2436 Larkspur Dr Alpine, CA 91901

Estimated Value: $831,373 - $885,000

3

Beds

2

Baths

1,706

Sq Ft

$507/Sq Ft

Est. Value

About This Home

This home is located at 2436 Larkspur Dr, Alpine, CA 91901 and is currently estimated at $864,343, approximately $506 per square foot. 2436 Larkspur Dr is a home located in San Diego County with nearby schools including Granite Hills High School, The Heights Charter, and Liberty Charter High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 22, 2018

Sold by

Peterson Gregg M and Peterson Linda M

Bought by

Cole Ann M and Cole Barry T

Current Estimated Value

Purchase Details

Closed on

Dec 11, 2014

Sold by

Peterson Gregg M and Peterson Linda M

Bought by

The Peterson Joint Living Trust

Purchase Details

Closed on

Aug 30, 2009

Sold by

King Catherine

Bought by

Peterson Gregg M and Peterson Linda M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$225,000

Interest Rate

5.02%

Mortgage Type

New Conventional

Purchase Details

Closed on

Dec 5, 2007

Sold by

King Kenneth William

Bought by

King Kenneth William and King Catherine

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$176,000

Interest Rate

6.29%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Oct 22, 2007

Sold by

King Alice C

Bought by

King Kenneth William

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$176,000

Interest Rate

6.29%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Oct 19, 2007

Sold by

King Kenneth William

Bought by

King Kenneth William

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$176,000

Interest Rate

6.29%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Aug 18, 2003

Sold by

King Kenneth William

Bought by

King Kenneth William

Purchase Details

Closed on

Feb 27, 2002

Sold by

Fahey Kathleen S

Bought by

King Kenneth William

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$235,200

Interest Rate

6.78%

Purchase Details

Closed on

Apr 7, 1999

Sold by

Johnson Ted & Betty Family Trust

Bought by

Fahey Kathleen S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$213,210

Interest Rate

6.96%

Purchase Details

Closed on

Feb 23, 1998

Sold by

Johnson Theodore A and Johnson Betty J

Bought by

Johnson Theodore A and Johnson Betty J

Purchase Details

Closed on

May 10, 1996

Sold by

Rjt Builders Llc

Bought by

Johnson Theodore A and Johnson Betty J

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Cole Ann M | $590,000 | California Title Company | |

| The Peterson Joint Living Trust | -- | None Available | |

| Peterson Gregg M | $425,000 | Advantage Title Inc | |

| King Kenneth William | -- | None Available | |

| King Kenneth William | -- | Southland Title Company | |

| King Kenneth William | -- | Southland Title Company | |

| King Kenneth William | -- | -- | |

| King Kenneth William | $294,000 | First American Title | |

| Fahey Kathleen S | $237,000 | Commonwealth Land Title Co | |

| Johnson Theodore A | -- | -- | |

| Johnson Theodore A | -- | Chicago Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Peterson Gregg M | $225,000 | |

| Previous Owner | King Kenneth William | $176,000 | |

| Previous Owner | King Kenneth William | $176,000 | |

| Previous Owner | King Kenneth William | $235,200 | |

| Previous Owner | Fahey Kathleen S | $213,210 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $7,925 | $658,150 | $193,571 | $464,579 |

