Public Records

Map

Nearby Homes

- 1834 Katie Rose Trail

- 1929 Katie Rose Trail

- 2107 Quail Run

- 2025 Thompson Dr

- 2109 Thompson Dr

- 2137 Killdeer Ct

- 1908 Custer Rd

- 2328 Osprey Ct

- 2038 Sutter Woods Rd

- 2326 Osprey Ct

- 0000 Rucker Rd

- 1504 Thompson Dr

- 2332 Buckshot Dr

- 1228 W 18th St

- 1845 Elmdale Ave

- 1228 Downtain St

- 1222 W 17th St

- 1904 Davis Dr

- 0000 Us Highway 77

- 1304 Rockwell Dr

Your Personal Tour Guide

Ask me questions while you tour the home.