| 2024 | $7,925 | $645,246 | $189,776 | $455,470 |

| 2023 | $8,020 | $632,595 | $186,055 | $446,540 |

| 2022 | $7,935 | $620,192 | $182,407 | $437,785 |

| 2021 | $8,148 | $608,032 | $178,831 | $429,201 |

| 2020 | $7,741 | $601,799 | $176,998 | $424,801 |

| 2019 | $7,591 | $590,000 | $173,528 | $416,472 |

| 2018 | $6,231 | $482,131 | $141,802 | $340,329 |

| 2017 | $6,095 | $472,678 | $139,022 | $333,656 |

| 2016 | $5,920 | $463,411 | $136,297 | $327,114 |

| 2015 | $5,689 | $440,000 | $128,000 | $312,000 |

| 2014 | $5,545 | $430,000 | $126,000 | $304,000 |

Source: Public Records

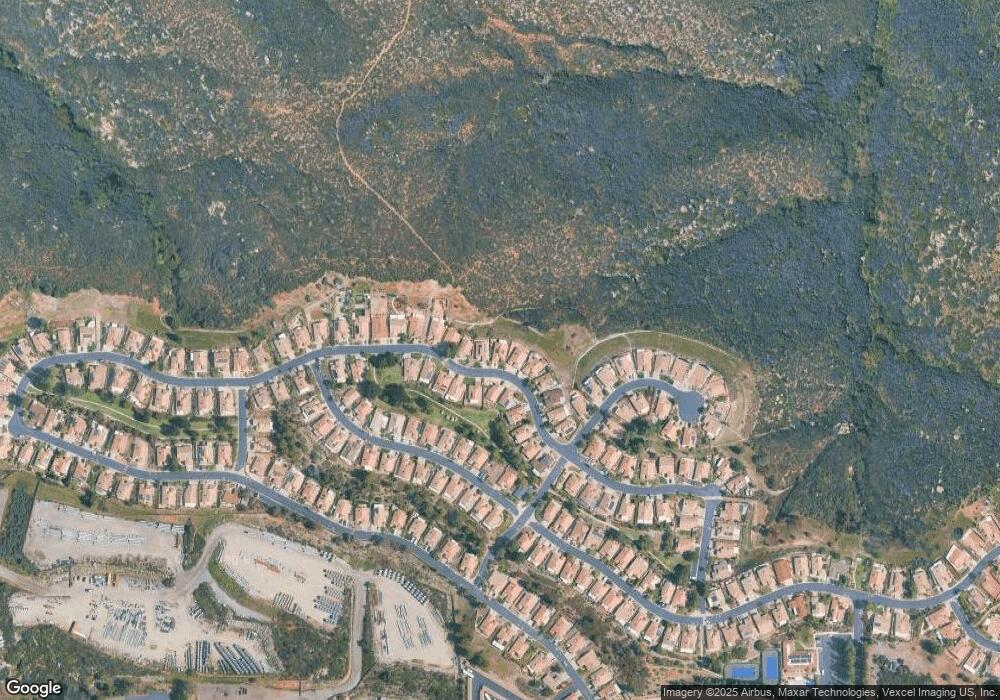

Map

Nearby Homes

- 2501 Columbine Dr

- 2617 Lobelia Rd

- 1478 Peutz Valley Rd

- 2288 Boulders Ct

- 2638 W Victoria Dr

- 2406 Mcdougal Place

- 1165 Midway Dr

- 2389 Victoria Cir

- 1392 Nancy Lee Ln

- 1259 Alpine Estates Place

- 602 Starbright Ln

- 0 England Place

- 2157 Arnold Way Unit 324

- 0 Peutz Way Unit 250039332

- 1434 Marshall Rd Unit 16

- 1528-44 Olivewood Ln Unit 403-350-02-00

- 2292 Marquand Ct

- 1714 Foss Rd

- 2400 Alpine Blvd Unit 6

- 2400 Alpine Blvd Unit 135

- 2428 Larkspur Dr

- 2444 Larkspur Dr

- 2420 Larkspur Dr

- 2452 Larkspur Dr

- 2439 Larkspur Dr

- 2425 Larkspur Dr

- 2457 Larkspur Dr

- 2412 Larkspur Dr

- 2460 Larkspur Dr

- 2421 Larkspur Dr

- 2471 Larkspur Dr

- 2413 Larkspur Dr

- 2404 Larkspur Dr

- 2468 Larkspur Dr

- 2407 Larkspur Dr

- 2483 Larkspur Dr

- 2434 Larkspur Dr

- 2396 Larkspur Dr

- 2512 Begonia Way

- 2520 Begonia Way